Bitcoin ( BTC ) traders are demanding BTC price upside as liquidity sets up fresh battles for bulls.

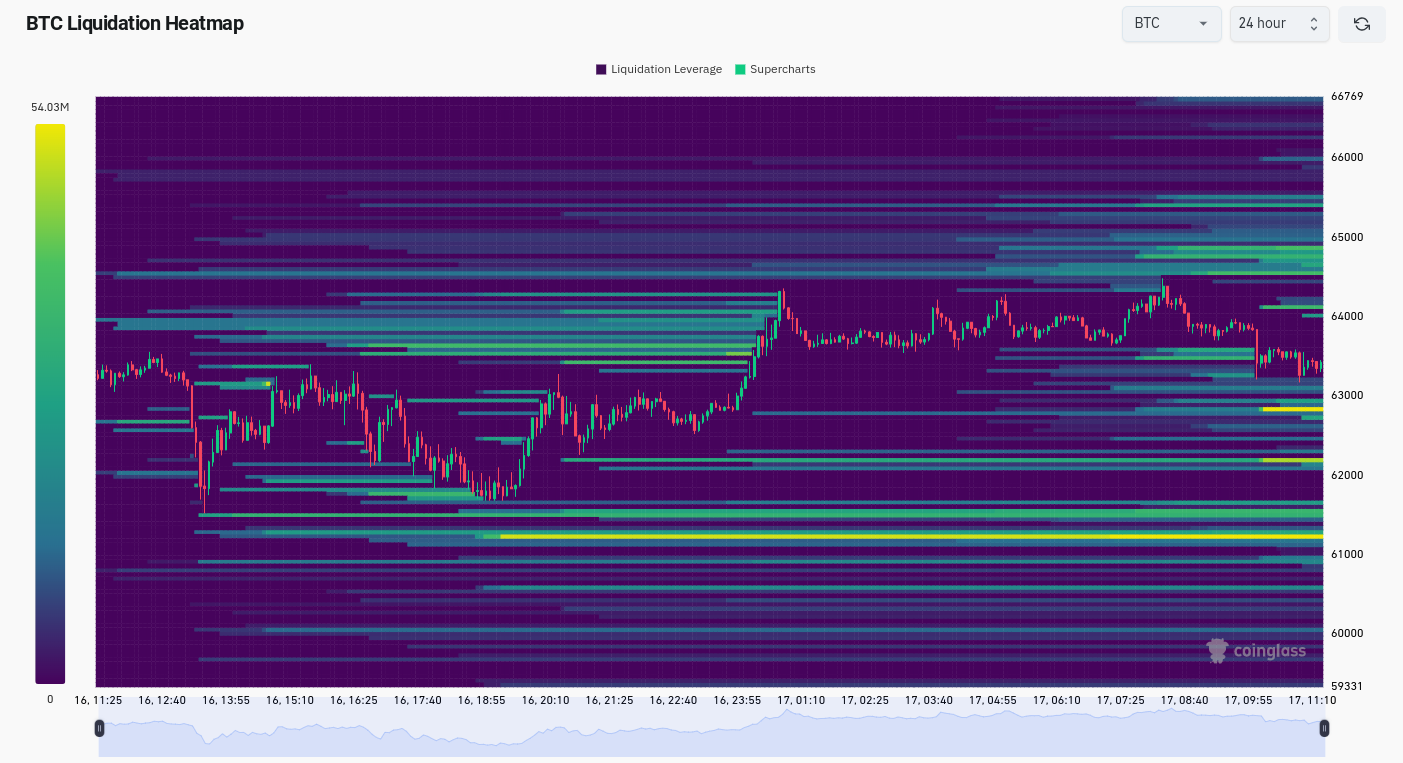

Data from monitoring resource CoinGlass shows bid liquidity moving closer to the active trading range above $60,000 on April 17.

BTC price liquidity thickens near key support

Bitcoin has liquidated a considerable chunk of longs this week, with a snap retracement “flushing” hundreds of millions of dollars in positions.

Bulls have yet to redress the balance, however, with BTC/USD stuck around $63,000 while still threatening a fresh breakdown .

The latest order book data shows that bids are currently attempting to get filled just below spot price — a common practice which aims to draw the market lower .

As explained by Keith Alan, co-founder of trading resource Material Indicators, this is ultimately cathartic for a market in need of an upside bounce. Taking bids, he suggested in video analysis uploaded to X (formerly Twitter) on April 16, has historically preceded a run into overhead resistance.

“What we want to see ultimately before we get a move that can have a better chance of breaking through this up here is more bid liquidity — something more akin to what we have seen historically,” he commented on an order book chart.

According to CoinGlass, the largest concentrations of bids, which have appeared in the 24 hours to the time of writing sit at $61,200, $62,200 and $62,800.