More than half a billion dollars worth of Ether ( ETH ) long positions could face liquidation if Ether experiences the same price volatility as it did last weekend.

This comes amid mounting concerns that the U.S. Securities and Exchange Commission (SEC) might reject an Ether spot ETF next month.

At the time of publication, Ether is currently trading at $3,134, as per CoinMarketCap data .

Ether's price has hovered between $3,705 and $2,915 over the past 30 days. Source: CoinMarketCap

Over the past few weekends, Ether has experienced short bursts of volatility in its price, followed by quickly recovering to key support levels.

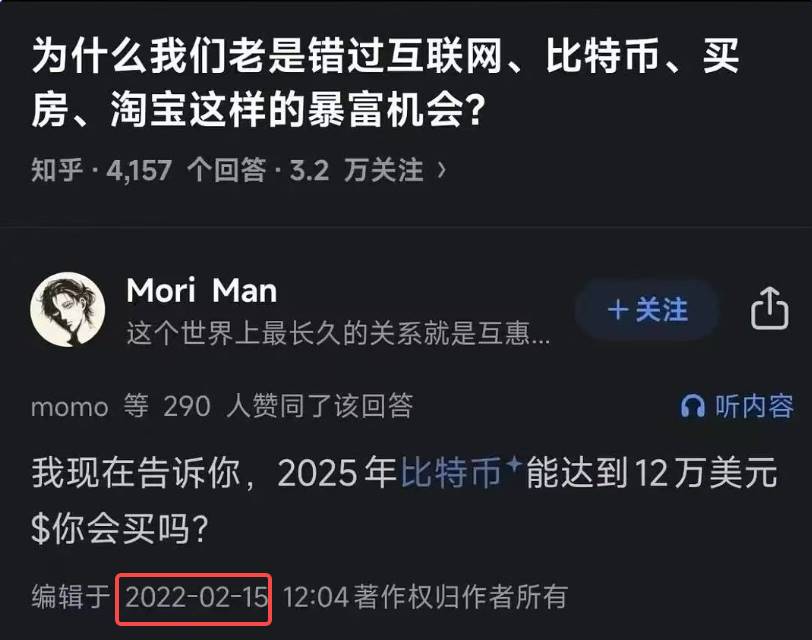

On April 20, the price briefly dipped by 2.25% to $3,036. The previous Saturday, April 13, it fell nearly 9% to $2,950 before recovering to $3,075.

If it happens again this weekend, a significant amount of liquidations will be at risk. A similar drop of just 2.25% at its current price will lead to $510 million in long liquidations, as per CoinGlass data .

Meanwhile, a sharper decline similar to the 9% drop seen the previous weekend would result in $853 million being wiped in long liquidations.

Ether's price has little wiggle room without risking a significant amount of liquidations. Source: CoinGlass

The high volume of potential liquidations comes as Ethereum is experiencing broader uncertainties regarding the status of its spot ETF, along with other legal challenges.

On April 24, Cointelegraph reported that U.S. issuers and other firms expect the SEC to reject spot Ether ETF applications next month following meetings with the regulator in recent weeks, citing four people who participated in the meetings.

The four persons claimed that recent meetings between issuers and the SEC have been one-sided, and agency staff have not discussed substantive details about the proposed products.

Meanwhile, it has beenrevealed on Thursday that software development company Consensys filed a lawsuit against the SEC and its five commissioners over claims they plan “to regulate ETH as a security.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.