Volume 191: Digital Asset Fund Flows Weekly Report5th largest weekly inflows on record of US$1.44bn

5th largest weekly inflows on record of US$1.44bn

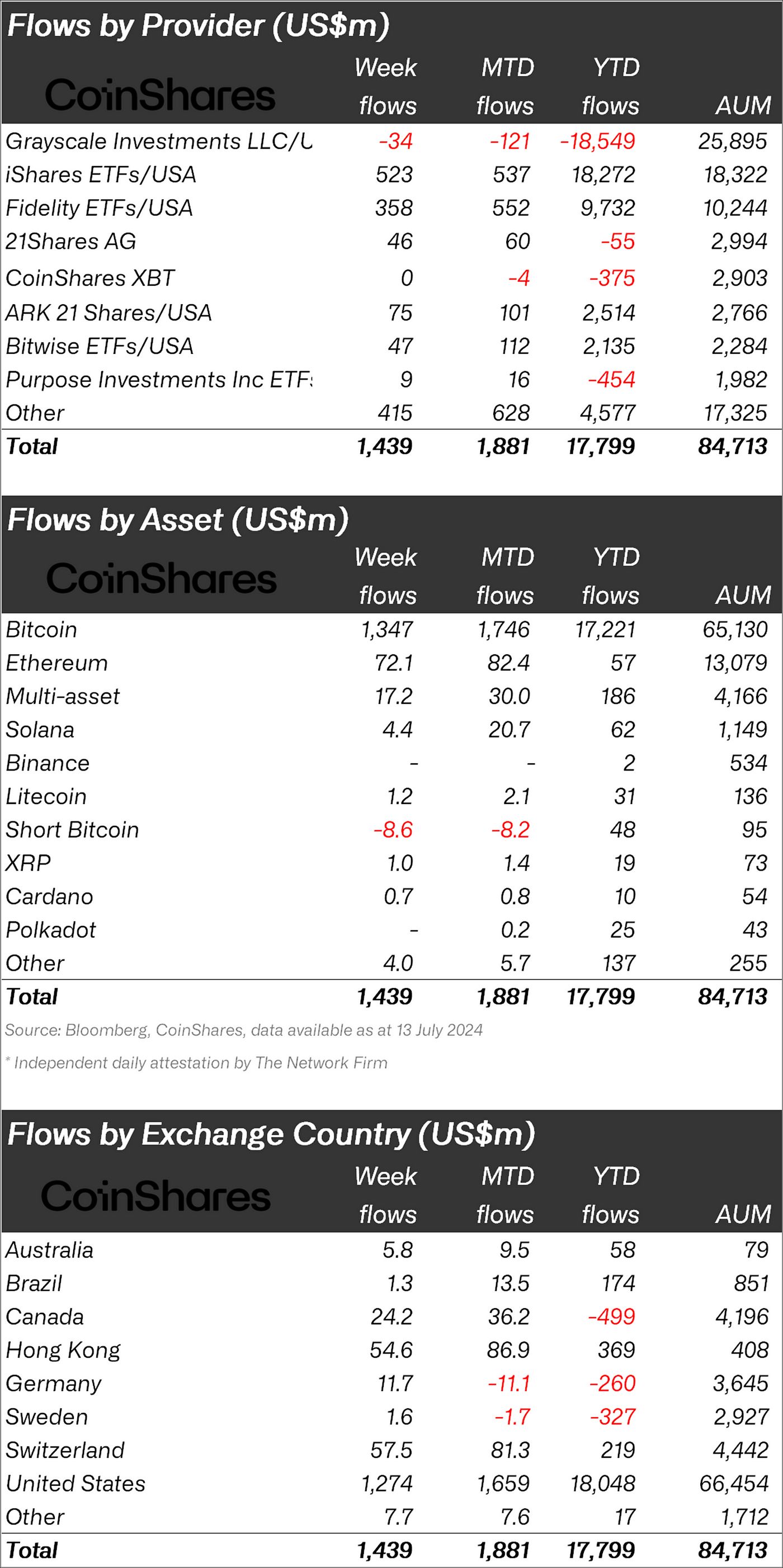

- Digital asset investment products saw further buying on price weakness with inflows of US$1.44bn inflows last week, bringing year-to-date (YTD) inflows to a record US$17.8bn, far surpassing the 2021 inflows of US$10.6bn.

- Bitcoin saw the 5th largest weekly inflows on record with US$1.35bn, while short-bitcoin saw the largest weekly outflows since April at US$8.6m.

- Ethereum, which saw US$72m inflows last week, likely in anticipation of the imminent approval of the spot-based ETF in the US.

Digital asset investment products saw further buying on price weakness with inflows of US$1.44bn inflows last week, bringing year-to-date (YTD) inflows to a record US$17.8bn, far surpassing the 2021 inflows of US$10.6bn. Volumes remained low though at US$8.9bn for the week, compared to the 7 day average this year of US$21bn.

Regionally, the US led with US$1.3bn for the week, although the positive sentiment was seen across all other countries, most notable being Switzerland (a record this year for inflows), Hong Kong and Canada with US$58m, US$55m and US$24m respectively.

Bitcoin saw the 5th largest weekly inflows on record with US$1.35bn, while short-bitcoin saw the largest weekly outflows since April at US$8.6m. We believe price weakness due to the German Government bitcoin sales and a turnaround in sentiment due to lower than expect CPI in the US prompted investor to add to positions.

A wide range of altcoins saw inflows, most notable being Ethereum, which saw US$72m inflows last week, being the largest inflows since March and likely in anticipation of the imminent approval of the spot-based ETF in the US.

Solana, Avalanche and Chainlink saw inflows of US$4.4m, US$2m and US$1.3m respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.