The net inflow of Bitcoin spot ETF yesterday was approximately 216 million US dollars, with a net inflow for three consecutive trading days

According to SoSoValue data, yesterday (Eastern Time July 9), the total net inflow of Bitcoin spot ETF was $216 million. Yesterday, Grayscale's ETF GBTC had a single-day net outflow of $37.4956 million, and the current historical net outflow of GBTC is $18.615 billion. The Bitcoin spot ETF with the most single-day net inflows yesterday was BlackRock's ETF IBIT, with a single-day net inflow of $121 million; currently, IBIT's total historical net inflow has reached $18.047 billion. Next is Fidelity's ETF FBTC, with a single-day net inflow of $90.9503 million; currently, FBTC's total historical net inflow has reached $9.513 billion. As of press time, the total asset value of Bitcoin spot ETFs is $50.794 billion; the ratio of ETF assets (the proportion to Bitcoin’s market cap) reaches 4.45%, and the cumulative historical net influx has reached $15.274 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

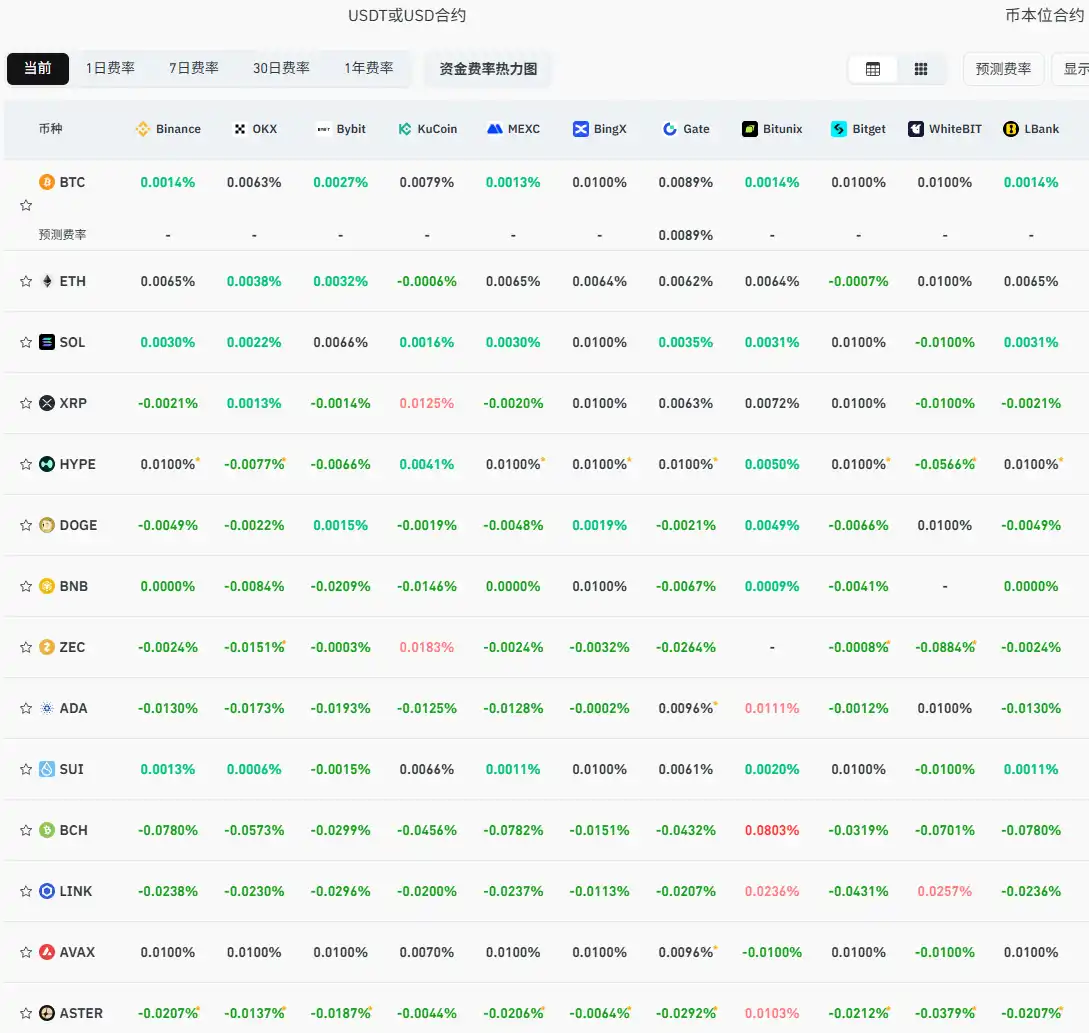

Current mainstream CEX and DEX funding rates indicate the market is once again leaning bearish.

African stablecoin payment infrastructure Ezeebit completes $2.05 million seed funding round