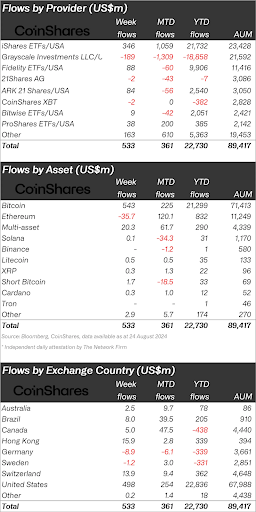

- Bitcoin led with $543 million inflows after Powell hinted at possible rate cuts in September.

- Ethereum faced $36M outflows despite new ETFs drawing $3.1B in investments this month.

- U.S. led with $498M in digital asset inflows, reflecting its dominance in the market.

Digital asset investments saw a big jump last week with inflows hitting $533 million.

This was the largest influx in five weeks and coincided with Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole Symposium . Powell’s hint that the first interest rate cut could come as early as September triggered a major market reaction, particularly for Bitcoin.

Source: Coinshares

Source: Coinshares

Bitcoin was the clear frontrunner, attracting $543 million in inflows. This underscores how sensitive Bitcoin is to changes in interest rate expectations. Most of these inflows happened on Friday, right after Powell’s dovish comments. This pattern shows Bitcoin’s strong link to macroeconomic indicators and investor sentiment about future monetary policy.

However, Ethereum did not fare as well. The digital asset saw outflows of $36 million last week. While new Ethereum ETFs have brought in $3.1 billion in inflows since their launch, these gains were partially offset by significant outflows from the Grayscale Ethereum Trust, which lost $118 million. This mixed performance suggests that while Ethereum is gaining popularity through ETFs, it faces challenges in keeping investor confidence, especially in traditional investment vehicles like trusts.

Region-wise, the United States dominated the inflows, capturing $498 million. This figure highlights the US’s leading position in the digital asset market, especially during times of economic uncertainty. Hong Kong and Switzerland also recorded notable inflows, with $16 million and $14 million, respectively. Conversely, Germany experienced outflows of $9 million, making it one of the few countries with net outflows year-to-date.

The report also noted that Blockchain equities continued their positive momentum, marking their third consecutive week of inflows. These investments totaled $4.8 million, indicating continued interest in blockchain technology beyond just cryptocurrencies.

Overall, last week’s inflows into digital assets were mainly driven by Bitcoin, reflecting its safe-haven status in uncertain economic times. Meanwhile, Ethereum faced some hurdles, and regional differences in fund flows showed varying investor sentiment across the globe.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.