Market Insider: The cancellation of physical Ethereum ETF collateral may reduce the appeal of the fund

Many people in the cryptocurrency market believe that key changes made to some applications for the proposed spot Ethereum ETF will benefit the Ethereum blockchain, but put future ETF products at a disadvantage. Issuers including Fidelity Investments and Ark Investment Management have already cancelled their staking plans. The cancellation of ETF staking plans is not surprising to many observers, as regulators view Ethereum's basic mechanism as similar to cryptocurrency lending. Ayesha Kiani, Chief Operating Officer of crypto hedge fund MNNC Group, said that currently, staking is more seen as a security measure because staked Ether can provide returns. This is the best example of decentralization intersecting with SEC standards. Owning Ether without pledging tokens means that holders are not helping protect the blockchain, which is an issue because it gives people like Fidelity or VanEck an opportunity to contribute to the Ethereum network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

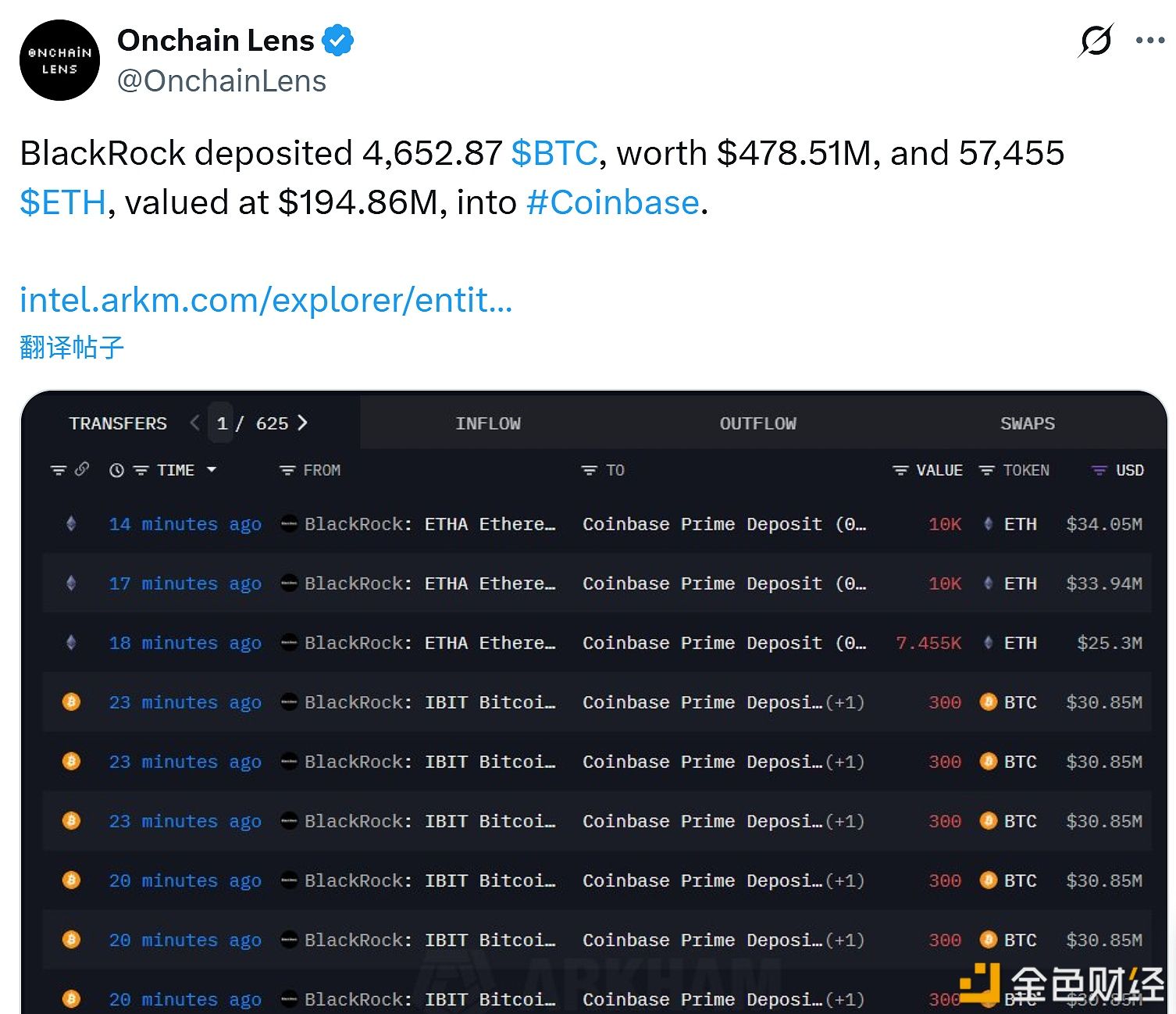

BlackRock deposits 4,652.87 BTC and 57,455 ETH into a certain exchange

Opinion: Quantum computing may crack the Bitcoin algorithm within three years

Hong Kong-listed company Moon has been listed on the US OTCQX market, focusing on bitcoin consumer products.

Trump: Hopes to Make the United States a "Bitcoin Superpower"