Cboe submits revised application for listing spot Bitcoin and Ethereum ETF options

According to two regulatory documents dated August 28, the Chicago Board Options Exchange (Cboe Exchange) has submitted revised applications for listing spot Bitcoin and Ethereum ETF options to regulators. The documents show that Cboe seeks to list options on Bitcoin and Ethereum ETFs issued by asset management companies, including Fidelity, 21Shares, Invesco, VanEck, Grayscale, Bitwise, BlackRock iShares and Valkyrie. According to the information in the Bitcoin and Ethereum option files, the proposed rule changes will classify cryptocurrency spot ETFs with commodity-based ETFs (such as Goldman Sachs Physical Gold ETF and iShare Silver Trust Fund) as "securities suitable for options trading". Previously reported news stated that Nasdaq announced plans on August 27th to list Bitcoin options linked to CMCF's Real-Time Bitcoin Index (BRTI). This August both NYSE and Nasdaq withdrew four bitcoin option listing applications they had submitted earlier this year to the U.S. Securities and Exchange Commission (SEC). On August 8th , Cboe withdrew an application it had previously submitted for a bitcoin ETF option listing. Bloomberg expects that bitcoin spot options will be listed in the fourth quarter of this year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

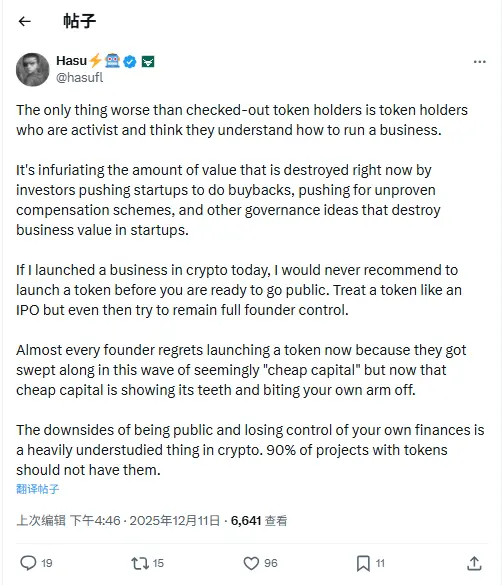

Flashbots Strategy Director Hasu: 90% of crypto projects should not issue tokens

Analysis: Bitcoin's next key support level is $88,500, with structural selling pressure dominating the market

Raoul Pal: The current bull market cycle should peak in 2026, and cryptocurrency is actually a macro asset.