Cryptocurrency Speculation Index Shows Widespread Speculative Sentiment in Q1 Has Dissipated, Signals Bull Market May Resume

July 11 (Bloomberg) -- Observations have found that bull markets tend to stall during periods of over-optimism and only recover when speculative bubbles are cleared, according to CoinDesk.Capriole Investment's Cryptocurrency Speculation Index shows that the speculative excesses that were prevalent in the first quarter have dissipated, signaling that bitcoin could be in for a new round of bullish price gains. The speculative index, which measures the percentage of torrents with 90-day returns higher than Bitcoin's, has stabilized at just under 10 percent, well below January's high of nearly 60 percent. Bitcoin, the largest cryptocurrency by market capitalization, hit a new high of more than $70,000 in the first quarter, before falling back to $58,000

CoinGecko shows that more than 14,800 torrents exist as of this writing. Most of them are illiquid and difficult to prove their use cases. As a result, torrents are often viewed as speculative instruments, with trading volumes closely correlated to Google Trends, which is an indicator of retail investor interest. And the overperformance of torrents relative to bitcoin is seen as a sign of speculative mania. The bursting of speculative bubbles acts as a corrective mechanism, helping to bring asset prices back into line with fundamentals and curbing excessive speculation. As such, they set the stage for a healthier market environment in the long term.

This is exactly what happened in the cryptocurrency market. Since 2019, speculative indices below 10% have coincided with the beginning of Bitcoin's sharp rise, as observed in the first half of 2019, the end of 2020, and the second half of 2023.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. stocks open with the Dow slightly up, Oracle plunges and drags down AI stocks

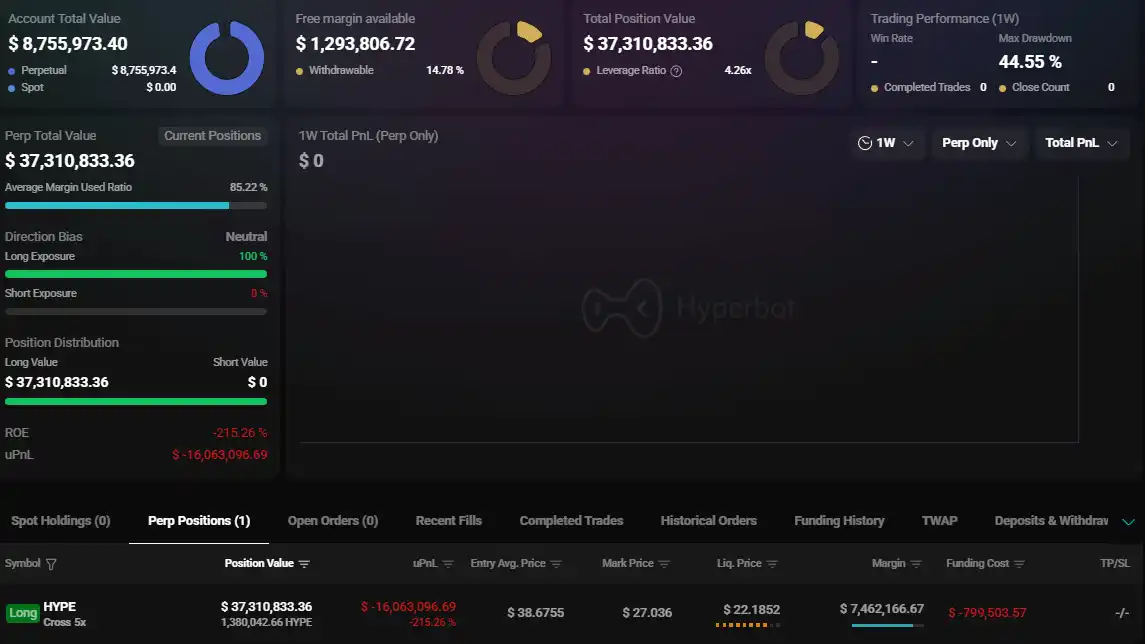

"HYPE Listing Insider Whale" suffers a floating loss of $16 million on 5x HYPE long positions

Disney to make $1 billion equity investment in OpenAI