Bitcoin dips below $60,000 in wake of Powell's comments, even as halving draws near

Bitcoin dipped to $59,889 on April 17 before rebounding to over $60,300 shortly after.Bitcoin’s price fall began after the Fed chair commented that interest rates likely won’t go down for the foreseeable future.The next bitcoin halving event is 336 blocks away, slated to occur on April 19 at 9:44 p.m. ET.

Bitcoin BTC -1.54% hit $59,889 around 12:00 p.m. ET on April 17, according to The Block's Price page for bitcoin . The token rebounded to just over $60,300 at 1:05 p.m. ET on the same day, experiencing a decrease of $2,423, or 3.9%, in the past 24 hours.

In the perpetual futures market, liquidations reached $15.54 million between 12:00 p.m. ET and 1:00 p.m. ET on April 17. Long liquidations were about $8.4 million and short liquidations totaled $6.02 million. Twenty-four-hour liquidations hit $214.28 million across 67,301 traders, according to the crypto data tracker CoinGlass.

Price of bitcoin at 1:16 p.m. ET on April 17. Image: The Block Prices

Bitcoin saw a high of roughly $64,000 on April 16 going into early April 17.

Fed comments

RELATED INDICES

Bitcoin's price fall began after comments from the Fed chair that interest rates likely won't go down for the foreseeable future. On Tuesday, Jerome Powell, Chair of the Federal Reserve Bank, commented in a Washington forum that the U.S. central bank probably will not reach its 2% inflation goal anytime soon.

According to Reuters , Powell said, "Right now, given the strength of the labor market and progress on inflation so far, it's appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us."

Bitcoin halving

The bitcoin halving, expected on April 19, will cut mining rewards from 6.25 BTC to 3.125 BTC. This marks the fourth bitcoin halving since the network's inception in 2009, and it is a way to control the token's supply and maintain scarcity. The event occurs every 210,000 blocks , which are sequential units of data holding transaction history in a blockchain network.

The Block's bitcoin halving countdown shows that as of 1:34 p.m. ET on April 17, the next bitcoin halving is 336 blocks away. The last halving occurred on May 11, 2020.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

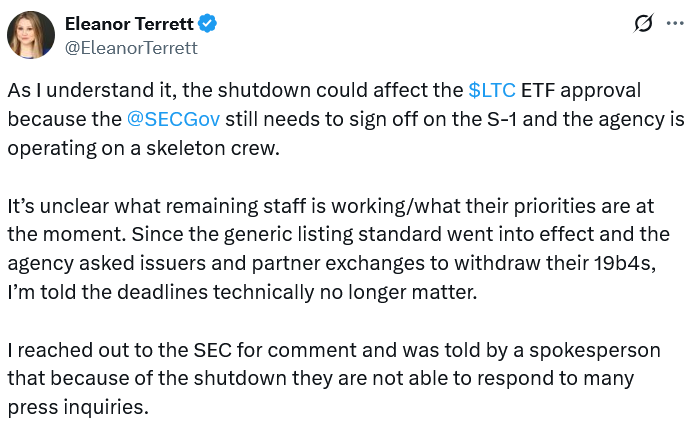

SEC silent on Canary Litecoin ETF amid gov shutdown

Bitcoin Breaks $119,000: Analyst Says $139,000 Could Be Next

Ethereum Price Forecast: Expert Predicts Final Impulse Wave Targeting $18,000

September’s Scars Fade: Is Fibonacci Pointing XRP and ETH to Uncharted Highs?