Bitget Research: Approval of ETH ETF Sees Breakthrough, Bitget Wallet Launches BWB LaunchPad

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors with strong wealth creation effect: ETH ecosystem.

-

Top searched tokens and topics: Li.Fi, Bitget Wallet (BWB), and GALA.

-

Potential airdrop opportunities: Spark and Amnis Finance.

1. Market Environment

2. Wealth Creation Sectors

2.1 Sector Movements – Core Assets in the ETH Ecosystem (PENDLE, ETHFI, and LDO)

-

The U.S. SEC has urged exchanges to expedite updates to the 19B-4 form for the spot Ethereum ETF, increasing the likelihood of approval by May 31.

-

ETH rose by 20% in the last 24 hours.

-

Continued rise of ETH: DEXs in the Ethereum ecosystem have good liquidity, where many tokens are priced in ETH. An increase in ETH directly boosts the rise in Ethereum ecosystem assets. If the ETH price keeps rising, core assets on Ethereum tend to maintain their popularity.

-

Updates on the Ethereum ETF: The U.S. SEC is set to decide on the VanEck spot Ethereum ETF on the 24th. It is advisable to follow Bloomberg senior ETF researchers James Seyffart and Eric Balchunas on X for timely trading based on the latest information.

2.2 Sector Movements – Memecoins in the ETH Ecosystem (PEPE, WOJAK, and FLOKI)

-

Continued rise of ETH: DEXs in the Ethereum ecosystem have good liquidity, where many tokens are priced in ETH. An increase in ETH directly boosts the rise in Ethereum ecosystem assets. If the ETH price keeps rising, core assets on Ethereum tend to maintain their popularity.

-

Changes in the open interest amount: The surge occurred yesterday in open interest for PEPE and FLOKI indicates an influx of hot money. Utilize the tv.coinglass to understand the direction of major funds, and monitor futures data, especially the increase in net long positions. Check if there is a rise in open interest (OI) and trading volume. If so, it indicates increased bullish buying, suggesting that holdings can be maintained.

2.3 Sectors to Focus on Next — ETH Ecosystem

-

UNI: The first DeFi Swap project among blockchain applications, which received a Wells notice from the SEC last month. Uniswap is expected to soon present a self-defense, creating trading opportunities.

-

LDO: A leading LSD project within the ETH ecosystem. It has a TVL of $34.5 billion but is valued at just under $2.5 billion, making it relatively undervalued.

-

OP: Built using OP stack technology on the Base chain. Last year, the project signed a profit-sharing agreement with the OP Foundation, indirectly receiving an endorsement from Coinbase.

-

PENDLE: The project's TVL has been on a continuous rise, now standing at $5.7 billion. The increase in stablecoin market cap and high demand in the restaking sector have led to an increased demand for PENDLE's services during the bull market.

3. Top Searches

3.1 Popular DApps

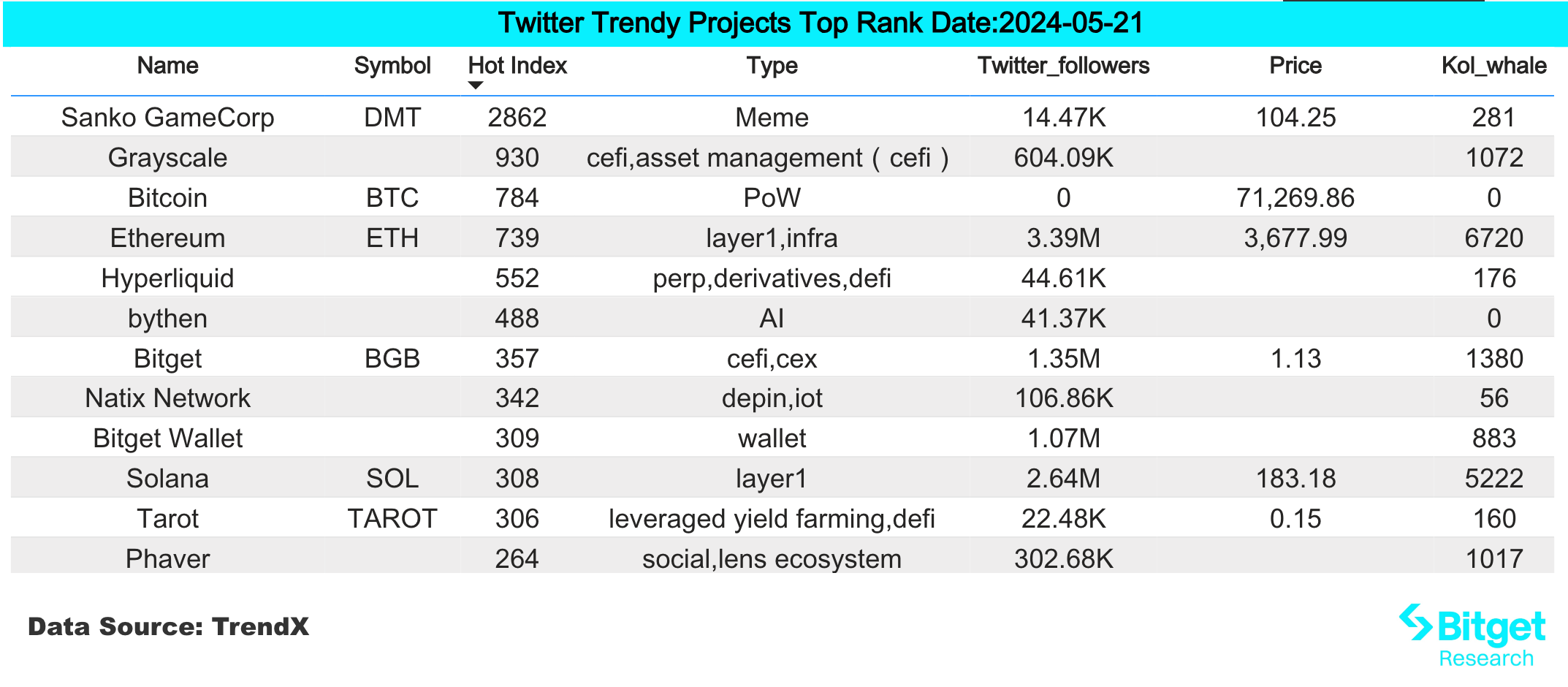

3.2 X (former Twitter)

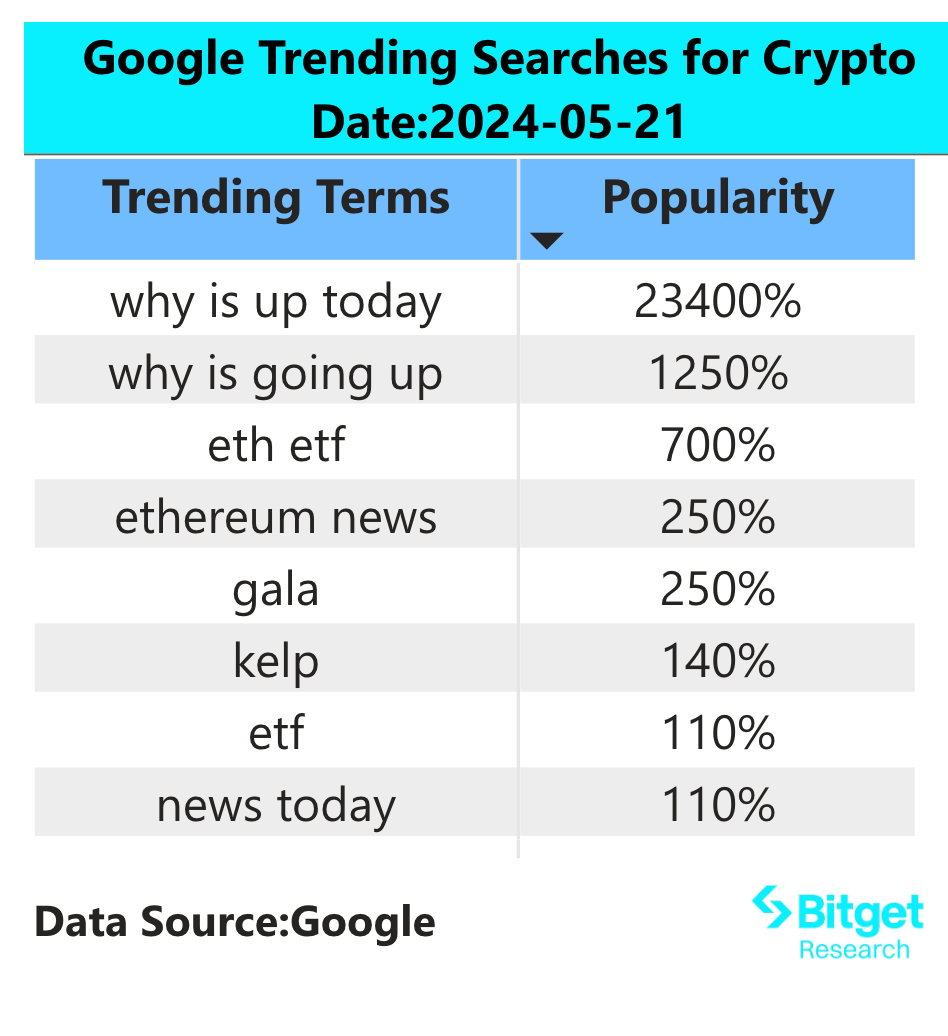

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!