Fed Issues Cease-and-Desist Order to United Texas Bank Over Risk Management Deficiencies in Crypto Operations

The Federal Reserve docket issued a cease-and-desist order to United Texas Bank on September 4, citing serious risk management system deficiencies in the bank's cryptocurrency client business. The decision was based on an examination conducted in May of this year, which revealed issues with the bank's corporate governance structure, board and senior management oversight, foreign correspondent banking, and virtual currency customer service. In particular, Fed highlighted “significant deficiencies” in the bank's anti-money laundering (AML) practices and Bank Secrecy Act (BSA) compliance. In response, UTB's board of directors has agreed to submit a plan to strengthen BSA/AML compliance oversight.

The bank's latest quarterly report shows it has 75 employees and about $1 billion in assets under management. Niko Demchuk, legal director at crypto compliance firm AMLBot, told Decrypt that the impact of such cease-and-desist orders extends far beyond the recipients and their customers. Every cease-and-desist order plays an important role in the market,” he noted. Other banks will be working to gain more insight into exactly what is not compliant with current AML regulations in order to improve their own internal AML processes.” Demchuk added that the references involving cryptoassets will serve as a warning to other banks dealing with cryptoassets to review their risk management systems to ensure that all risks are considered and mitigated. (decrypt)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

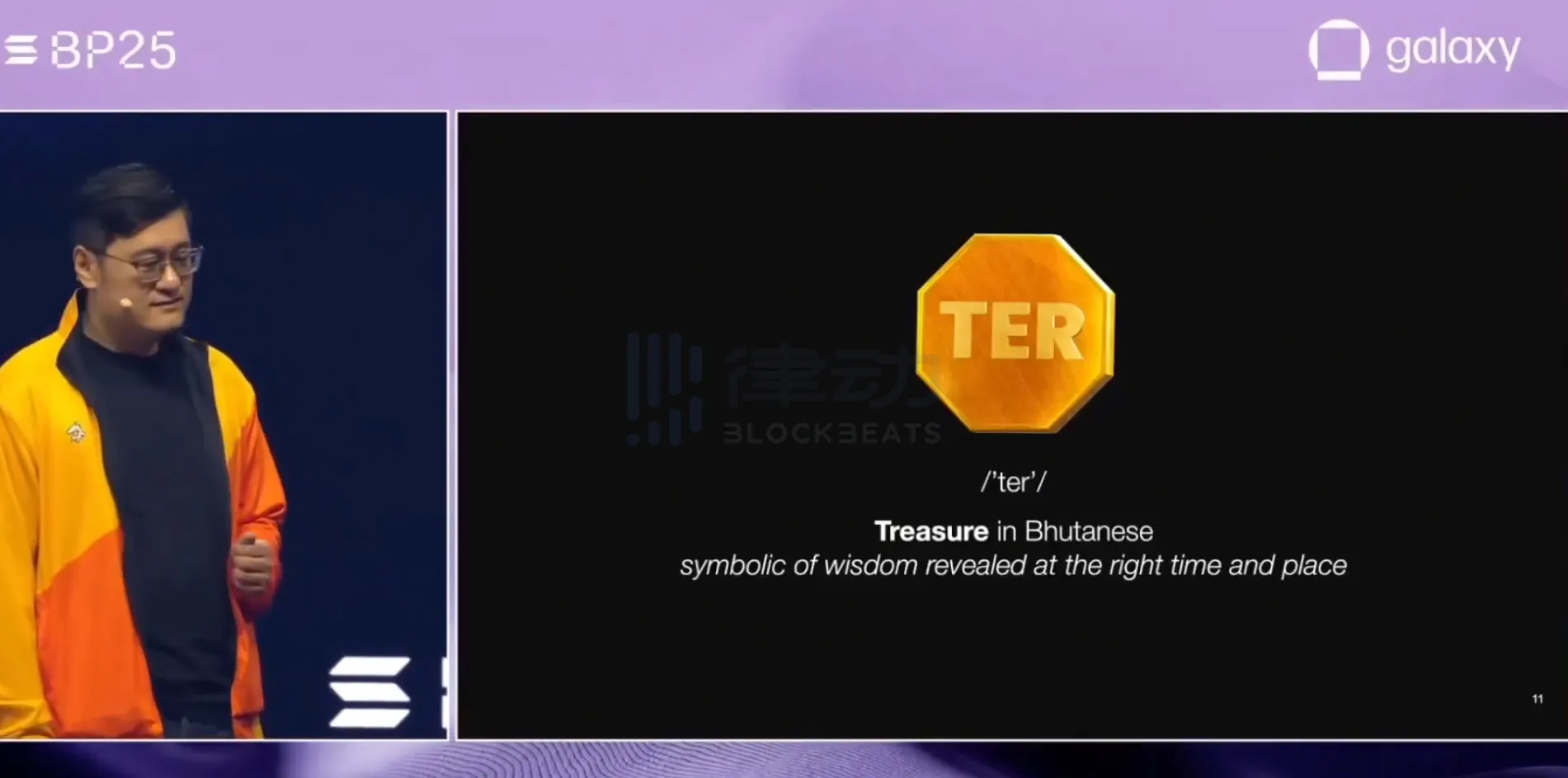

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network