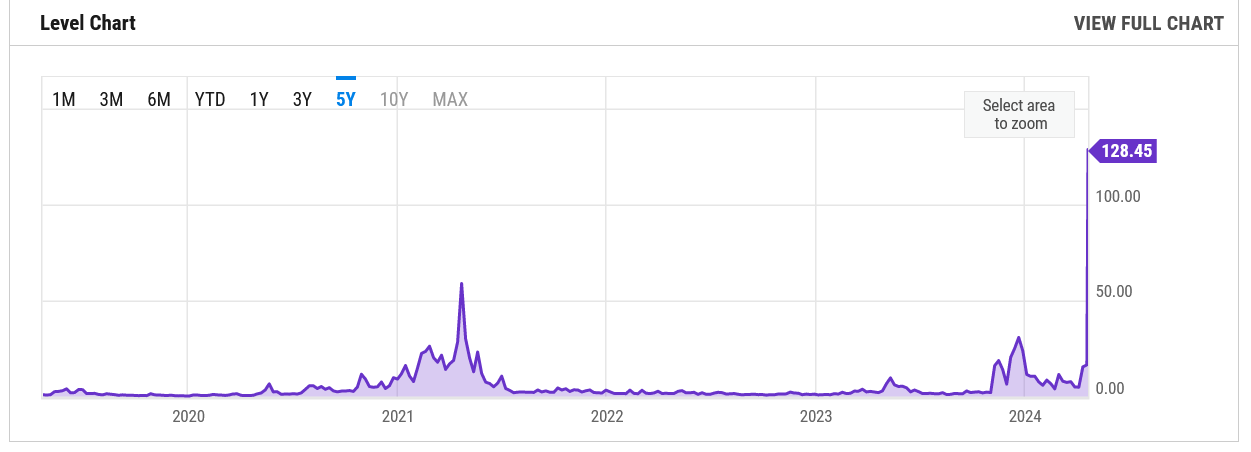

The average fees paid on Bitcoin have sharply fallen just a day after reaching a record average of $128 on April 20 — the day of the fourth Bitcoin halving.

As of April 21, Bitcoin (BTC) fees have fallen to an average of $8-10 for medium-priority transactions, according to mempool.space.

Average daily transaction fee on Bitcoin over the last 5 years. Source: Y Charts

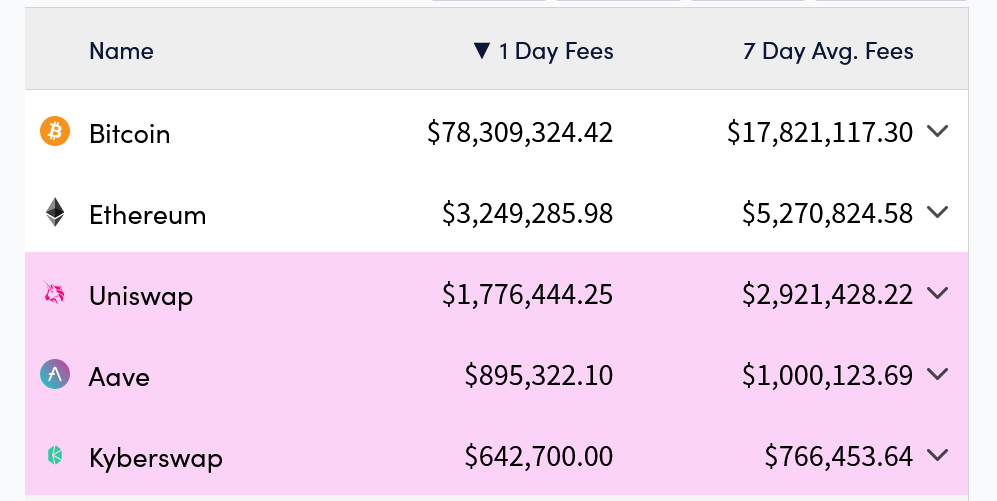

Only one day before, Bitcoin clocked $78.3 million in total fees, beating Ethereum by over 24 times according to Crypto Fees.

The day included a staggering 37.7 Bitcoin ($2.4 million) paid to Bitcoin miner ViaBTC in the Bitcoin halving block at block height 840,000 — making it the most sought-after piece of digital real estate in the network’s 15-year history.

Much of the demand at block 840,000 came from memecoin and nonfungible token enthusiasts competing to inscribe and etch rare satoshis via the Runes protocol — a new token standard that launched at the halving block.

3050 transactions were included in that block, meaning the average user paid a little under $800.

Largest fees by blockchains and decentralized finance projects on April 20. Source: Crypto Fees

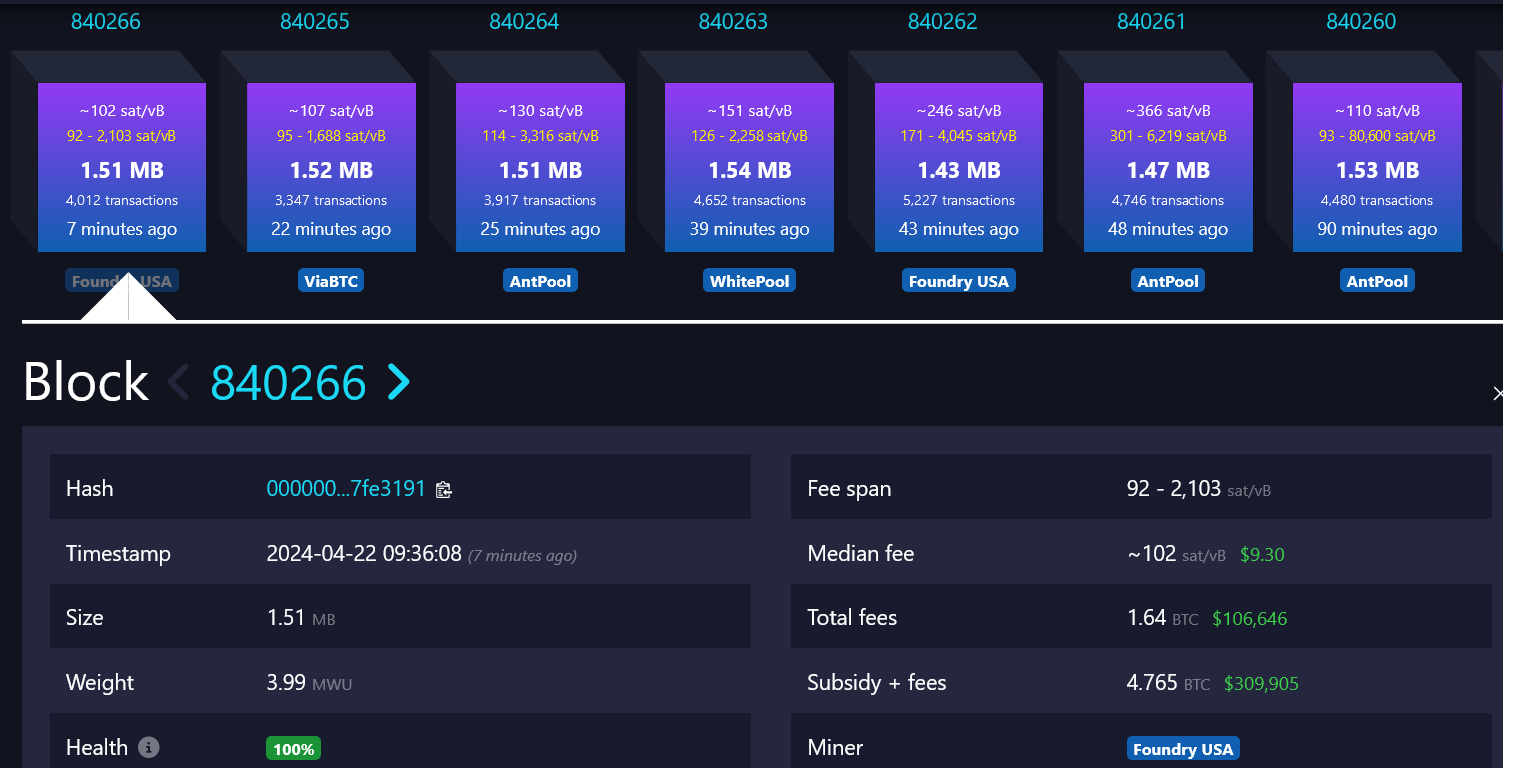

The higher-than-normal block fees continued until about block 840,200, according to mempool.space, however, block fees have since fallen to around 1-2 Bitcoin.

The large block fee payouts to miners throughout on halving day meant they weren’t initially impacted by the block subsidy halving from 6.25 Bitcoin to 3.125 Bitcoin.

But that’s no longer the case now that the average block fee is well below 3.125.

Source: Total fees for block 840,266 came out at 1.64 BTC. With the new block subsidy of 3.125, total rewards came out at 4.76 BTC. Source: mempool.space

Meanwhile, fees on Bitcoin have now topped Ethereum for six consecutive days between April 15-20, with its 7-day fee average now at $17.8 million.

The halving event didn't have a material impact on Bitcoin's price, which is up 1.5% since then to $64,840, according to CoinGecko.