U.S. Treasury yields rise due to an increase in the U.S. core monthly rate

News on September 11, according to foreign media reports, the key inflation indicator in the United States - August core CPI monthly rate recorded 0.3%, hotter than economists expected, and U.S. Treasury yields slightly increased. Short-term US bond yields that are particularly sensitive to recent prospects for monetary policy led the gains. This suggests traders believe this report may prevent the Federal Reserve from aggressively cutting interest rates in the coming months, despite recent signs of a cooling labor market. In recent trading, the yield on two-year U.S. Treasuries rose from Tuesday's 3.608% to above 3.69%, and ten-year Treasury yields also rose.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

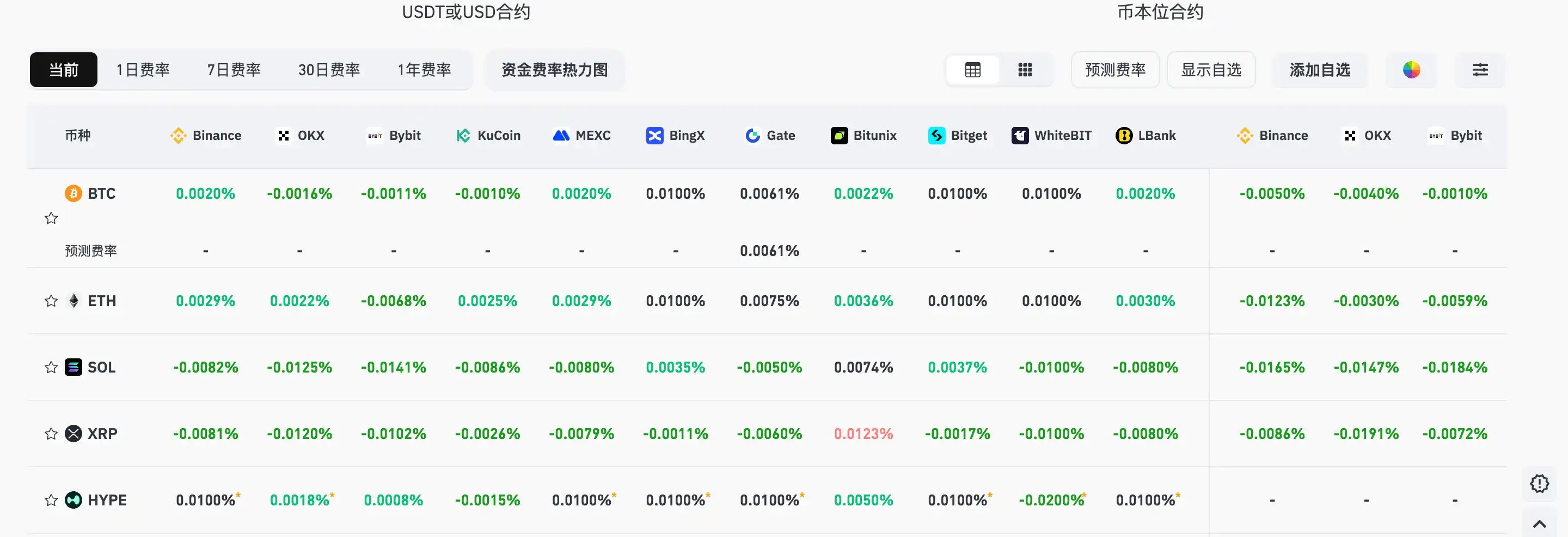

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.