CryptoQuant Analyst: On-chain indicators show Bitcoin is nearing a "favorable" buying level

CryptoQuant analyst Grizzly wrote that historical data shows that the range of the Bitcoin Puell Multiple Index between 0.6 and 0.8 can be described as the "Decision Zone". Analysis of trends over the past decade shows that when the index falls below the 0.6 threshold, it usually represents an ideal opportunity for the dollar cost averaging (DCA) strategy. On the contrary, historically, breaking through the 0.8 level has been associated with bullish market behavior, often pushing Bitcoin prices to all-time highs. Currently, the Puell Multiple Index fluctuates between these two critical levels. If the historical pattern remains unchanged, the bearish scenario of the index falling below 0.6 may once again bring favorable buying opportunities to investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: "Machi Big Brother" Jeff Huang has lost over $53 million in trading on Hyperliquid in the past month

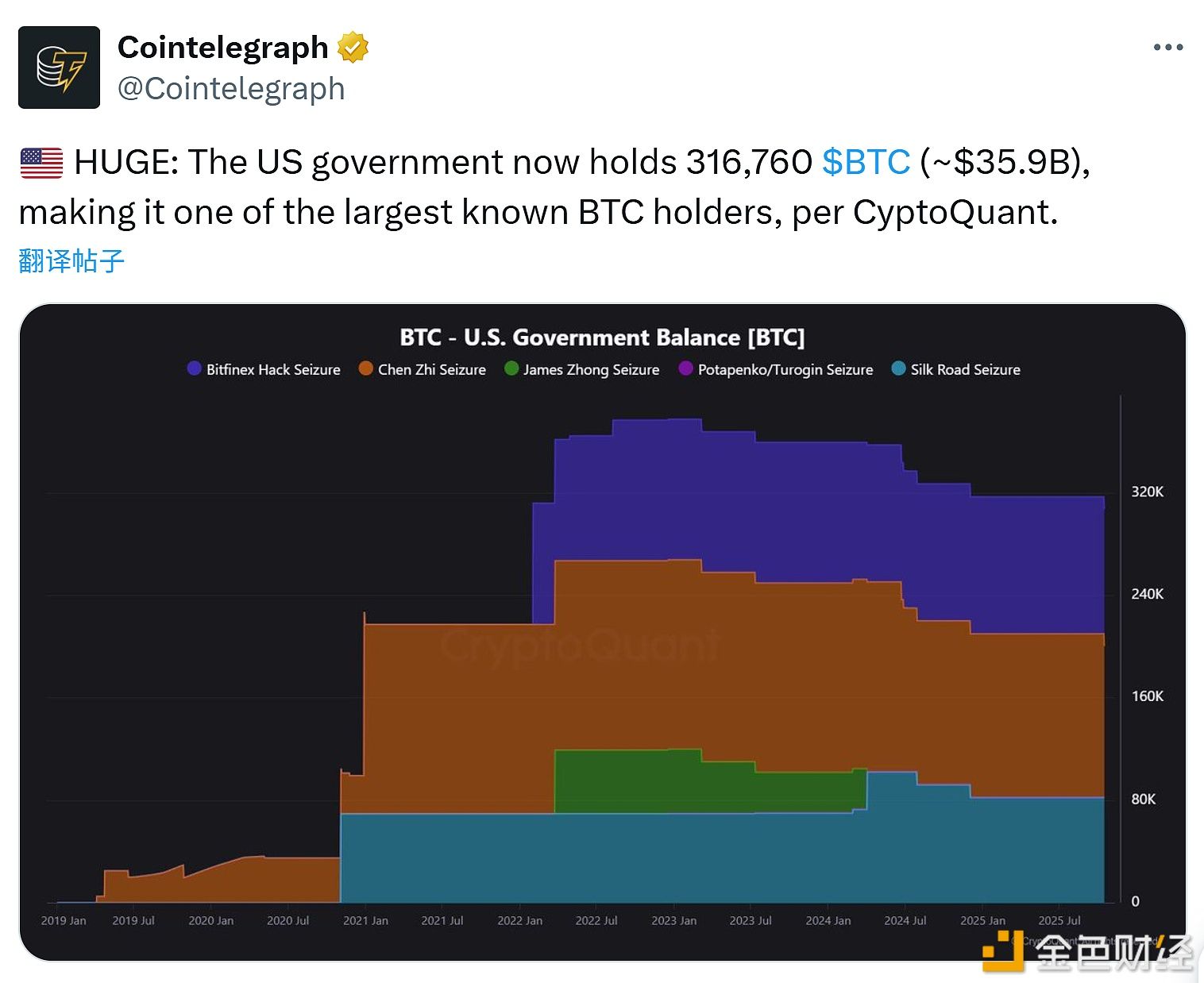

CryptoQuant: The U.S. government currently holds 316,760 BTC