QCP Capital analyzed the reason why cryptocurrencies did not follow the rise in stock and gold prices since early last week

PANews reported on July 8th that Singaporean crypto investment firm QCP Capital stated that since the beginning of last week, stock and gold prices have been rising, but cryptocurrency prices have gone in the opposite direction. Particularly during the afternoon hours in New York time, there was a large amount of spot selling which might be related to a large supply entering the market associated with the German government and Mt. Gox distribution. During the American holiday on July 4th, there was a significant gap in cryptocurrency prices which then found support when returning to US markets; Bitcoin's spot ETF recorded net inflows exceeding $143 million USD. Over the weekend, liquidity in the cryptocurrency market was thin causing violent fluctuations in Bitcoin price; trading range expanded to between $53,500 and $58,500 USD showing increased market uncertainty. This could mean that larger scale fluctuations due to lack of liquidity during non-US trading hours will become normal for cryptocurrencies or it may just be a phenomenon unique to summer where markets are swayed by large trades due to lack of strong narratives.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

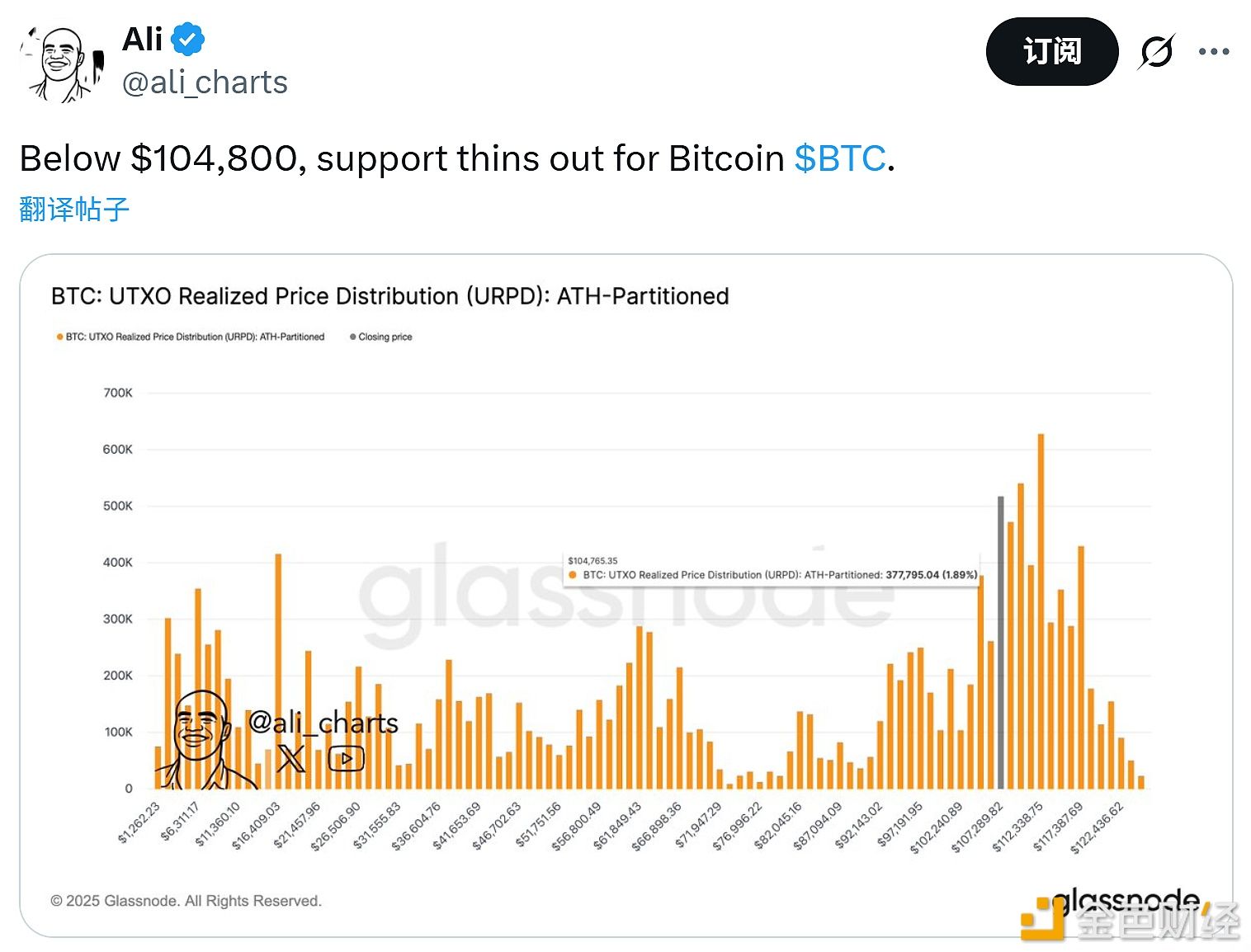

Opinion: Bitcoin Lacks Buying Support Below $104,800

Data: An entity has almost fully repaid the borrowed 66,000 ETH, earning a profit of $26.9 million.