Greeks.live Researcher: Market Climate More Pessimistic, Mainstream Coin Put Option IVs Rise Significantly

The data shows that 18,000 BTC options are about to expire with a Put Call Ratio of 0.65, a maximum pain point of $61,500 and a notional value of $1 billion. 164,000 ETH options are about to expire with a Put Call Ratio of 0.36, a maximum pain point of $3,350 and a notional value of $470 million. Adam, a researcher at Greeks.live, said in a post on the X platform that the crypto market suffered heavy losses at the beginning of July, with all major cryptocurrencies dropping to new lows in months, and that the market saw huge volatility just after quarterly delivery was completed, with major maturity IVs increasing sharply, making it a good opportunity for institutional sellers to build their positions. The market atmosphere is more pessimistic, the IV of put options on mainstream coins has risen significantly, and the term structure shows an inversion of far-low and near-high, ETH ETF will have more clear news in the near future, and those who want to bottom out can buy some end-of-month calls, which are far more cost-effective than futures to do more.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

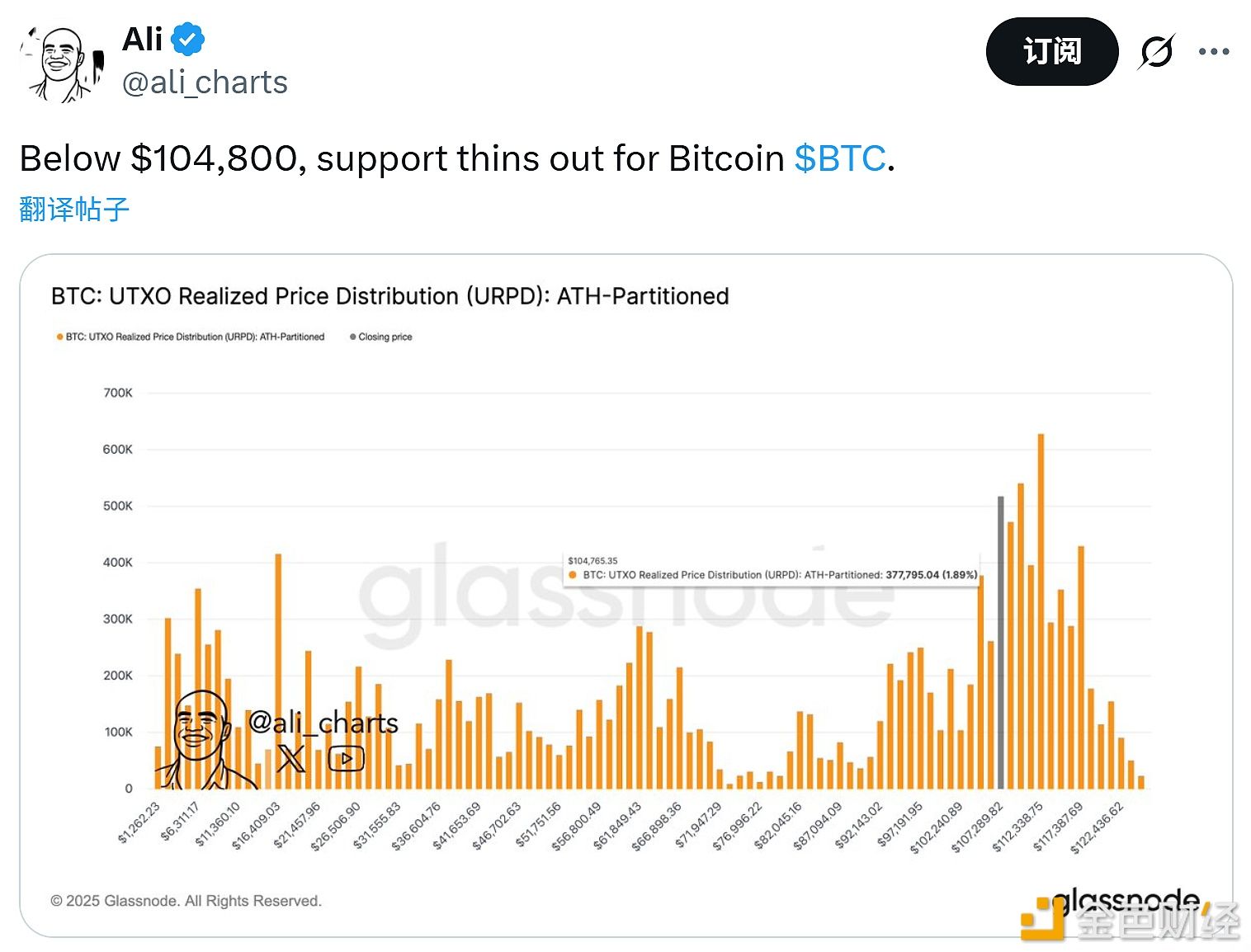

Opinion: Bitcoin Lacks Buying Support Below $104,800

Data: An entity has almost fully repaid the borrowed 66,000 ETH, earning a profit of $26.9 million.