- ETH price is not a result of rising demand, claims analyst Crypto Lion.

- ETH’s “Exchange Withdrawing Transactions” deviated significantly from ETH price.

- The surge in ETH’s price is a result of rising Open Interests.

Ethereum’s recent price surge may be built on shaky ground, according to analyst ‘Crypto Lion’ in a ‘Quicktake’ on blockchain analytics platform CryptoQuant. The analyst cautioned that a correction could be imminent, citing data that suggests a lack of genuine demand for Ether, despite recent gains driven by the approval of ETH ETFs.

Crypto Lion highlighted the lack of demand for Ether, citing the “Exchange Withdrawing Transactions” diverging significantly from the digital asset’s price trajectory. “This means that physical withdrawals are declining, so it is safe to assume that there is simply no demand,” the analyst stated:

“This means that physical withdrawals are declining, so it is safe to assume that there is simply no demand.”

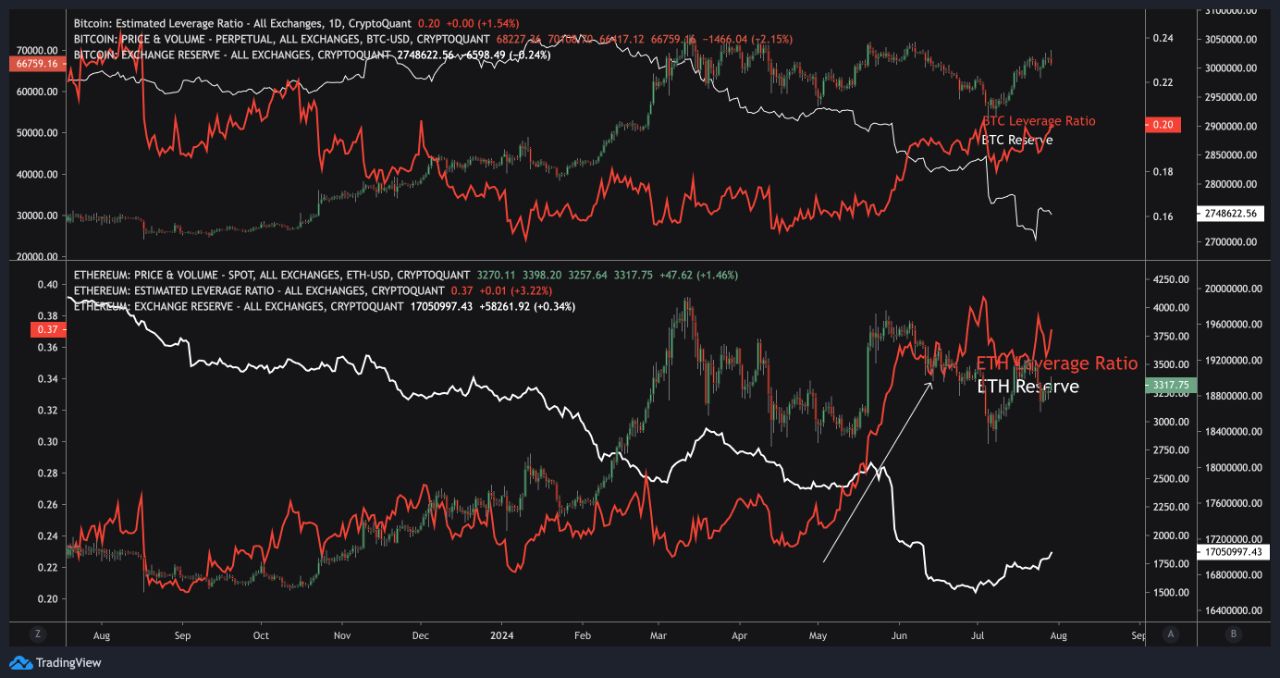

According to Crypto Lion, the price of Ether is being driven higher by the Estimated Leverage Ratio (ELR) of ETH which printed monumental gains just before mid-May when the ETH ETF was approved . The analyst explained the reasons for the rise in ELR.

The formula for ELR is Open Interest / ETH Exchange reserve and as per Crypto Lion, the ELR rose sharply even before the reserve decreased. This surge resulted from a spike in Open Interest, “which means that a large amount of vertical balls were loaded, and the assumed leverage rose sharply,” Crypto Lion said, adding:

“ETH price moves like a range after ETH ETF approval. However, in the absence of Withdraw and while the ELR has not yet been resolved, it is advisable to refrain from buying.”

In the past 24 hours, Bitcoin, the leading digital asset, has crashed more than 4%. On the other hand, ETH dropped only 1.5% and is currently trading at $3,316 with a 59.39% surge in trading volume, which stands at $17.3 billion, as per CoinMarketCap data .

According to SoSoValue data , spot ETH ETFs witnessed outflows totaling $98.29 million on July 29, bringing the total net outflow to $439.64 million. Over $1.72 billion has left Grayscale’s ETHE while BlackRock’s ETHA has recorded $500 million in inflows until now.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.