Bitget Research: Negative Market Sentiment Persists, Grass Launches Tokens Airdrop

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors with strong wealth creation effect: USDT-based earning pools offering high annual yields with low risk, and DeFi blue chips (AAVE, 1INCH).

-

Top searched tokens and topics: World Liberty Financial, Yuga Labs.

-

Potential airdrop opportunities: Story Protocol, Elixir.

1. Market Environment

2. Wealth Creation Sectors

2.1 Recommended to Watch – High-Yield, Low-Risk USDT-M Pools

-

Given the current market panic and the low likelihood of a significant short-term rebound, it is advised to hold a substantial amount of stablecoins and wait for market stabilization before engaging in right-side trading.

-

Kamino: Currently the lending protocol with the highest TVL on Solana, offering an APY of 13% on USDC and 19% on PYSUD.

-

NAVI Protocol: Currently the protocol with the highest TVL on SUI, offering stable returns with an APY of 10.6% on USDC and 7.7% on PYSUD.

2.2 Sectors to Focus on Next: DeFi blue chips (AAVE, 1INCH)

-

DeFi blue-chip projects are experiencing significant buybacks. For example, the 1INCH team has spent a total of 2,993,000 USDT to repurchase 11,454,000 1INCH tokens since July 5, at an average price of $0.26. In the traditional market, such phenomena are seen as positive signs, indicating that companies are confident in their own stocks and are taking action to buy them back, which can boost overall market confidence.

-

Total protocol asset size: The cash flow generated by such protocols primarily depends on the asset size they manage. As the asset size increases, revenue typically rises, which should enhance the performance of their respective token prices.

-

Policy impact: As the cryptocurrency industry gradually gains legislative approval and societal acceptance, favorable policies will become a major driver of rising token prices. With more asset management giants entering the field, we anticipate steady progress in its development.

3. Top Searches

3.1 Popular DApps

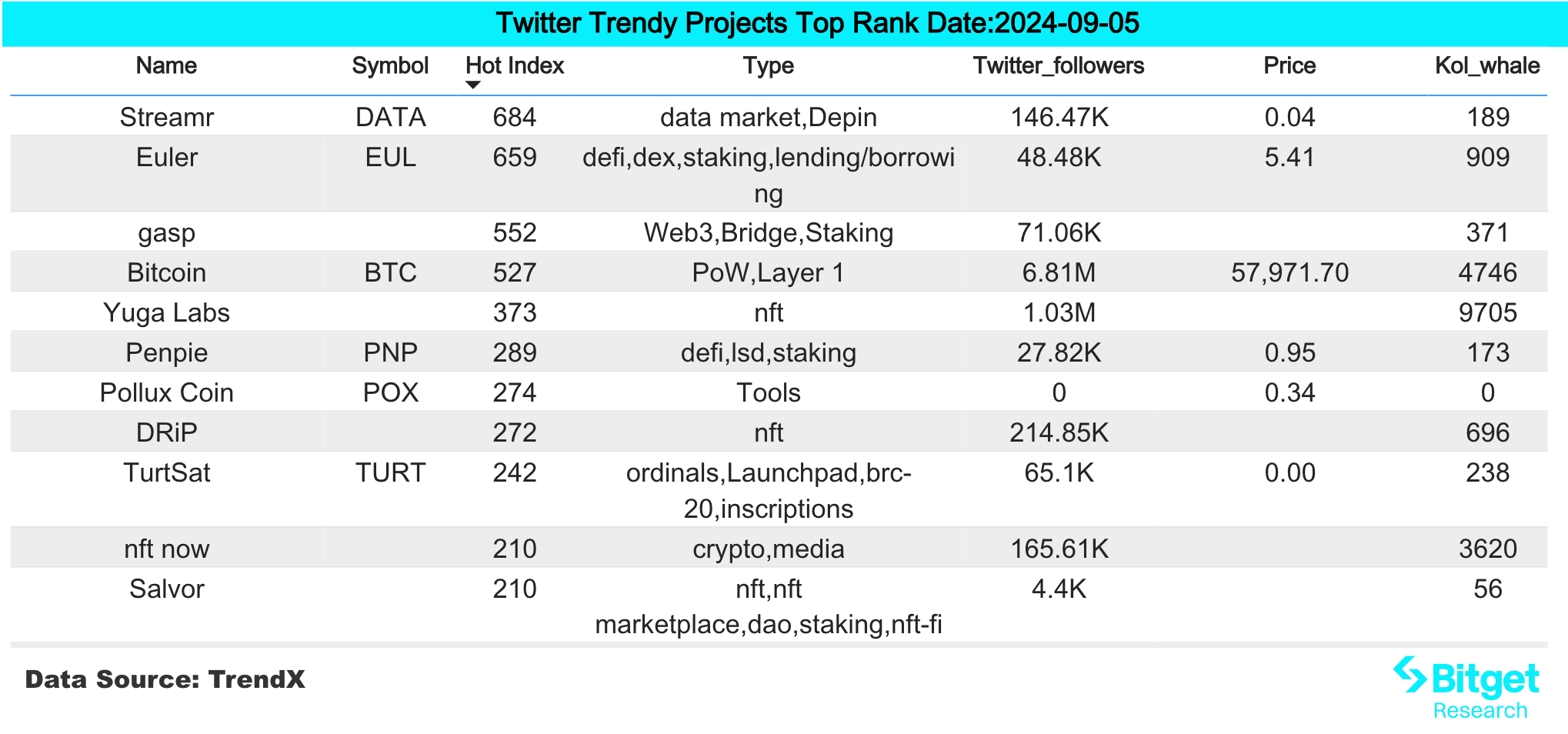

3.2 X (former Twitter)

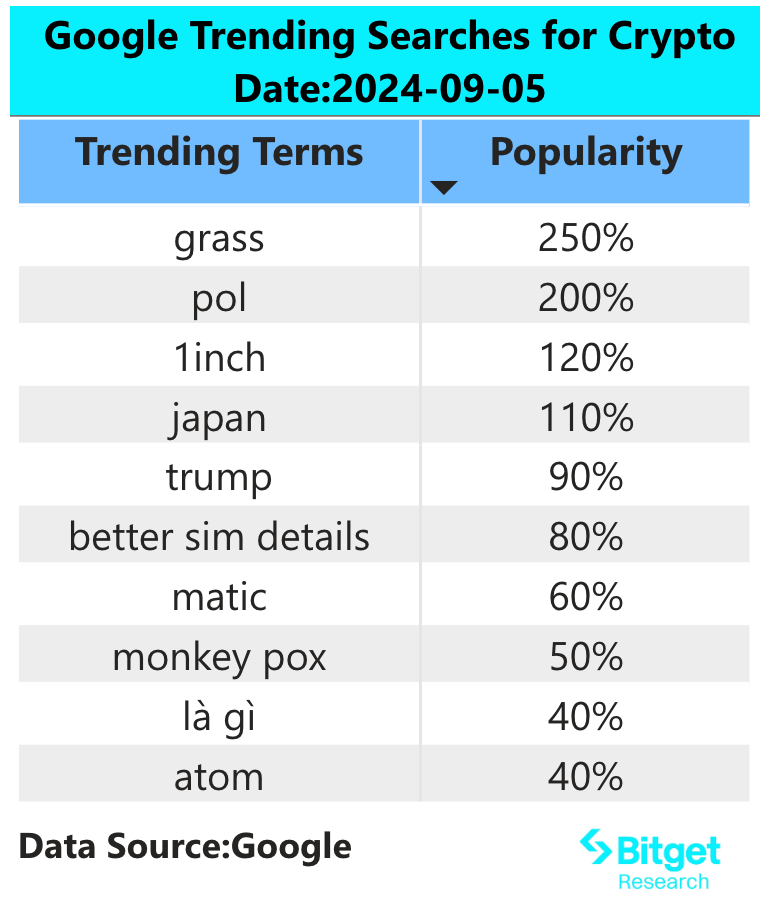

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!