Bitget Research: Mt.Gox States No Repayments in the Short Term, Crypto Market Stabilizes with Narrow Fluctuations

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors with strong wealth creation effects: RWA sector and Ethereum Layer 2 sector.

-

Top searched tokens and topics: Particle network, Atomicals Protocol, and Celestia.

-

Potential airdrop opportunities: Espresso and Morph.

1. Market Environment

2. Wealth Creation Sectors

2.1 Sector Movements – RWA Sector (ONDO, TRU, and POLYX)

-

Changes in macroeconomic monetary policy: From a macroeconomic perspective, the rise in U.S. 10-Year Treasury Bond Yields supports the fundamentals of the RWA sector. It is essential to monitor subsequent changes in the dollar index, treasury yields, and the cryptocurrency market to adjust trading strategies dynamically.

-

TVL changes in projects: RWA sector projects are generally supported by TVL, making it essential to monitor the changes in this metric. If a project's TVL rises continuously or suddenly, it is usually a signal to buy.

2.2 Sector Movements – Ethereum Layer 2 Sector (ARB, OP, and STRK)

-

Approval of Ethereum ETFs: The market has largely priced in the approval of the Ethereum ETF. Should there be unexpected developments in the ETF approval tomorrow morning, a trend reversal might occur.

-

Development of Layer 2 projects: As a widely used chain ecosystem, the future development of Layer 2 depends on its collaboration with projects and user growth.

2.3 Sectors to Focus on Next — AI Sector

-

OpenAI launched its flagship AI model, capable of real-time audio, visual, and text reasoning processing. The release of the text-to-video model Sora by OpenAI in February drove up valuations across the sector. The launch of GPT-4o highlights the importance of maintaining focus on the AI sector.

-

According to Cointelgraph, tech giant Microsoft is closely monitoring the crypto industry, including ways blockchain technology and artificial intelligence might support each other.

-

TAO: Bittensor is an open-source protocol that powers a blockchain-based machine learning network. Machine learning models train collaboratively and are rewarded in TAO according to the informational value they offer the collective.

-

NEAR: Recently, many AI projects within the NEAR ecosystem are in the development or funding stage, positioning NEAR to potentially become a future AI Hub.

3. Top Searches

3.1 Popular DApps

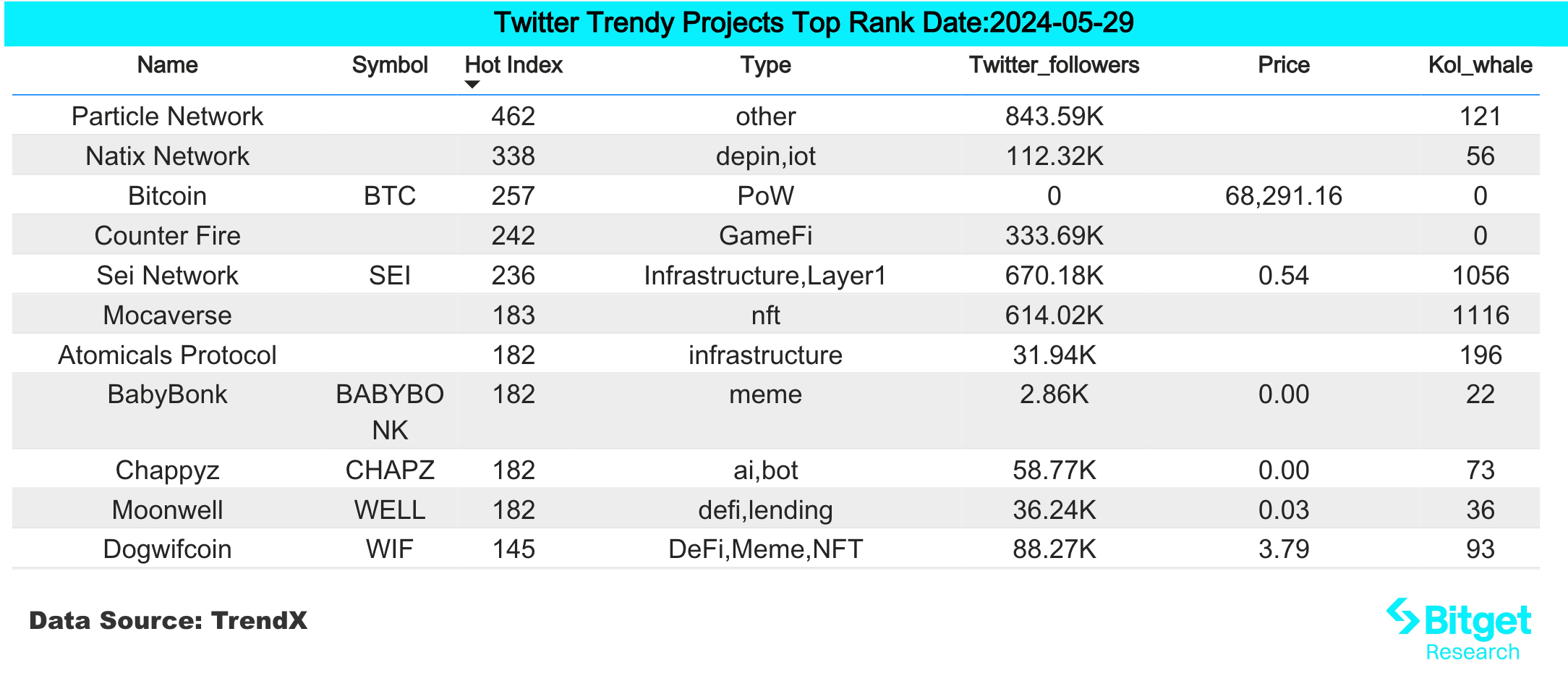

3.2 X (former Twitter)

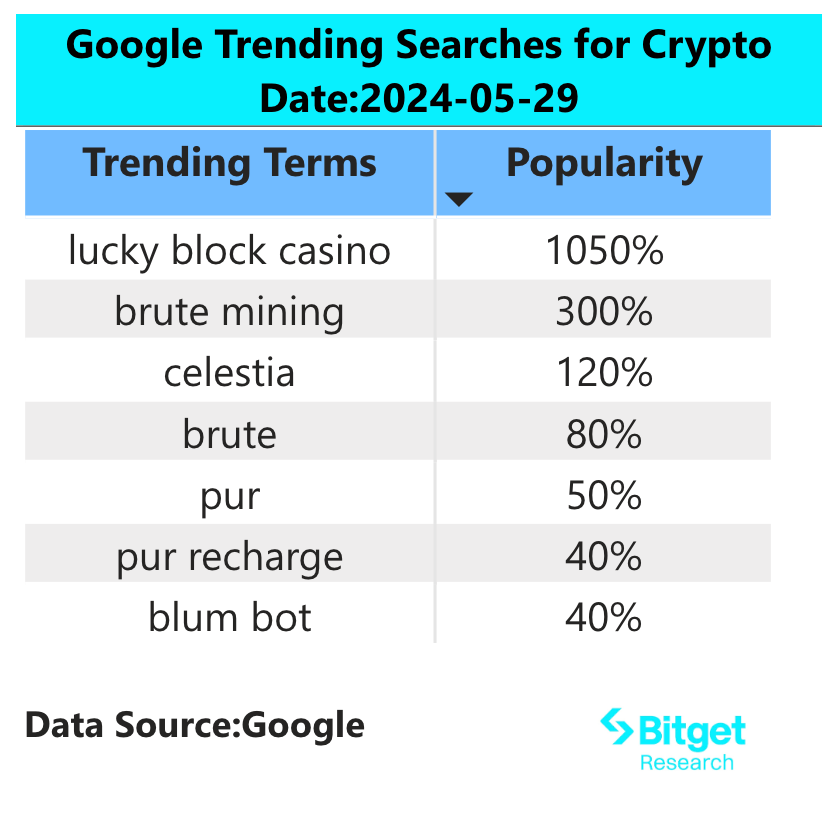

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.