Analysis: Whales spend most of the bear market accumulating BTC

According to WhalePanda's monitoring, Bitfinex whales have been accumulating BTC for most of the bear market. As prices began to rise in November last year, they started selling some positions. Then, after the ETF was approved and a large amount of GBTC flowed out, they began to accumulate again at the end of January. When the price rose to $70,000, they started reducing their positions more aggressively. Now, every sell-off is below $62,000 and whales are slowly but surely accumulating again. It is estimated that about 300-400 BTC are accumulated each day which almost entirely covers newly mined bitcoins (450 BTC every 24 hours).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

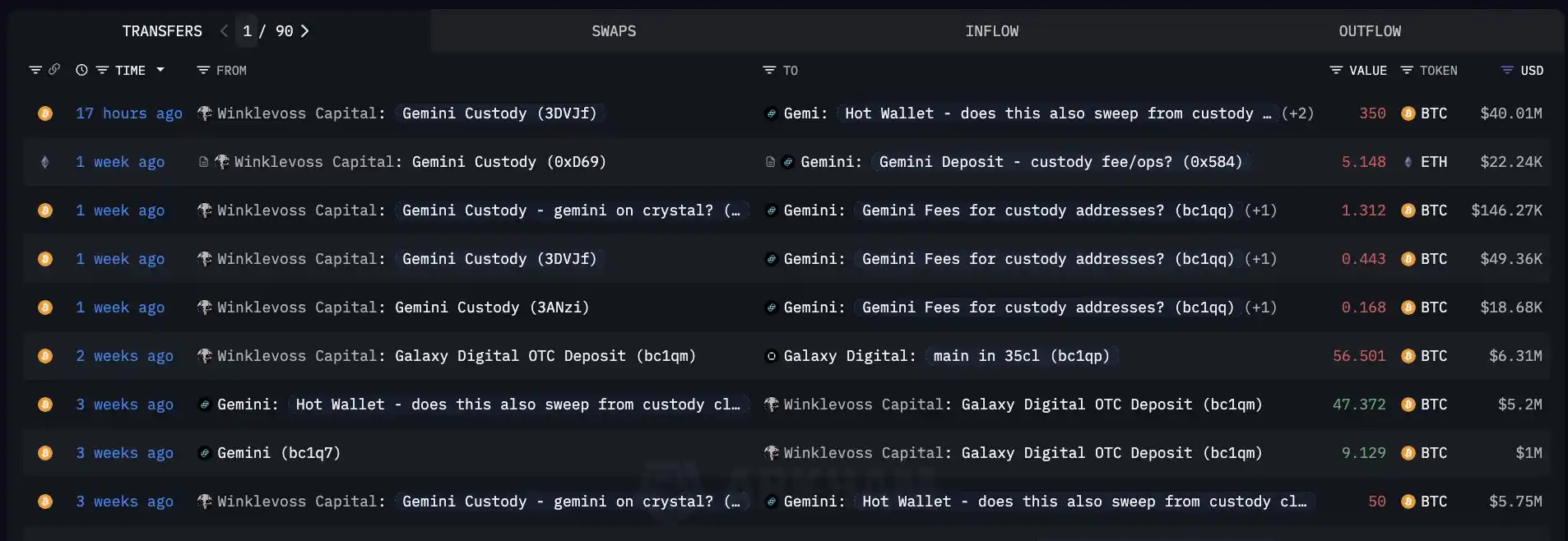

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.