Volume 181: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

Outflows of US$251m globally overshadow US$307m inflows into Hong Kong

- Digital asset investment products saw outflows for the fourth consecutive week totalling US$251m. This week marked the first week to see any measurable outflows from the newly issued ETFs in the US.

- The bright spot last week was the successful launch of spot-based ETFs in Hong Kong, which saw US$307m inflows in the first week of trading.

- Ethereum broke its 7-week spell of outflows, seeing US$30m of inflows last week.

Digital asset investment products saw outflows for the fourth consecutive week totalling US$251m. This week marked the first week to see any measurable outflows from the newly issued ETFs in the US, which saw US$156m outflows last week. We estimate the average purchase price of these ETFs since launch to be US$62,200 per bitcoin, as the price fell 10% below that level, it may have triggered automatic sell orders.

Regionally, while the outflows were primarily focussed on the US, which saw US$504m of outflows, Canada, Switzerland and Germany also saw outflows, totalling US$9.6m, US$9.8m and US$7.3m respectively.

The bright spot last week was the successful launch of spot-based Bitcoin and Ethereum ETFs in Hong Kong, which saw US$307m inflows in the first week of trading.

As usual Bitcoin was the primary focus, seeing US$284m of outflows. Unusually, this was the only digital asset to see outflows. Ethereum broke its 7-week spell of outflows, seeing US$30m of inflows last week.

A wide range of altcoins saw inflows, with the most significant being Avalanche, Cardano and Polkadot, seeing US$0.5m, US$0.4m and US$0.3m respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

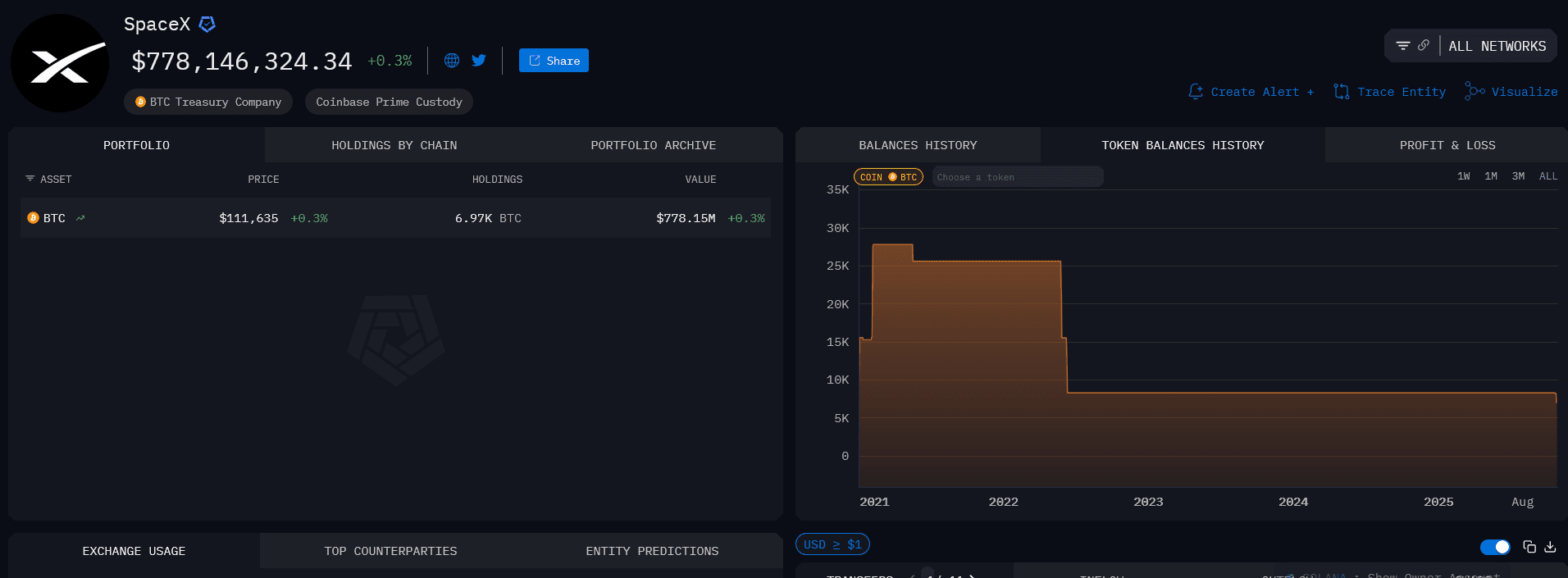

Elon Musk’s SpaceX Transfers $134 Million Worth of Bitcoin

BlockDAG’s $ 430M Presale, 3.5M Miners, and Real Infrastructure Set Stage for Rank #28 CoinMarketCap Launch

Boros: Swallowing DeFi, CeFi, and TradFi to Unlock Pendle's Next 100x Growth Engine

The profit potential of Boros yield space can even surpass that of Meme.

SUI Targets Wave 3 Rally as $1.71 Level Defines Bullish Breakout Path