Global cryptocurrency funds have seen outflows for the second consecutive week, as investors worry that interest rates will not decrease

A report from CoinShares International Ltd shows that the demand for global cryptocurrency funds has declined for the second consecutive week due to investor concerns that interest rates will not decrease in the short term. The report indicates that as of the week ending April 19, there was a total outflow of $206 million in crypto assets. Investors withdrew $244 million from U.S. ETFs, with outflows primarily coming from existing funds while newly issued ETFs continued to see inflows, albeit lower than previous weeks. Data suggests investors may be pulling out due to expectations that the Federal Reserve will maintain these high interest rates over an extended period. The U.S spot Bitcoin ETF, which began trading earlier this year after approval by the Securities and Exchange Commission, saw an outflow of $192 million within one week but "few investors see this as a shorting opportunity". Funds holding Ethereum experienced an outflow of $34.2 million marking six consecutive weeks of withdrawals. Cryptocurrency-related stocks have seen withdrawals for 11 straight weeks totaling $9 million because "investors continue to worry about halving's impact on crypto mining companies."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise Executive: Solana Will Become Wall Street’s Preferred Stablecoin Network

Data: Hyperliquid platform whale currently holds $10.517 billions, with a long-short ratio of 0.86

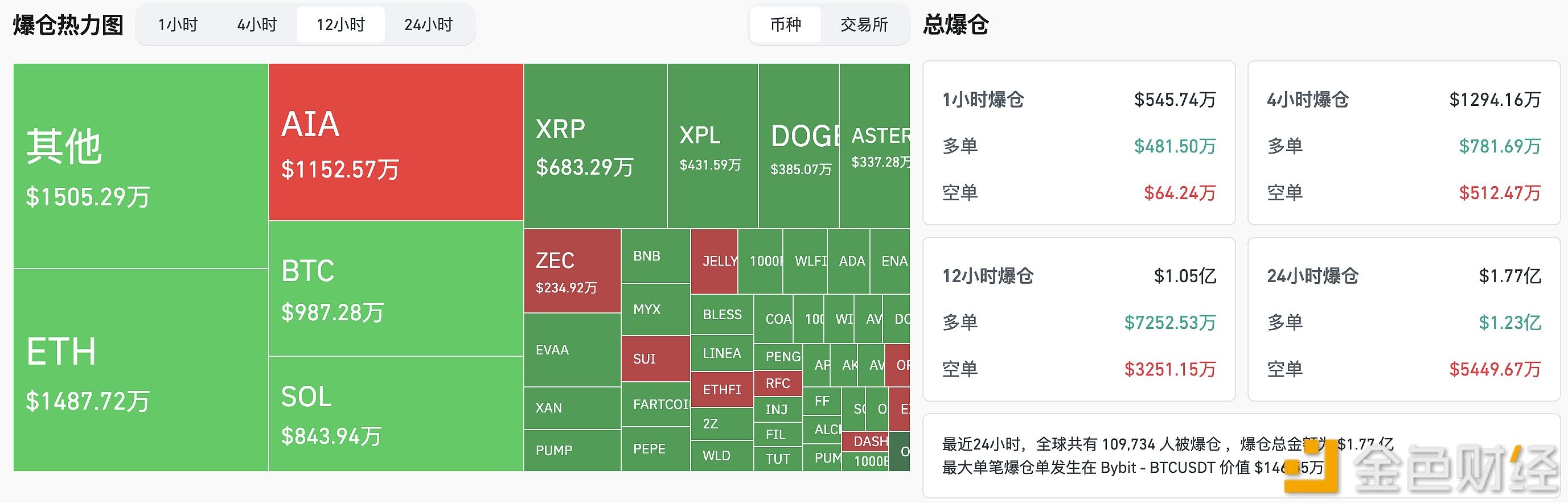

$105 million liquidated across the entire network in the past 12 hours