Data: Market views of various investment banks/institutions this week

Market views of various investment banks/institutions this week:

1. Goldman Sachs: Still expects the Fed to cut interest rates by 25 basis points this week.

2. Deutsche Bank: The Fed's rate cut this week will foreshadow the overall rate cuts in 2024.

3. JPMorgan Chase: Reiterates its expectation for a 50 basis point rate cut by the Fed in September.

4. Yuexin Bank: A 25 basis point rate cut by the Fed is not enough to trigger a strong dollar recovery.

5. UBS: US retail sales data may affect the extent of the Federal Reserve's interest rate cuts.

6. Deutsche Commercial Bank: As the Federal Reserve is about to lower interest rates, German bonds are expected to stabilize.

7. Citibank: There are no signs that European Central Bank will accelerate its pace of cutting rates.

8. Bank of America: Expects economic weakness will hit European stock markets.

9. Capital Economics Macro : The industrial sector's share in Eurozone economy is expected to shrink further

10.Netherlands International : It’s hard for Eurozone industry to rebound strongly in coming months

11.Netherlands International : If Bank of England remains cautious, pound sterling might rise

12.Moody’s : Expecting Japan central bank would stand pat this week

13.Westpac Banking Corporation : Differences between US and Japanese policies remain key driver for USD/JPY exchange rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spot gold falls below $4,200

OpenMind, a robotics track project, launches on FABRIC Network and Badge Collection

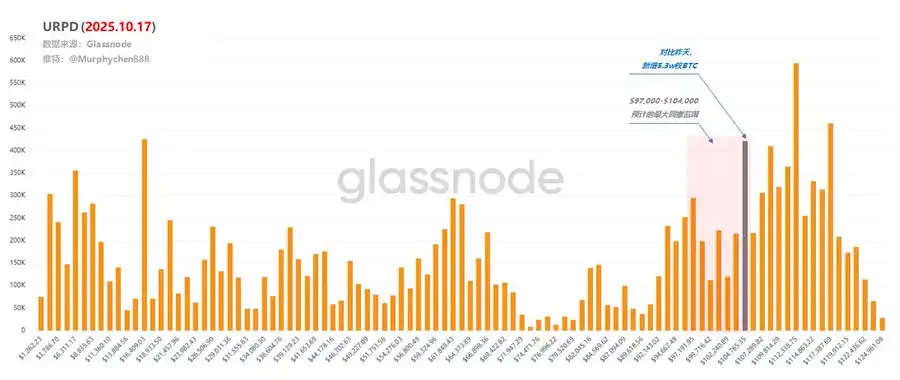

Analysis: Bitcoin Chips Approaching "Extreme Pullback Zone," Traders Preparing to "Swing"

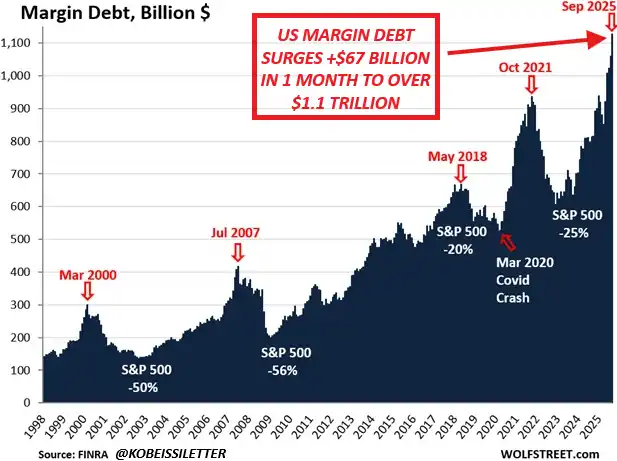

Analysis: Market risk appetite is at a historic high, making the path upward more volatile