In a landmark achievement, US Bitcoin spot exchange-traded funds (ETFs) have cumulatively netted over $17 billion in inflows, setting a new record.

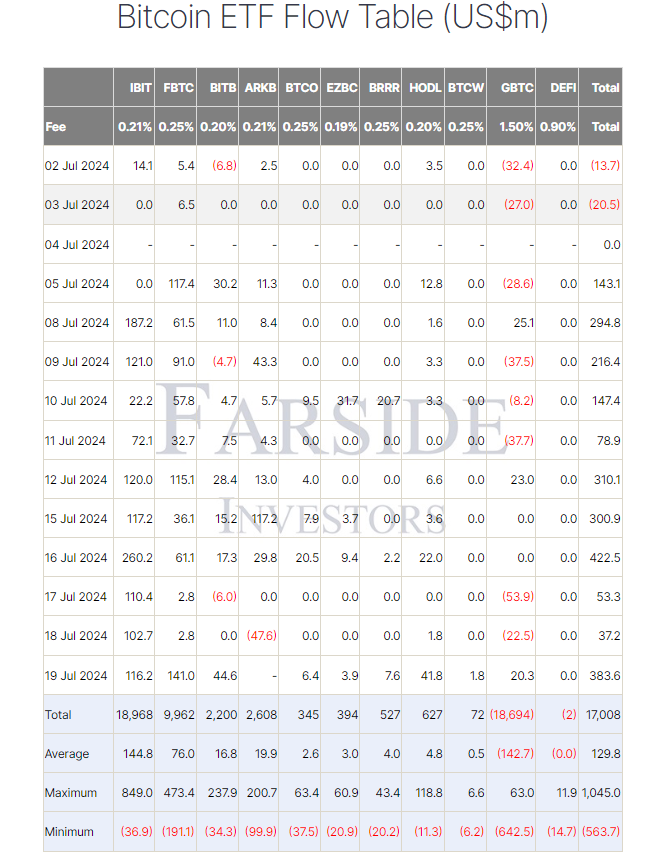

According to data monitored by Farside Investors, the net inflows were driven primarily by BlackRock's IBIT, which alone accumulated $18.968 billion. Fidelity’s FBTC also contributed significantly, with net inflows of $9.962 billion.

Record-breaking net inflows

Conversely, Grayscale’s GBTC experienced a substantial net outflow of $18.694 billion, highlighting a shifting preference among investors. On Wednesday, July 17, the 11 US spot Bitcoin ( BTC ) ETFs recorded a total daily net inflow of $53.35 million, marking the ninth consecutive day of positive inflows.

However, this figure was notably lower than the $422 million net inflow seen on Tuesday, July 16. Despite this, BlackRock's IBIT continued to lead , posting the most significant net inflows of the day at $110.37 million and achieving a trading volume of $1.21 billion.

Bitcoin spot ETFs’ cumulative net inflows exceeded $17 billion

Source: Farside Investors

Fidelity’s FBTC was the only other fund to report net inflows on July 17, adding $2.83 million. In contrast, Grayscale’s GBTC and Bitwise’s BITB faced net outflows of $53.86 million and $6 million, respectively. Seven other funds, including ARK Invest and 21Shares’ ARKB, reported zero flows for the day.

The total trade volume for US spot Bitcoin ( BTC ) funds on July 17 was $1.79 billion, a significant drop from March’s peak when daily volumes exceeded $8 billion. Before the current record high, these ETFs had amassed a total net inflow of $16.59 billion since their launch in January, reflecting steady investor interest despite fluctuations in daily inflows.

BlackRock's Bitcoin bet

This record-setting inflow highlights the increasing acceptance and integration of Bitcoin into mainstream investment portfolios. BlackRock's Bitcoin ( BTC ) holdings have surged above $20 billion in value, driven by the firm’s recent acquisition of 4,004 additional Bitcoin ( BTC ) and a 3% increase in Bitcoin’s ( BTC )price since the market closed on Monday.

The fund initially surpassed $20 billion in assets under management in late May, coinciding with Bitcoin’s ( BTC ) rapid ascent toward $70,000 , earning it the distinction of being the most prominent Bitcoin ( BTC ) ETF globally.

Bitcoin ( BTC ) is currently priced at $66,994, a 2.33% reduction from $65,470 on July 17 after it fell to a near five-month low of $53,600 on July 5.