- Sentiment has flipped slightly bullish with major inflows into Bitcoin ETFs.

- Bitcoin has reclaimed the average cost basis for 2024 ETF investors.

- BTC needs to hold above a certain key level to avoid a potential sell-off.

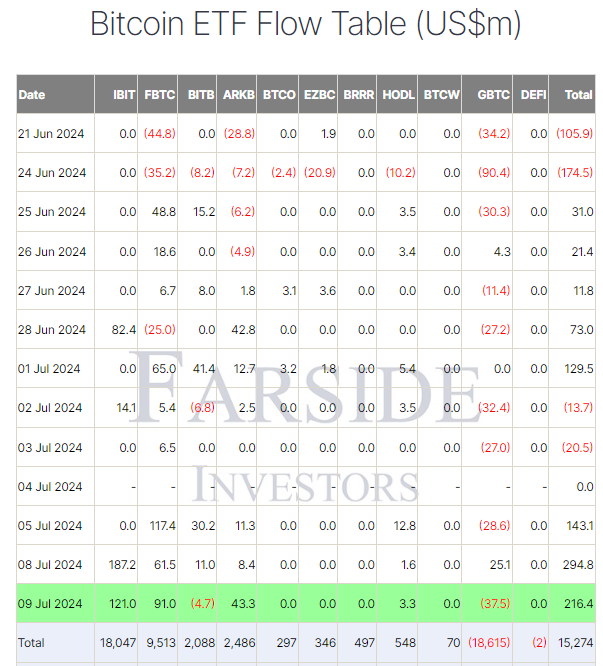

A seismic shift appears to be underway in the cryptocurrency landscape. Just days ago, investor sentiment towards Bitcoin exchange-traded funds (ETFs) was decidedly lukewarm. However, a dramatic reversal of fortune has unfolded, with a major $654.3 million pouring into Bitcoin ETFs over the past three days, as reported by Farside on July 9.

This surge in investment signifies a powerful resurgence of bullish sentiment among investors, marking a stark contrast to the recent outflows that had dampened spirits. The sudden influx of capital suggests a renewed confidence in Bitcoin’s future, potentially signaling a turning point for the world’s leading cryptocurrency.

Bitcoin ETF Net Inflows Soar

BlackRock’s IBIT ETF led the pack, raking in $121 million. This brings its total net inflows to a staggering $18 billion, solidifying its position as the top Bitcoin ETF by a significant margin.

Sponsored

Fidelity’s FBTC followed closely behind with $91 million, pushing their net inflows to $9.5 billion. ARK Invest’s ARKB ETF also saw a notable increase of $43.3 million, bringing its total to $2.5 billion.

However, not all Bitcoin ETFs enjoyed positive movement. Grayscale’s GBTC, a trust rather than a true ETF, continued to experience outflows, with investors pulling out $37.5 million. Similarly, Bitwise’s ETF saw a minor outflow of $4.7 million.

Bitcoin ETF Flow Table. Source: Farside

Bitcoin ETF Flow Table. Source: Farside

This surge in ETF investment coincides with Bitcoin’s price climbing above $59,000, marking a significant milestone as it surpasses the average cost basis of $58,060 for investors who bought into Bitcoin ETFs throughout 2024. However, since then, Bitcoin has receded back to $58,540.

Bitcoin Eyes Key Level for Continued Growth

This positive price movement could further incentivize investors to jump back into the market through ETFs, potentially leading to a sustained upward trend. Maintaining this momentum hinges on Bitcoin’s ability to stay above a key technical indicator on the daily time frame, the 200-day moving average.

Sponsored

The 200-day moving average is currently at $58,720, underscoring its significance as a key support level. A drop below this daily threshold could lead to increased selling pressure, affecting both ETFs and broader markets.

On the Flipside

- Despite major Bitcoin ETFs seeing inflows, Grayscale’s GBTC trust and Bitwise’s ETF faced $42.2 million in redemptions, indicating some investors’ continued caution.

- The surge only covers the past three days. A longer time frame is needed to confirm a sustained trend in Bitcoin ETF investment.

- A drop below the 200-day moving average on the higher term time frame could trigger selling and reverse the recent gains.

Why This Matters

This sudden surge in capital directed towards Bitcoin ETFs, particularly by major players like BlackRock, signifies a potential shift in investor sentiment. If sustained, this renewed confidence in Bitcoin could propel its price further, potentially impacting the entire cryptocurrency market.

To learn more about the recent buying behavior of Bitcoin ETF investors despite a market downturn, read here:

Bitcoin ETF Holders Unshaken by Market Meltdown

To learn more about technical analysis that could indicate Bitcoin’s future direction and the significance of the $50,000 support level, read here:

Bitcoin Bull Run Stumbles: Will $50,000 Hold?