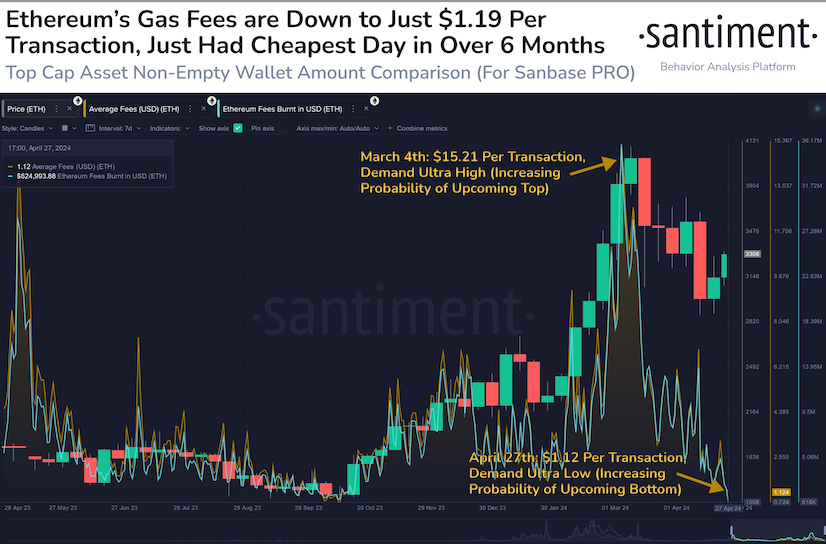

Gas fees on the Ethereum network have plunged to a six-month low even as the price of Ether ( ETH ) rallied slightly over the weekend, which analysts from crypto analytics platform Santiment say could signal an upcoming altcoin rally.

On April 27, the average fee for an Ethereum translation fell as low as $1.12, according to an April 28 X post from Santiment.

“Traders historically move between sentimental cycles of feeling that crypto is going ‘To the Moon’ or feeling that ‘It Is Dead’, which can be observed through transaction fees,” wrote Santiment.

Santiment explained that fees tend to peak around local market tops and fall back to “resting state” lows around the time of market bottoms.

Gas fees on Ethereum reached an eight-month high in February this year amid a tidal wave of interest in an experimental token standard called ERC-404.

The analytics platform suggested the low gas fees could indicate a future uptick in Ethereum network activity and herald the beginning of an altcoin rally.

“With markets mainly retracing over the past 6 weeks, the lack of demand and strain on the network may help turn ETH and associated altcoins around sooner than many may expect.”

It comes as the price of Ether rallied slightly, gaining 4.3% in the last week, per CoinGecko data .

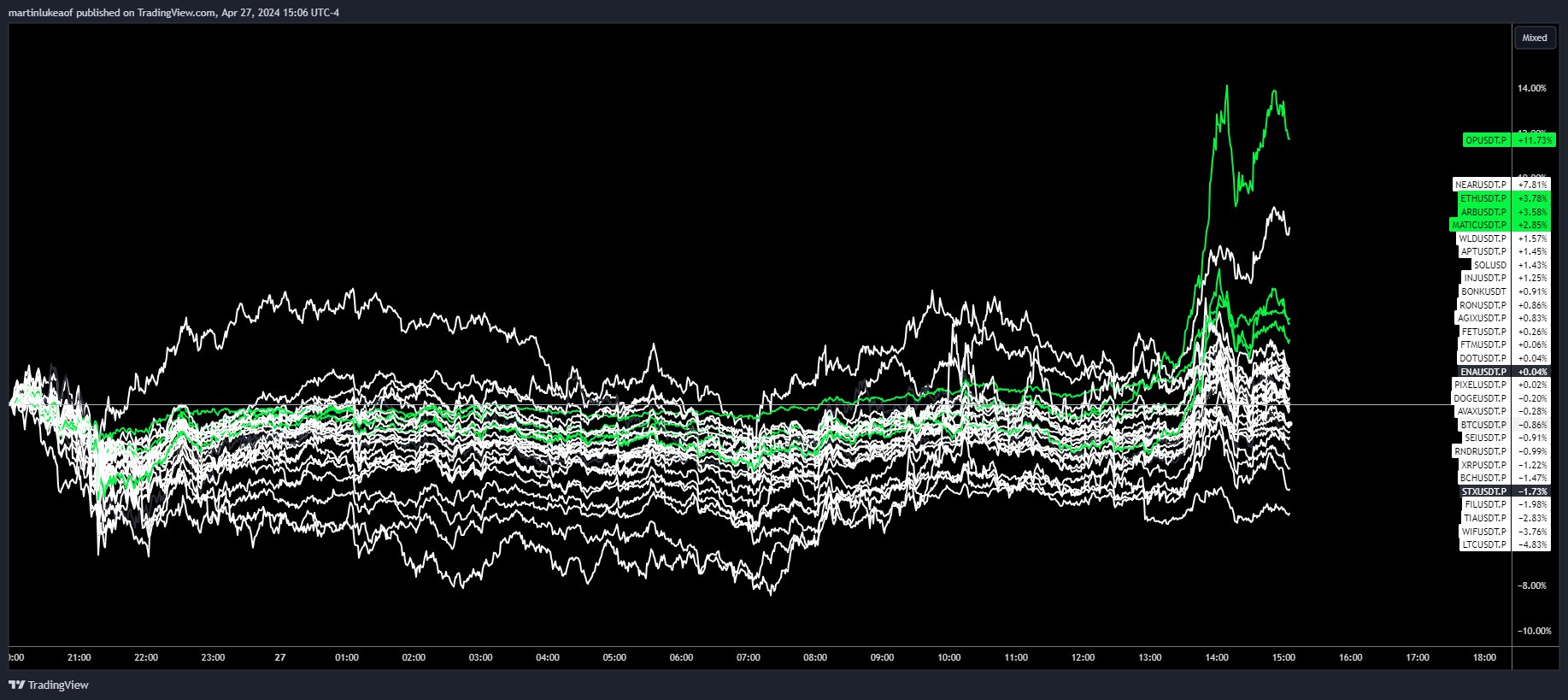

On April 27, Ethereum layer-2 networks Optimism (OP), Arbitrum (ARB), and Polygon ( MATIC ) accounted for three of the top five best-performing assets in the top 50 cryptocurrencies by market cap, gaining 11.7%, 3.5%, and 2.8% respectively.