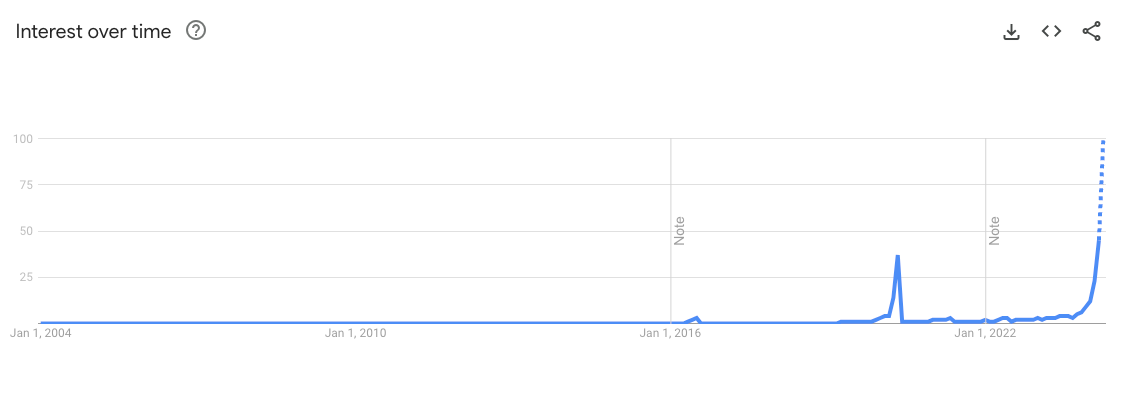

The level of interest in the ‘Bitcoin halving’ on Google has soared to its highest point of all time, with predicted data pegging it at more than double that of the last halving in 2020.

Search interest for the term ‘Bitcoin halving’ has already reached a score of 45, according to Google Trends data — with Google predicting it will reach an estimated score of 100 by the end of this month.

Google Trends notes that a value of 100 translates to “peak popularity” for the term.

Search interest for ‘Bitcoin Halving’ has shot to record levels. Source: Google Trends

The Bitcoin halving refers to when the rewards paid to miners are halved. This year, the Bitcoin halving will block rewards reduced from 6.25 BTC to 3.125 BTC.

The halving is currently slated to occur around 4am UTC on April 20, per the Cointelegraph countdown timer .

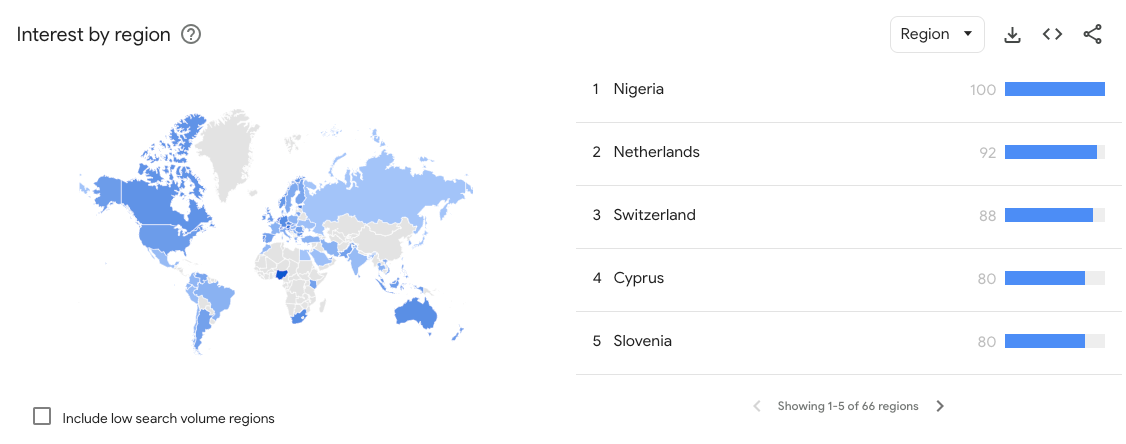

Google Trends shows the Bitcoin halving saw the most interest from Nigeria, Netherlands, Switzerland, and Cyprus.

Search interest in the Bitcoin halving was highest in Nigeria. Source: Google Trends

Record levels of interest in the halving event may not come as a surprise following Bitcoin’s ( BTC ) banner performance over the last few months.

Bitcoin began the year at a price of $42,200 and soared 74% to reach a new all-time high of $73,600 on May 13, per CoinMarketCap data .

Bitcoin’s price action has since cooled off and has traded consistently lower since mid-May. At the time of publication, Bitcoin is changing hands for $61,078 — down 17% from its all-time high.

Despite souring sentiment from market participants, several market commentators have pointed to the historical patterns of Bitcoin price action to suggest that Bitcoin could rally significantly in the months following the halving.