Greeks.live: Today, multiple end-of-day bullish options have increased by more than 1000%, with the day's main transactions primarily being active purchases of bullish options

Macro analyst Adam from Greeks.live posted on the X platform, stating that the ETH ETF will be launched next Tuesday. Stimulated by this positive news, ETH rose by 8%, significantly driving up the entire cryptocurrency market. The sharp increase in coin prices also drove up IVs across all terms synchronously. The implied volatility of BTC even exceeded that of ETH, but both are still relatively low. This month we have mentioned multiple times in our tweets that good news about ETH would stimulate the market; a low IV situation is very suitable for buyers as option IV remains relatively low and buyer's cost-effectiveness is still high. Today, several end-of-day bullish options increased by more than 1000%. Most transactions throughout the day were mainly proactive purchases of bullish options, accounting for more than half of trading volume.

It should be noted that end-of-day options, also known as "doomsday wheel" options refer to the last few trading days when an option contract is about to expire.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Figment acquires Rated Labs to enhance staking data services

IOBC Capital Managing Partner: Crypto investment is entering the era of US dollar fund investment

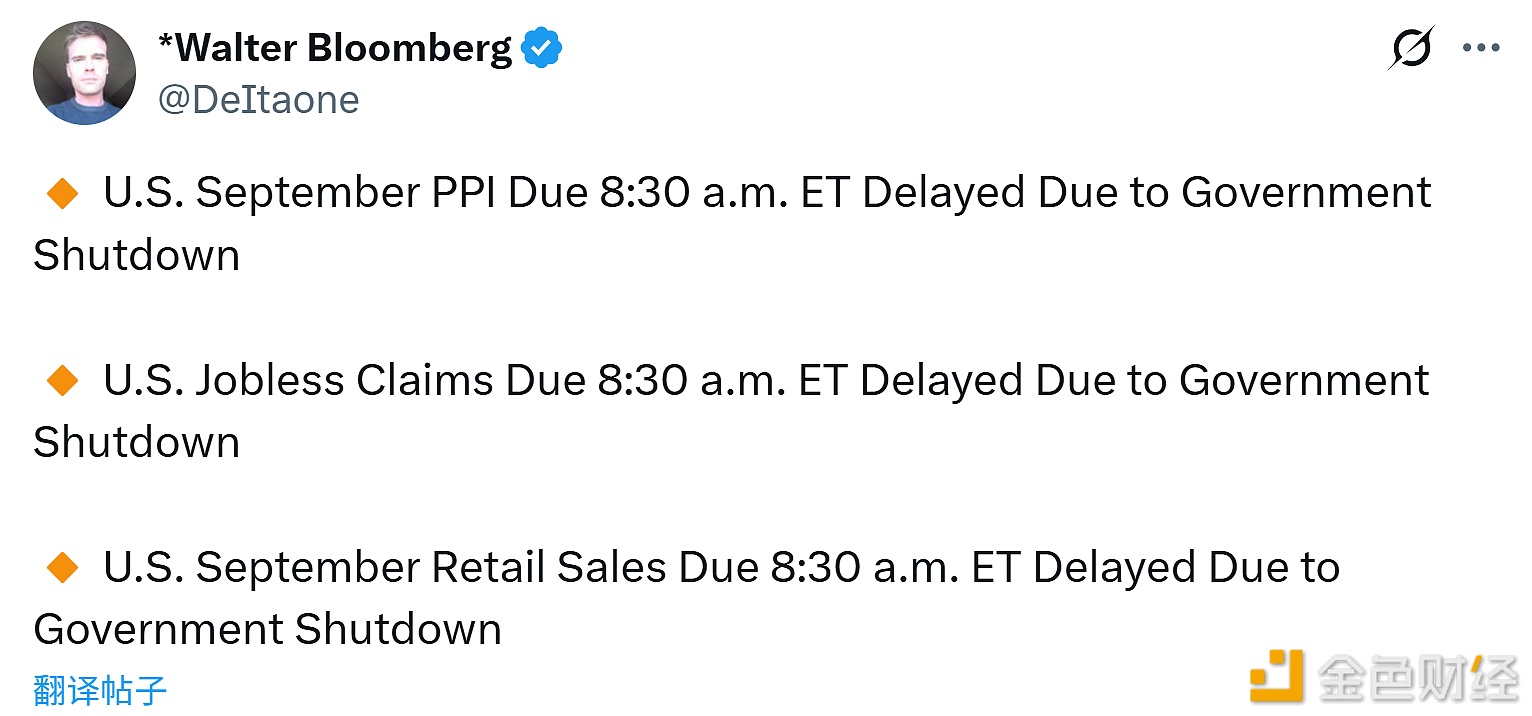

U.S. September economic data delayed due to government shutdown

FSB warns that inconsistent crypto regulation may trigger contagion risk