Volume 196: Digital Asset Fund Flows Weekly Report

Low inflows overall at US$30m, but Solana suffers its largest outflows on record

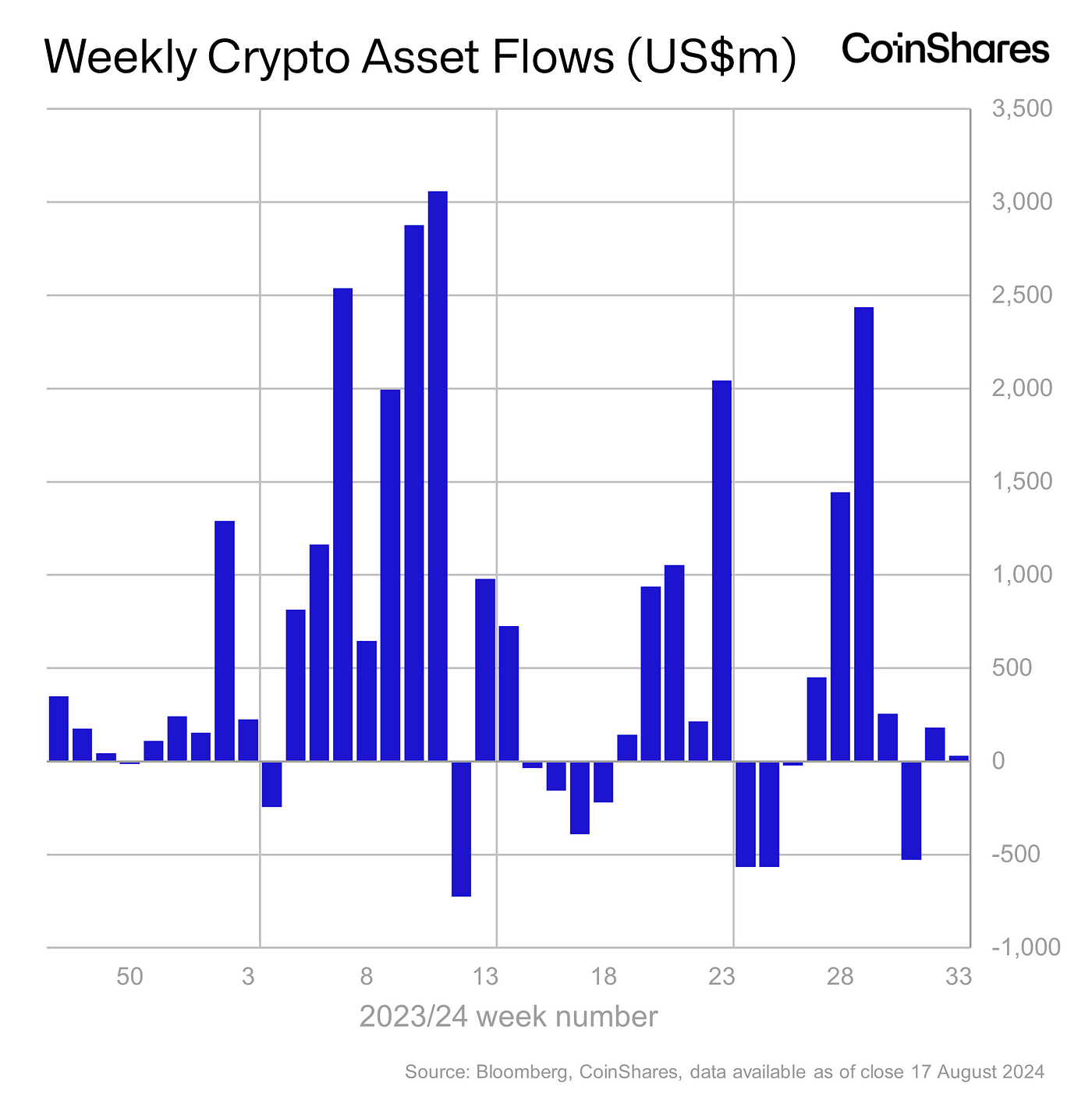

- Last week, digital asset investment products experienced minor inflows totalling US$30m, as recent macroeconomic data implied the FED were less likely to cut interest rates by 50 basis points in September.

- Ethereum saw only US$4.2m inflows last week, although this masked a flurry of activity between providers.

- Solana saw outflows of US$39m, the largest on record, as it faced a sharp decline in trading volumes of memecoins, on which it heavily relies.

Last week, digital asset investment products experienced inflows totalling US$30m. However, this modest figure conceals varying trends among different investment product providers, as established providers continued to lose market share to issuers of newer investment products. Weekly trading volumes on investment products fell to nearly 50% of the week prior at US$7.6bn, as recent macroeconomic data implied the FED were less likely to cut interest rates by 50 basis points in September.

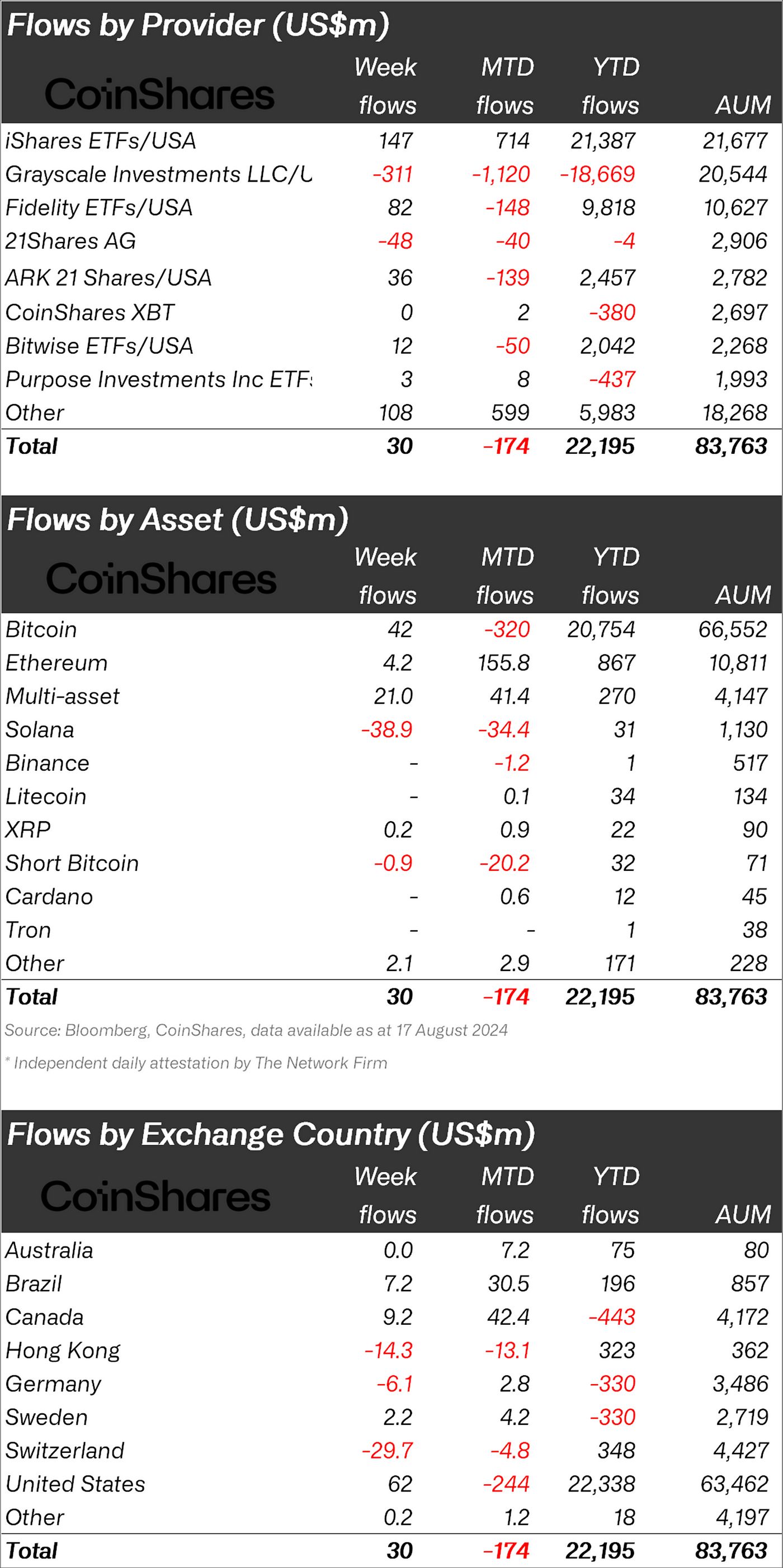

Flows were very mixed from a regional perspective, the US, Canada and Brazil saw inflows of US$62m, US$9.2m and US$7.2m respectively, while Switzerland and Hong Kong saw the most significant outflows totalling US$30m and US$14m respectively.

Bitcoin saw inflows saw the most significant inflows, totalling US$42m, while short-bitcoin ETFs saw outflows for the second consecutive week totalling US$1m.

Ethereum saw only US$4.2m inflows last week, although this masked a flurry of activity, with new providers seeing US$104m inflows, while Grayscale saw US$118m outflows.

Solana saw outflows of US$39m, the largest on record, as it faced a sharp decline in trading volumes of memecoins, on which it heavily relies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."