Bitcoin inflows hit $543 million last week amid hint of interest rate cut: CoinShares

Last week, bitcoin inflows totaled $543 million as Fed Chair Jerome Powell indicated the central bank may start lowering interest rates, according to CoinShares.Digital asset investment products saw weekly inflows of $533 million, the largest positive swing in five weeks.

Bitcoin BTC -1.19% experienced $543 million in inflows last week after favorable comments from Fed Chair Jerome Powell, according to CoinShares.

"The majority of those inflows were on Friday, following the dovish comments" from Powell, CoinShares said in its latest report. At the end of last week, Powell expressed confidence that U.S. inflation could return to 2% while indicating the central bank may lower interest rates.

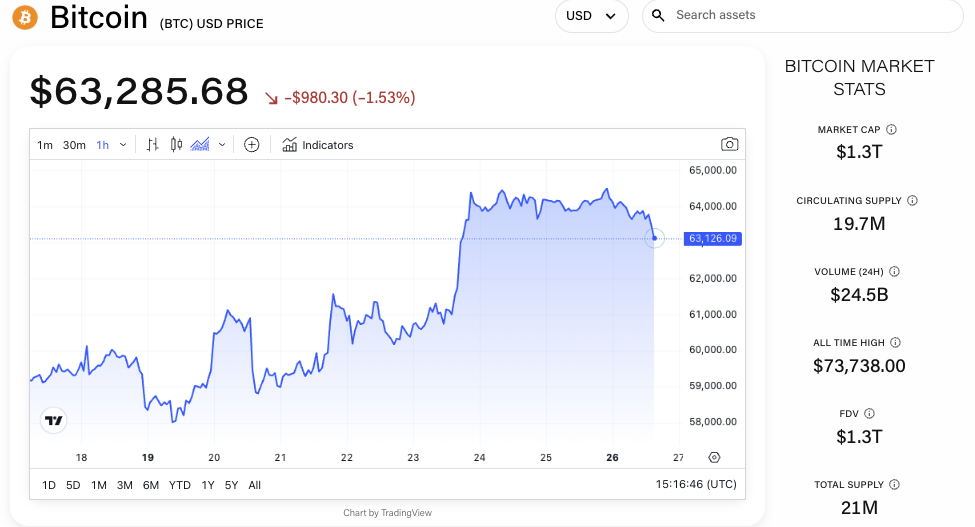

Powell's comments appeared to push bitcoin's price higher immediately . Bitcoin has since climbed from below $61,000 to about $63,500, according to The Block Price Page . Thanks to the increased confidence in bitcoin, inflows for the month of August now sit at $225 million, according to CoinShares.

The Fed Chair's comments also appear to have benefitted crypto investment products, according to the CoinShares report. "Last week, digital asset investment products saw inflows totaling $533 million, marking the largest inflows in five weeks," the report also said. The crypto-based ETFs offered by BlackRock led the way with a total of $346 million in inflows, said CoinShares.

The U.S. led the charge for inflows into digital asset investment products with $498 million, while Hong Kong and Switzerland rounded out the top three nations with $16 million and $14 million, respectively.

Roughly a month since the newly created Ethereum-based ETFs launched, the products have brought in $3.1 billion in cumulative inflows, according to the report. That has been offset by Grayscale's ether-based product shedding $2.5 billion, said CoinShares.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK