Janet Yellen, the U.S. Secretary of the Treasury, has pointed fingers at the U.S. itself for the potential downfall of the U.S. dollar. She made her views known while speaking to the House of Financial Services Committee on Tuesday.

Janet explained that America’s frequent use of sanctions as a tool of foreign policy is hurting the dollar’s status around the world. Countries are moving away from the dollar, trying to protect themselves from these sanctions.

President Joe Biden

President Joe Biden

She said this habit is making enemies for the dollar. Many countries are now joining the crusade of using other currencies in international trade. This is weakening the dollar’s position and adding pressure on the U.S. economy.

Countries are sick and tired of being at the mercy of the U.S. and are seeking to avoid the dollar. Just this year, Russia, China, and Hungary have called America an economic terrorist.

In her testimony, Janet emphasized that these countries will keep on with de-dollarization if the U.S. doesn’t change its approach. The Treasury Secretary stated that:

“The more we sanction, the more we push these nations to diversify their currency holdings.”

A clear example of this is the growing relationship between Iran and Russia. Iranian Parliament Speaker Mohammad Bagher Ghalibaf announced that all transactions between Iran and Russia are now done without the dollar.

So are all trades between Russia and India. Vladimir Putin is the leading force behind dethroning America and its dollar.

Prime Minister Narendra Modi with his buddy President Vladimir Putin

Prime Minister Narendra Modi with his buddy President Vladimir Putin

Ghalibaf explained that the BRICS offers a huge opportunity for countries looking to move away from the dollar. He accused America of being selfish, cruel, and unilateral.

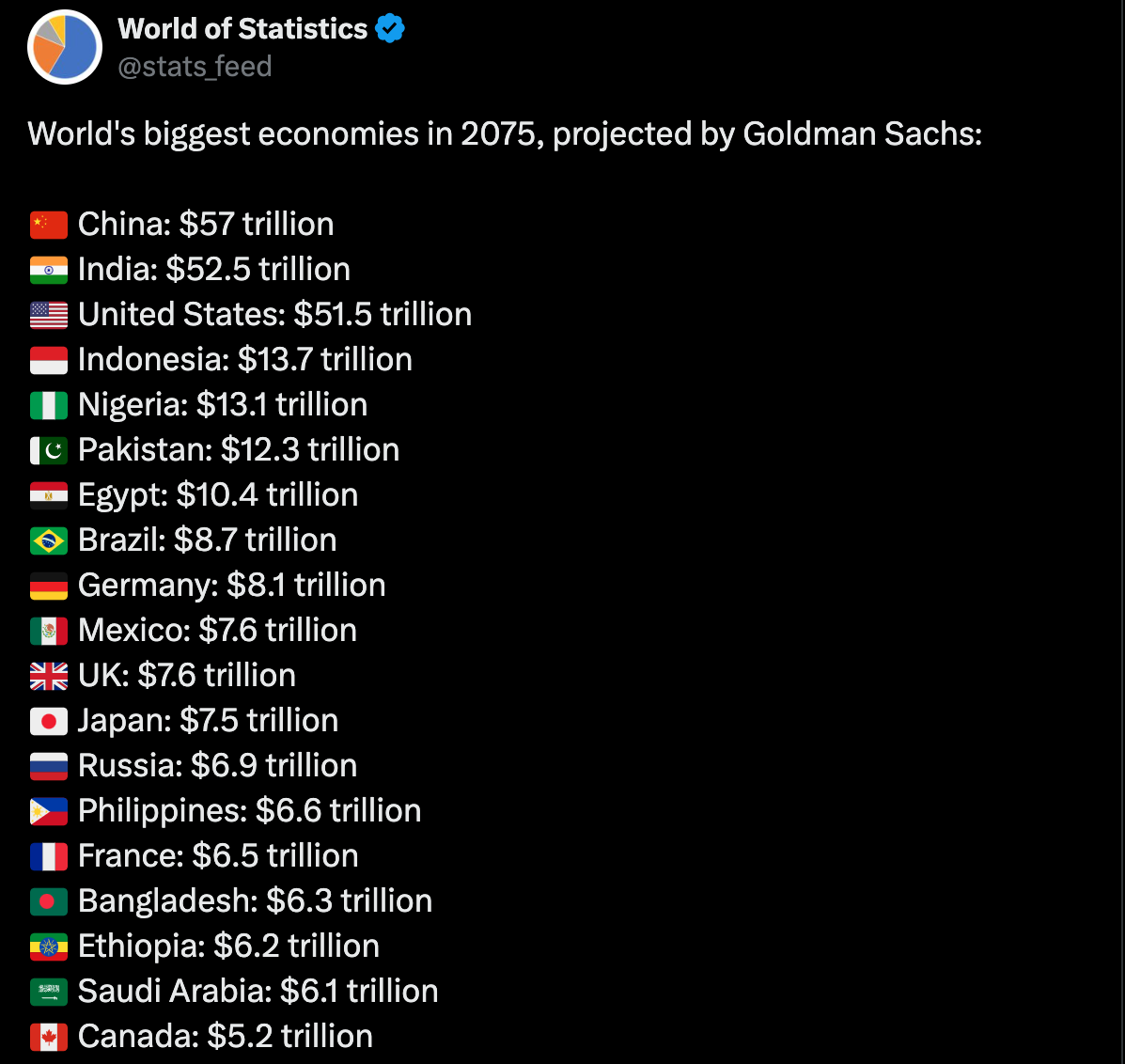

Meanwhile, Goldman Sachs has predicted an economic downfall for the United States. They believe that the BRICS will have the world’s first and second-largest economy spots by 2075.

India and China will surpass the U.S. economy by a considerable margin, leaving it far behind in third place. Over the next 50 years, the chances of America remaining an economic superpower will become close to none.

Source: X.com

Source: X.com

Developing countries are set to outshine it in various sectors, including trade, technology, and fintech. Saudi Arabia is also expected to see massive economic growth. Goldman Sachs predicts that its economy could reach $6.1 trillion.

Keep in mind that while Saudi Arabia has not accepted the offer to join BRICS, it recently warned the U.S. and UK against freezing Russian assets.