The number of crypto VC funds has risen sharply over the past six years, but total funding is still in the early stages compared to traditional sectors

The Block posted that in 2018 there were only about 50 funds focused primarily on cryptocurrency investments. Today, there are more than 1,150 worldwide. By comparison, there are about 4,000 registered hedge funds in the U.S. alone and about 30,000 globally. In terms of venture capital, cryptocurrencies raised more than $72bn between 2018 and 2023, while general venture capital in the US raised more than $600bn over the same period. The balance still leans heavily in favour of traditional venture capital, but also in the early days of tech and other sectors. While there are high hopes for 2024 (especially with the Bitcoin Spot ETF and its early performance), the year seems more like a transition period. It is important not to compare this cycle to previous ones, as the landscape has changed dramatically.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shares of major U.S. banks fall in pre-market trading

Typus Finance: Vulnerability fix completed, no liquidation risk during perpetual contract suspension

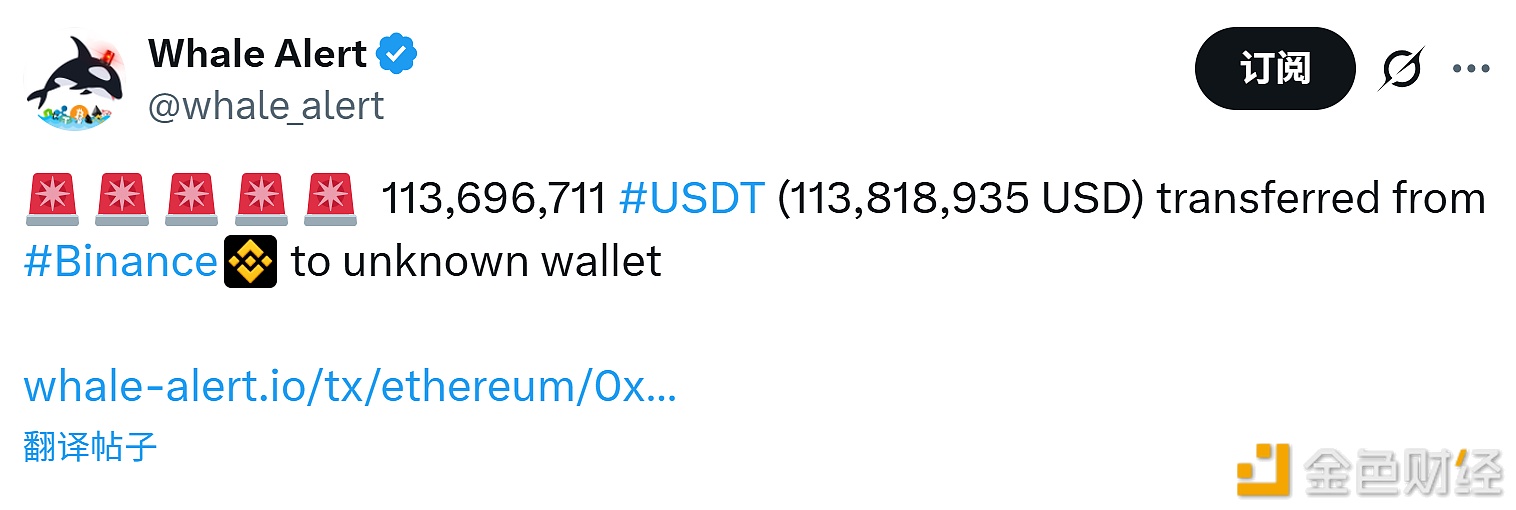

113,696,711 USDT transferred out from a certain exchange

Data: Machi's ETH long position is less than $25 away from liquidation