Bitcoin reaches local price bottom amid indicators of upcoming positive momentum: CryptoQuant

The price of bitcoin may have already found a local bottom, as large sellers have already realized losses and exhausted selling power, CryptoQuant analyst said.They also listed various bitcoin valuation metrics that suggest further positive price momentum for the world’s largest digital asset by market capitalization.

The price of bitcoin seems to have bottomed out after recovering to a high of almost $66,000 earlier this week, according to CryptoQuant analysts.

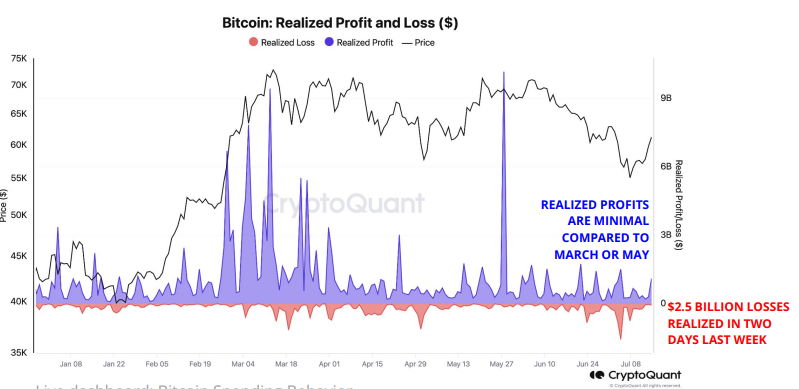

Thursday's CryptoQuant Weekly report noted that the recent drop in bitcoin's price to a low of around $55,000 last Wednesday resulted in the largest realized losses for the digital asset's holders so far in 2024. "Bitcoin BTC -1.96% holders realized losses of $2.5 billion in two days last week, while profit taking remained minimal compared to March. The realization of large losses is typically a sign of seller capitulation and it is associated with price bottoms," the CryptoQuant analysts said.

Bitcoin realized profit and loss indicators show the price has reached a local bottom. Image: CryptoQuant.

The CryptoQuant report described how bitcoin traders' unrealized losses last week reached levels not seen in nearly two years.

"Trader’s unrealized margins are now -5.7% vs. a low of -17% last week, which was the most negative since shortly after the FTX exchange collapse in November 2022," the analysts said. "Prices have typically bottomed out when traders' profit margins touch extremely negative levels, as seen in the last week."

Analysts forecast positive price momentum

The report added that various bitcoin valuation metrics have recently bounced off key levels, suggesting a local price bottom and signaling further positive price momentum for the world's largest digital asset by market capitalization.

The CyptoQuant analysts listed three chart indicators that show the recent rebound in the price of the largest digital asset by market cap could turn into a prolonged rally.

"The Bitcoin Profit Loss (PL) Index crossed over its 365-day moving average and the Bull-Bear Market cycle indicator has crossed over its 30-day moving average, and the Metcalfe price valuation bands have acted as support for prices for the second time this year," CryptoQuant analysts said.

Low stablecoin liquidity is still an obstacle to a substantial price rally

However, the report added that stablecoin liquidity is still not accelerating enough to drive a fully-fledged bull run. "A necessary condition for a sustained bitcoin price rally is stablecoin liquidity," the analyst said.

The CryptoQuant report found that despite some positive movement in the stablecoin market capitalization, USDT’s monthly market cap growth is still near zero. "This is dampening the potential for a more significant bitcoin price rally," the report said.

The bitcoin price traded flat in the past 24 hours, changing hands for $63,767 at 7:40 a.m. ET, according to The Block's Price Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget Will List Almanak (ALMANAK). Come and grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

Earn up to 50 USDT: Make your first USD deposit!