Sterling rises to new intraday highs against major currencies as traders reduce bets on BoE rate cuts

The Bank of England's chief economist Peel said the Monetary Policy Committee is focusing on the persistence of inflation, with a number of indicators pointing to upside risks to inflation. According to him, rising prices in the services sector and wage growth continue to suggest a disturbingly strong underlying inflation dynamic. Subsequently, traders reduced their bets on a rate cut by the Bank of England, with traders seeing less than a 50% chance of a rate cut in August. The pound briefly rose 30 pips against the dollar, up 0.3% to 1.2830, while the euro fell 0.3% against the pound to 0.8436, its lowest level since June 26th.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The 10-year US Treasury yield rises to 4.209%, analysts say the increase is limited

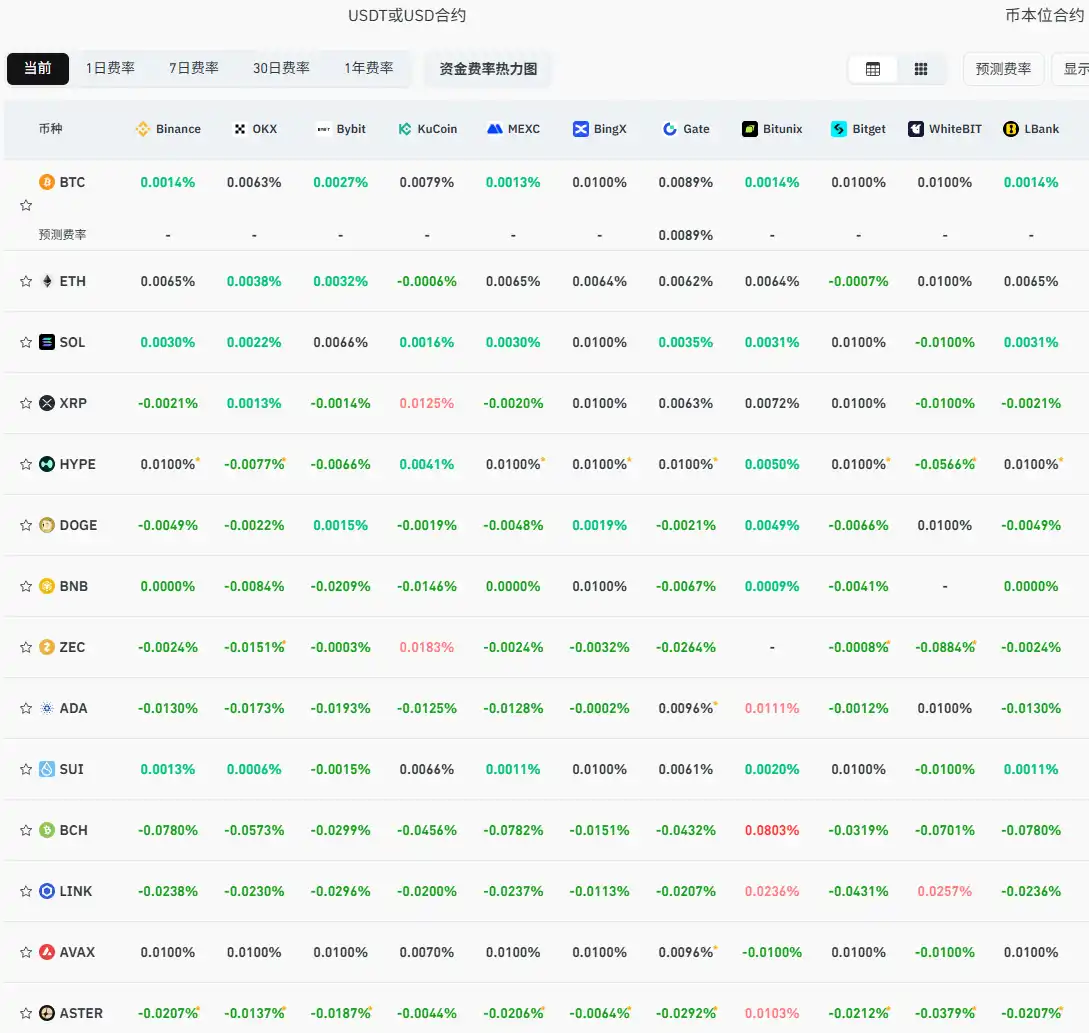

Current mainstream CEX and DEX funding rates indicate the market is once again leaning bearish.