Ripple Volatility Increases, May Consolidate Around $0.42

Ripple has been facing bearish declines lately, leading to increased volatility and volatility. The price is expected to consolidate around $0.42 before the next major move. An in-depth analysis of the daily chart shows that Ripple has been in a downtrend characterized by months of bearish price channels. Most recently, Ripple was denied access to the channel cap at $0.48, leading to a large number of long liquidation cascades and a sharp price drop.

The cryptocurrency has now reached key support areas, which include the middle boundary of the channel and the critical $0.42 support area. Activity in the area has increased and volatility has intensified. Consolidation between $0.42 and the upper limit of the channel at $0.47 is expected in the short term. If the price breaks below the key support area at $0.42, the likelihood of a continuation of the bearish trend will be higher.

On the 4-hour chart, after the sudden plunge, the price reached the key $0.42 support area and encountered an increase in buying activity. As a result, Ripple witnessed a bullish rebound and retreated to an important resistance area, which includes a range between the 0.5 ($0.4353) and 0.618 ($0.4480) Fibonacci levels. This area is the main target for the bullish correction phase. If the price is rejected near this key threshold, the bearish trend is more likely to continue and the $0.38 support area is the main target for sellers. Conversely, if price manages to break above this resistance area, a bullish retracement towards the $0.47 resistance area is likely to continue. Therefore, price action around these key Fibonacci levels is crucial in determining the upcoming move in Ripple.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

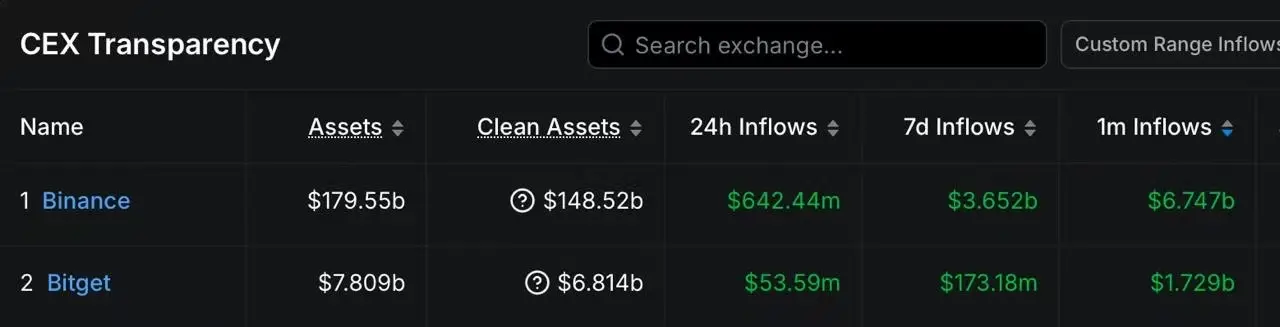

Data: In the past 30 days, the main capital inflows have been to a certain exchange and leading CEXs such as Bitget.

Analysis: Bitcoin’s next key support level is $99,000