Ethereum surpasses Tesla and JPMorgan in buyback yield, ranking 16th globally

The latest data from the crypto analysis platform Token Terminal shows that Ethereum (ETH) has surpassed some SP 500 companies in terms of buyback yield, currently ranking 16th globally. On this list, Ethereum has outperformed major companies including Tesla and JPMorgan Chase. This achievement indicates that Ethereum is not only a promoter of smart contracts but also possesses the ability to compete as a fintech entity. Notably, compared with an average age of 44 years for the companies on the list, Ethereum is only about nine years old. Although companies like JPMorgan Chase were established as early as 1799, Ethereum did not appear until 2015.

Token Terminal points out that this difference demonstrates the profitability of internet-native businesses, especially when their innovations are freely expressed. As a promoter of smart contracts, Ethereum leads innovators in building decentralized applications and increases its total value locked (TVL) in decentralized finance (DeFi) to $92.74 billion USD. Apart from Bitcoin (BTC), Ethereum is the second-largest crypto project held by whales.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pine Analytics Releases Analysis of Flying Tulip Fundraising and Mechanism

Abracadabra attacked, hacker has transferred all $1.7 million stolen to Tornado Cash

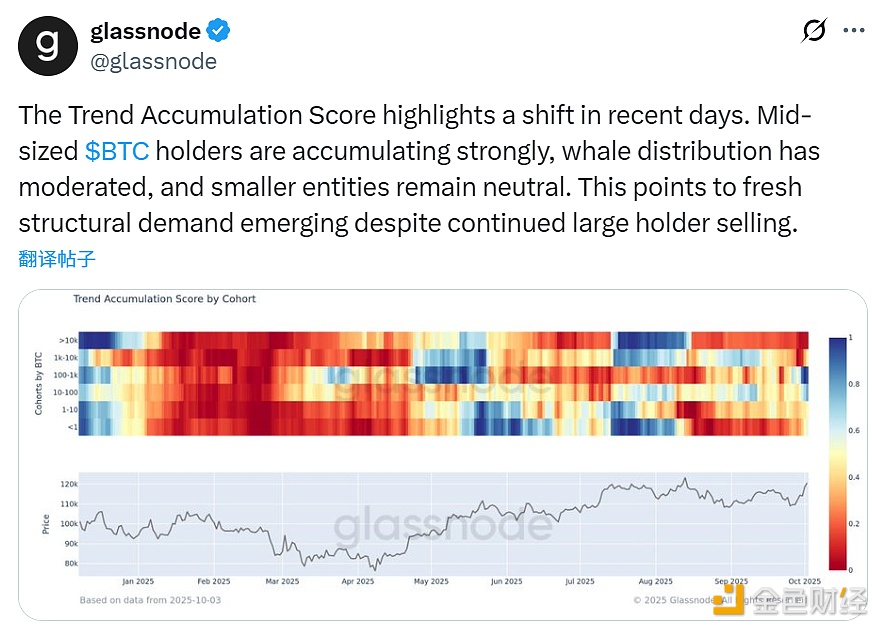

Opinion: Bitcoin Whale Sell-Off Slows Down, New Structural Demand Emerges

Data: Trend Research under Yilihua deposited 5,083.3 ETH to an exchange in the past 15 minutes