Cardano Hard Fork Near – What’s Next For ADA’s Price?

Cardano (ADA) could see significant price movements next month with the upcoming Chang Hard Fork.

Historically, Cardano’s price has reacted positively to major updates. For instance, during the Alonzo hard fork in August 2021, ADA’s value jumped 130%, but subsequent hard forks have had varied impacts.

The Valentine upgrade in February 2023, occurring during a bear market, resulted in a modest 16.9% gain, followed by a steep decline from $0.42 to $0.315 over three weeks.

Similarly, the Vasil hard fork in September 2022 saw an 11.1% increase before the price dropped again.

READ MORE:

Crypto Trader Makes Millions on Trump-Themed MemecoinCurrently, Cardano’s price chart shows a potential breakout from a falling wedge pattern that started in December 2023.

This breakout could signal a move towards $0.72-$0.78, representing an 80% gain.

However, trading volume has been decreasing, and the On-Balance Volume (OBV) indicator reflects this downward trend, which dampens bullish expectations.

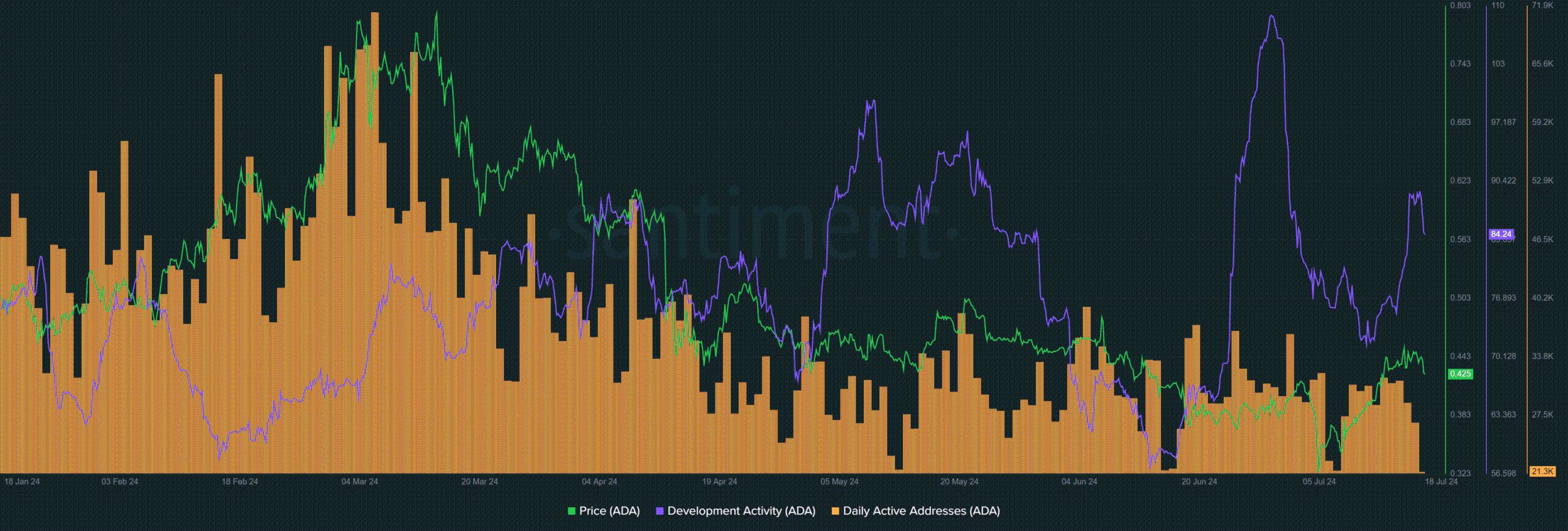

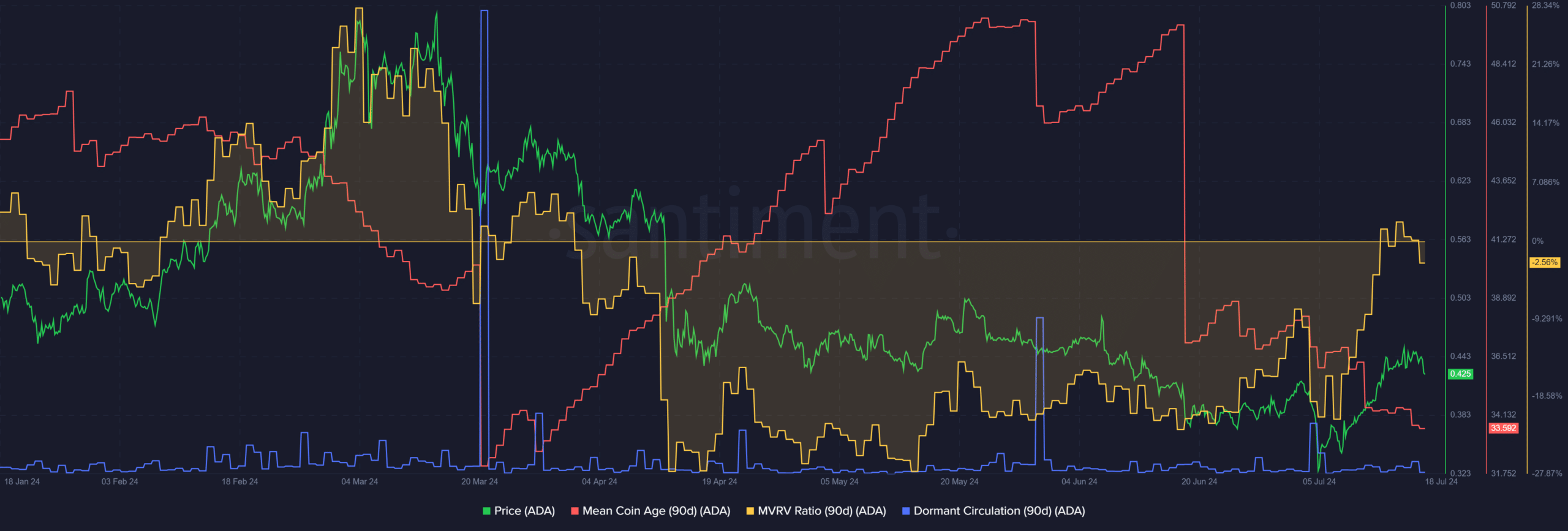

Stable daily active addresses since April suggest limited engagement, and despite increasing development activity, the significant drop in mean coin age indicates a distribution phase. This implies that without strong investor support, the Chang Hard Fork might not achieve substantial gains.

The 90-day Market Value to Realized Value (MVRV) ratio is slightly negative, showing average holders are at a minor loss.

Overall, while there are positive technical signs, the current metrics do not suggest a strong buying opportunity or sustained bullish momentum. Consistent buy volume will be crucial to initiate a significant rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Cysic Network (CYS)

Decoding 30 Years of Wall Street Experience: Asymmetric Opportunities in Horse Racing, Poker, and Bitcoin

A horse race, a poker book, and the wisdom of three legendary investors led me to discover the most underestimated betting opportunity of my career.

Fed cuts rates again: Internal divisions emerge as three dissenting votes mark a six-year high

This decision highlights the unusual divisions within the Federal Reserve, marking the first time since 2019 that there have been three dissenting votes.

Antalpha highlights strong alignment with industry leaders on the vision of a "Bitcoin-backed digital bank" at Bitcoin MENA 2025

Antalpha confirms its strategic direction, emphasizing the future of bitcoin as an underlying reserve asset.