Ray Dalio hints at an optimistic attitude towards Bitcoin, considering it a non-debt currency like gold

In a recent blog post, Ray Dalio shared some views that suggest he might have an optimistic attitude towards Bitcoin. Dalio pointed out that good currency should be a means of transaction and a store of wealth, accepted globally. Currently, the main competitors are the US dollar, Euro, Yen and Renminbi. But the problem is that they are all tied to debt.

He emphasized a simple fact: when there's increased risk of debts being unpayable or repaid with devalued currency, people's confidence drops. If a country has too much debt, its central bank may print more money to alleviate pressure leading to currency depreciation. However gold is different; it isn't backed by debt and is more resistant to cash and bond devaluation caused by inflation. Central banks and investors like gold because it doesn't collapse under defaulting debts or inflation; in fact it's the third largest reserve after major currencies. Now cryptocurrencies are like gold - also non-debt currencies.

When systems function properly without any debt or inflation crisis and governments manage their monetary responsibilities well without depreciating their own currencies financial assets remain stable but when problems arise Dalio stated that gold is a good asset as it’s reliable hedging tool He carefully clarified though he didn’t directly provide investment advice just his view on markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pine Analytics Releases Analysis of Flying Tulip Fundraising and Mechanism

Abracadabra attacked, hacker has transferred all $1.7 million stolen to Tornado Cash

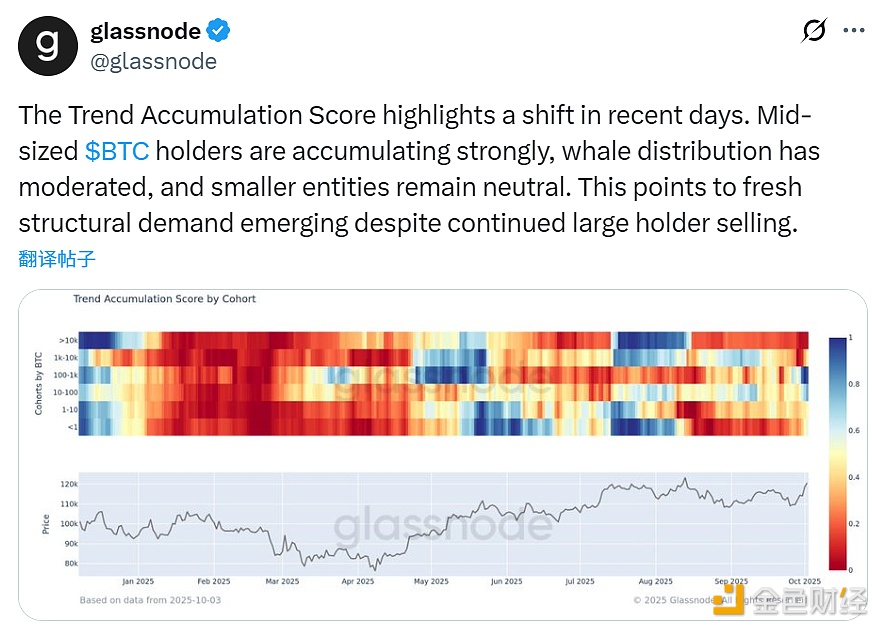

Opinion: Bitcoin Whale Sell-Off Slows Down, New Structural Demand Emerges

Data: Trend Research under Yilihua deposited 5,083.3 ETH to an exchange in the past 15 minutes