Bernstein says mining hardware is a $20 billion opportunity amid Trump's push to 'make bitcoin' in the US

Bitcoin mining chips and hardware represent a $20 billion opportunity over the next five years, according to analysts at Bernstein.The analysts see this as favorable for U.S. Bitcoin miners amid Donald Trump’s recent push to “make bitcoin” in America.

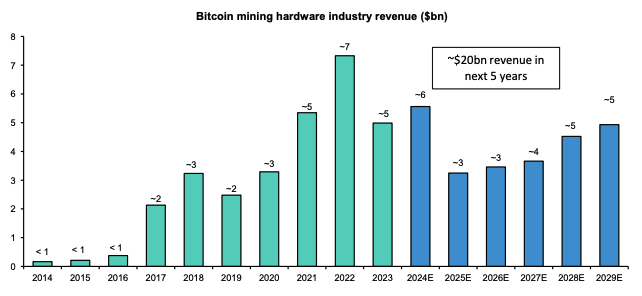

The Bitcoin BTC -4.36% mining chip and hardware industry represents a $20 billion total addressable market over the next five years, according to analysts at research and brokerage firm Bernstein.

The Bitcoin mining hardware market has been historically dominated by China-based companies such as Bitmain, with over 80% market share, Gautam Chhugani, Mahika Sapra and Sanskar Chindalia wrote in a note to clients on Tuesday. However, the launch of new mining chips in the U.S. by Block and Auradine presents an opportunity to diversify the supply chain, compete on advanced chip design and provide access to global foundry fabrication capacity, the analysts said.

Earlier this month, Block, co-founded by former Twitter CEO Jack Dorsey, announced an agreement to supply Core Scientific with its new 3-nanometer ASIC mining chips, representing approximately 15 EH/s of hashrate and more energy-efficient than current designs — a deal Bernstein values at $300 million and expects more U.S. Bitcoin miners to follow.

Auradine, backed by Bitcoin miner MARA, recently shipped its AT1500 Teraflux miners (22J/TH) and announced new AT2880 and AI3680 models. The Teraflux 2800 series uses 3nm ASIC chips with 14J/TH efficiency. Auradine closed an $80 million Series B round in April.

“We expect 15-30% growth in annual mining equipment demand led by increasing network hashrate (supported by our bitcoin price conviction) and replacement/upgrading of existing capacity to make mining more efficient after rewards are cut in half in bitcoin terms after halving,” the analysts said. “Based on today’s rack rate prices and pre-contract mining capacity rates, the hardware revenue opportunity is ~$3-5 billion annually.”

Bitcoin mining hardware industry revenue. Image: Bernstein.

Tailwinds for U.S. Bitcoin miners

Combined with Republican presidential candidate Donald Trump’s recent push to “make bitcoin” in America, promising to turn the U.S. into a "Bitcoin mining superpower" and provide increased electricity generation capacity for the industry, Bernstein sees this as a tailwind for U.S. Bitcoin miners, with the “potential to improve fleet efficiency, drive lower capex (from lower chip pricing) and spare power capacity for AI/HPC opportunities.”

“New U.S based competition in mining chips promises to diversify the mining supply chain and reduce the dominance of Bitmain and others. Also, there is opportunity for more innovation with open source and customizable software, by partnering closely with U.S. based miners to improve fleet efficiency (e.g the Core Scientific-Block deal),” the analysts said.

Bernstein sees this as particularly applicable to large-scale mining consolidators, rating four public U.S. miners within its coverage: Riot Platforms, CleanSpark, IREN and Core Scientific as outperform.

On Monday, the Bernstein analysts said crypto is “ no longer a bipartisan issue ” amid Trump's Bitcoin promises and Kamala Harris' “late” olive branch to the industry.

Chhugani maintains long positions in various cryptocurrencies. Certain Bernstein affiliates act as market makers or liquidity providers in the debt securities of Riot Platforms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CARV In-Depth Analysis: Cashie 2.0 Integrates x402, Transforming Social Capital into On-Chain Value

It is no longer just a tool, but a protocol.

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation