Bitget Contract Market Update

Bitget2024/07/02 05:03

By:Bitget

Circle Snags First Stablecoin License Under EU's New MiCA Crypto Rules

Circle became the first global stablecoin issuer to secure an Electronic Money Institution (EMI) license, a prerequisite to offering dollar- and euro-pegged crypto tokens in the European Union (EU) under the

Markets in Crypto Assets (MiCA) regulatory framework.

The license gives the company, whose USDC trails behind rival

Tether's market-leading USDT, pole position in grabbing market share among the 27-nation trading bloc's 450 million people.

Stablecoins are a key piece of infrastructure in the digital asset market, facilitating trading on exchanges and, increasingly, used for transactions and remittances. Circle's $32 billion USDC is the second-largest stablecoin and the gap to market leader Tether's $110 billion USDT has been widening. Armed with a license from the French banking regulatory authority, Circle Mint France will “onshore” the issuance of its euro-denominated EURC stablecoin to the EU and issue USDC from the same entity, the company said.

Source: CoinDesk

Futures Market Updates

Bitcoin prices neither shoot up as expected nor fell too low, causing liquidations on both sides.

Bitcoin Futures Updates

Total BTC Open Interest: $32.83B (-0.32%)

BTC Volume (24H): $36.87B (-14.62%)

BTC Liquidations (24H): $10.47M (Long)/$12.95M (Short)

Long/Short Ratio: 49.86%/50.14%

Funding Rate: 0.0033%

Ether Futures Updates

Total ETH Open Interest: $15.08B (-0.79%)

ETH Volume (24H): $14.85B (-7.75%)

ETH Liquidations (24H): $13.03M (Long)/$7.19M(M(Short)

Long/Short Ratio: 48.46%/51.54%

Funding Rate: 0.0073%

Top 3 OI Surges

1000APU: $2.33M (+133.39%)

ZEN: $13.33M (+131.35%)

BAL: $12.25M (+112.72%)

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Chaincatcher•2025/12/11 16:50

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Chaincatcher•2025/12/11 16:50

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

AICoin•2025/12/11 16:41

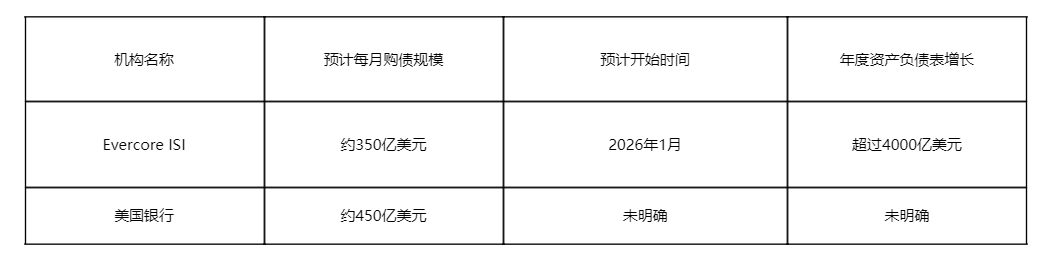

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

AICoin•2025/12/11 16:41

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$89,771.58

-2.75%

Ethereum

ETH

$3,177.35

-5.54%

Tether USDt

USDT

$1

+0.00%

XRP

XRP

$2

-3.75%

BNB

BNB

$867.68

-3.24%

USDC

USDC

$0.9998

-0.01%

Solana

SOL

$131.4

-3.66%

TRON

TRX

$0.2810

+1.27%

Dogecoin

DOGE

$0.1371

-6.13%

Cardano

ADA

$0.4136

-10.82%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now