SignalPlus: As the Federal Reserve's "dovish turn" ultimately becomes a market consensus, this rebound may continue

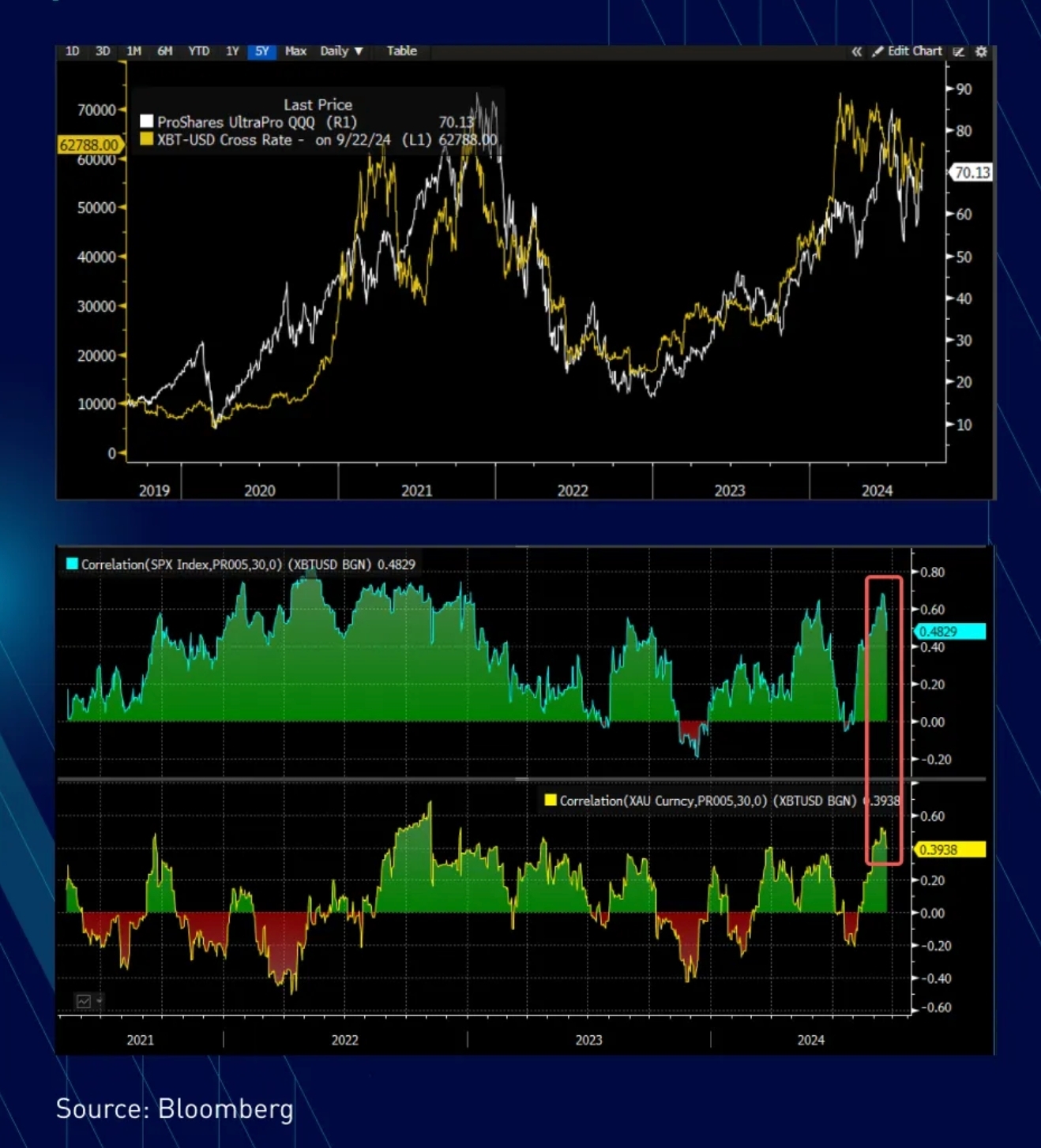

In terms of cryptocurrency, with the correlation to stocks (and gold) returning to a two-year high, BTC price significantly rebounded last week, rising by 6%. The trend of BTC and the triple-leveraged Nasdaq index has realigned. However, cryptocurrencies have the opportunity for more drastic movements in the short term. Especially altcoins performed very strongly last week. Even ETH, which has been heavily criticized, successfully rose by 11% over the past week without any new developments. In its latest report, research institution SignalPlus pointed out that as the Federal Reserve's "dovish turn" finally becomes a market consensus, this rebound may continue.

"The strong rebound of Altcoin is an encouraging signal and there is an opportunity for more rebounds in the short term as long as stock market sentiment can be maintained. Over the past week, inflows into BTC spot ETFs have recovered and are expected to reach a cumulative new high before end of this month. Can this price bounce save inflow volume for ETH ETF?" SignalPlus believes that answer will depend on whether or not stock markets can peak again before November while benefiting from Fed's dovish shift.

"As for importance of options; TradFi market will see over $43 trillion US equity options expire this week; now almost everyone is an index volatility trader making index option activity particularly active. After expiration at end of month will investors make more bullish option moves? Is it time to buy some out-of-the-money call options on BTC? Keep a close eye on this area," SignalPlus advises.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terraform Labs founder Do Kwon to be sentenced today, may face 12 years in prison

Reserve Rights proposes new plan to burn approximately 30 billion RSR tokens

Galaxy DeFi head: Solana is the only blockchain capable of supporting tokenized securities