Centrifuge raises $15 million in Series A funding for institutional DeFi adoption

Centrifuge has raised $15 million in Series A funding led by ParaFi Capital and Greenfield. The company said it will establish a lending market on Coinbase’s Base network.

The company plans to build an institutional-grade, decentralized finance lending market for RWAs, built on Coinbase's Base layer 2 and integrated with Coinbase Verification.

"DeFi has always been about accessibility, transparency and interoperability, making markets more open, fair and decentralized, and we’re bringing these innovations to institutions in a compliant and safe way," Centrifuge co-founder Lucas Vogelsang said.

RWA lending market built on Base

According to a Wednesday press release , the integrations with Coinbase will allow institutions to quickly and safely access tokenized real-world assets.

"Centrifuge is a pioneer in real-world assets, and is now scaling using Coinbase Verifications and Base as the open-source settlement layer. This is an important step in ensuring institutional clients can build with Centrifuge in a safe and secure manner across the Coinbase ecosystem," Coinbase Head of Allocators and Tokenization Anthony Bassili said.

The company aims to use the funding to drive its product development and position itself as the bridge between traditional and decentralized finance by building a compliant platform for institutional Defi adoption.

The Series A round was oversubscribed and included investment from Circle Ventures, IOSG Ventures, Arrington Capital, the Spartan Group and Wintermute Ventures.

Institutional adoption of RWA tokenization

Centrifuge is a real-world asset tokenization protocol with an aim to securitize and integrate structured credit markets on the blockchain, allowing for the representation and trading of RWAs as tokens. This enables greater liquidity, efficiency and accessibility in traditionally illiquid markets.

According to ParaFi Founder and Managing Partner Ben Forman, the institutional adoption of real-world asset tokenization now stands as the most valuable opportunity within the cryptocurrency ecosystem.

He added that this involves "the migration of all existing and new assets onto a composable ledger, stocks, bonds, currencies, commodities, collectibles, tickets, media, content, etc."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uphold Exec Validates XRP Ledger Token Standard, Names Major Upside

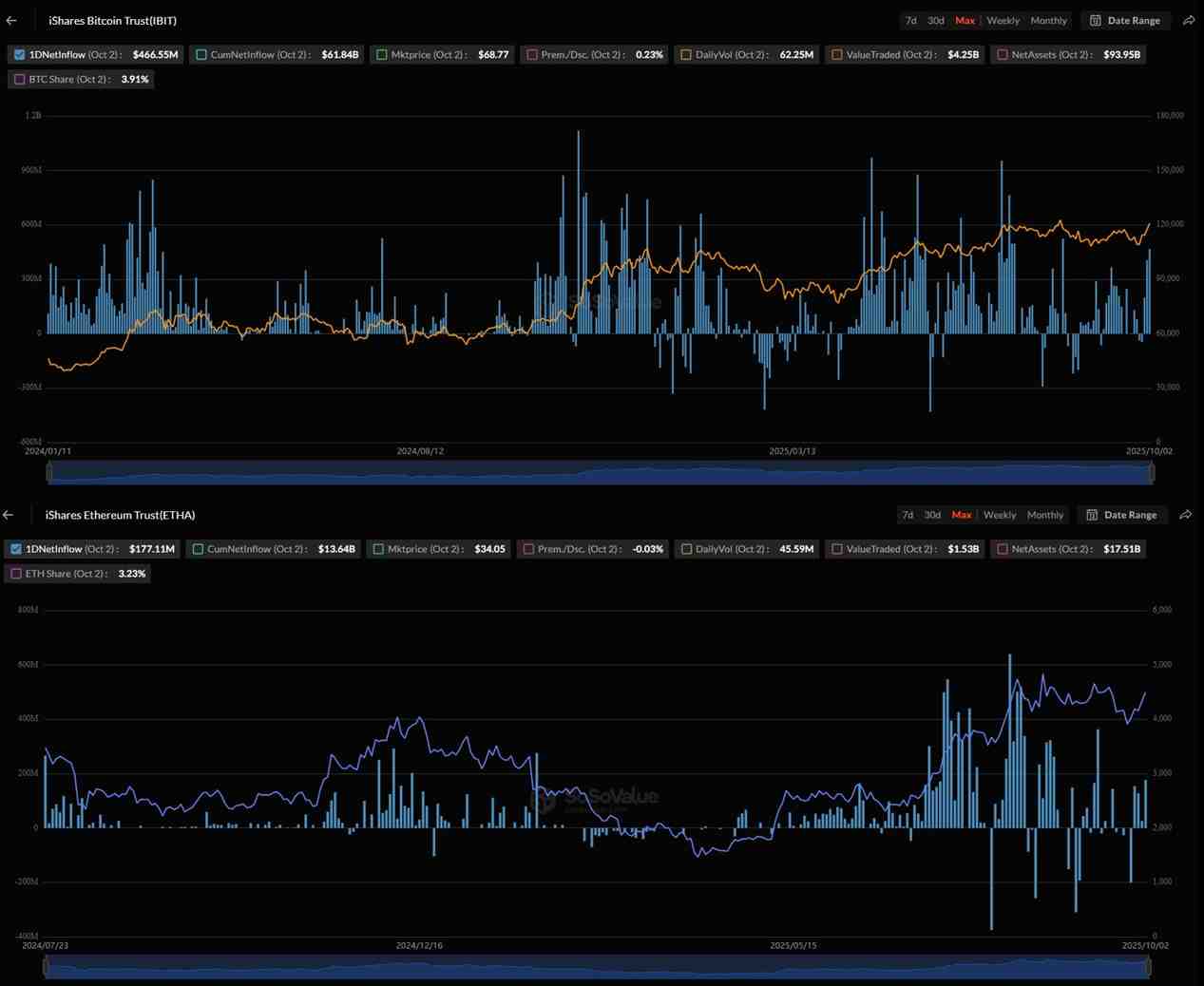

BlackRock buys over $600 million of these two cryptocurrencies

Bitcoin Could Reach $135,000 Soon: Standard Chartered

Zcash Rockets to Three-Year High, But Overheating Risks Loom