Analysis: If the market value of USDe does not exceed 3 billion dollars, the current reserves are sufficient to cope with a period of negative interest rates

The encrypted data analysis platform CryptoQuant released an analytical article stating that as long as the market value of USDe remains below 3 billion USD (currently at 2.4 billion USD), its reserve fund (32.7 million USD) can cope with a period of negative interest rates.

CryptoQuant pointed out that even during bear markets, most payments are positive (Ethena generates income), and the reserve fund can grow. However, extreme events such as the crash of the FTX trading platform (long-term payment rate at that time) could significantly reduce the reserve fund within a few days.

To safely deal with special events featuring large negative interest rates under larger market values of 5 billion USD, 7.5 billion USD or 10 billion USD, the reserve funds need to be increased to approximately 400 million USD, 600 million USD and 800 million USD respectively.

Previous news showed that according to DefiLlama data, due to a brief negative fee situation in contract market funding rate after market decline, Ethena experienced negative income for the first time last week amounting to $1.05 million; this mainly occurred on April 11th when it generated $1.38 million in negative income.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

American Federation of Teachers: Senate cryptocurrency bill will endanger pensions and the overall economy

U.S. stock market opens with the Dow Jones flat

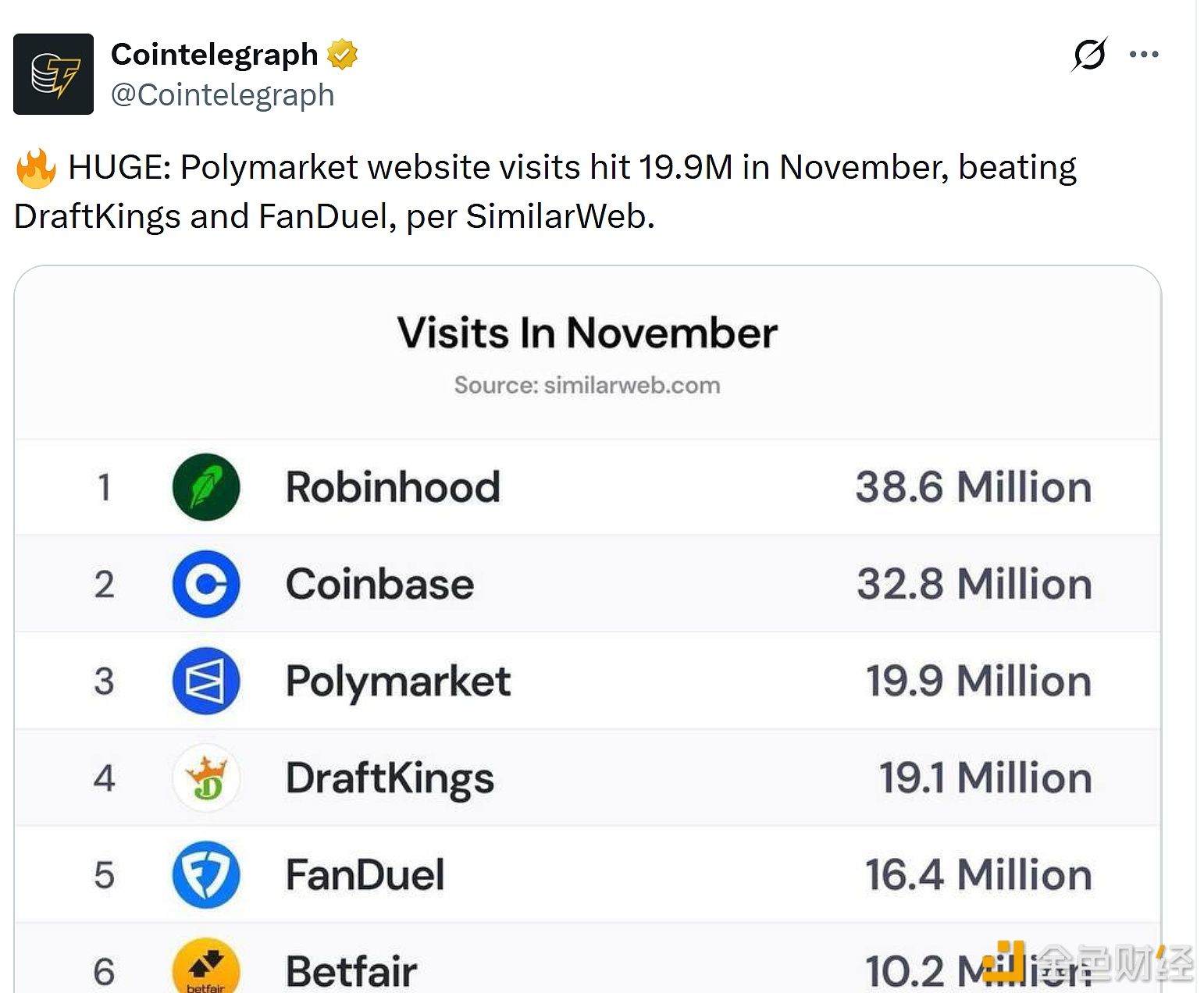

Polymarket website received 19.9 million visits in November