ParaFi Capital has raised $120 million with the aim of acquiring shares in other crypto funds

According to Bloomberg, New York-based digital asset management company ParaFi Capital has raised $120 million from investors such as Theta Capital Management and Accolade Partners. Henry Kravis, co-founder of KKR Co., is also one of the supporters of the company. According to a new strategy by ParaFi, part of this fund will be used to acquire shares in other crypto funds that focus on specific niche markets, strategies or regions. In an interview, ParaFi founder Ben Brman said that the company plans to establish a portfolio within the next three to five years, investing in shares of 30-50 such funds. In recent years, ParaFi has invested in nine different cryptocurrency management companies. As the number of crypto funds begins to grow again, the company is extending this strategy to external investors. ParaFi is one of the largest crypto funds and has been running hedge fund and venture capital strategies for about six years with a team of 22 people. Besides KKR and Kravis, investors in ParaFi also include Bain Capital Ventures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

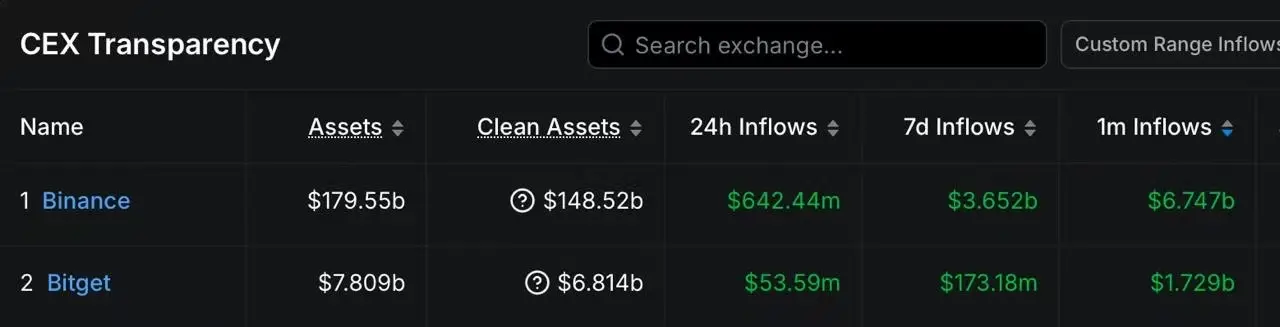

Data: In the past 30 days, the main capital inflows have been to a certain exchange and leading CEXs such as Bitget.

Analysis: Bitcoin’s next key support level is $99,000