Goldman Sachs has raised the probability of a US economic recession in the next 12 months by 10 percentage points to 25%

Goldman Sachs economists have raised the possibility of a U.S. economic recession next year from 15% to 25%. However, they also pointed out that despite a significant rise in unemployment rates, there are "several reasons not to worry about an economic recession." Goldman Sachs economists led by Jan Hatzius stated: "We still believe the risk of an economic recession is limited. The overall economy still looks good, with no major financial imbalances and the Federal Reserve has plenty of room for rate cuts if necessary." Notably, Goldman's forecast for the Fed is not as aggressive as Morgan Stanley and Citigroup. Hatzius' team predicts that the Fed will cut its benchmark interest rate by 25 basis points in September, November and December; in contrast, Morgan Stanley and Citigroup predict a 50 basis point cut in September.

The Goldman report states: "Our prediction is based on employment growth resuming in August and FOMC believing that a 25-basis-point cut would be sufficient to deal with any downside risks. If we're wrong and August's job report is as weak as July's then there could be a 50-basis-point cut in September." Economists added that they are skeptical about whether the US labor market faces rapid deterioration risks. They say this because job vacancies indicate demand remains solid without any obvious shocks causing downturns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

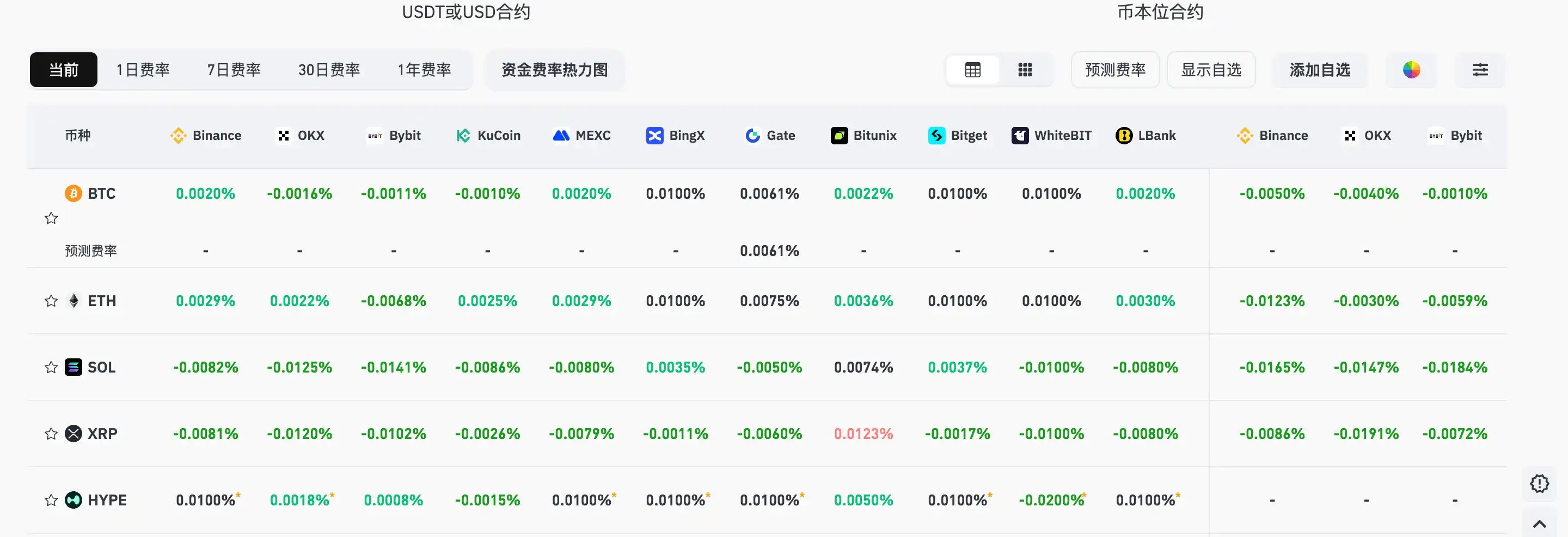

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.