Bitfinex Alpha: BTC may enter a consolidation phase after the Fed's interest rate cut

According to an analysis report by Bitfinex Alpha, since the Federal Reserve's decision to cut interest rates, Bitcoin has been on a steady rise. On September 20th (last Friday), it surged over 22%, hitting a local new high of $64,200, which is the highest point since September 6th. Despite Bitcoin's strong momentum, it is still slightly below the key high of $65,200 on August 25th. BTC has been in a downward trend since March. Although the recent price increase is positive, what worries people is that the increase in unliquidated contracts for BTC exceeded the price increase of BTC itself. This suggests that most of last week's gains were likely driven by futures and perpetual contract markets rather than spot markets.

Meanwhile, some altcoin prices have skyrocketed with some well-known tokens rising more than 100% from their lows in August and September. However similar caution needs to be exercised here as well because altcoin OI also hit new highs while broader underlying altcoin market did not see corresponding price breakthroughs. Other indices (measuring performance of altcoins excluding top ten by market cap) continued their downward trend over past month.

As purchases slow down in Bitcoin spot market - evidenced by flattening incremental trading volume when prices reached $63,500 - it’s expected that BTC will fluctuate within range short term. If there are no sustained spot purchases consolidation or partial retracement seems most likely scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: ETH surged briefly, then dropped over 5.04% within 5 minutes

As competition with Google intensifies, OpenAI launches GPT-5.2

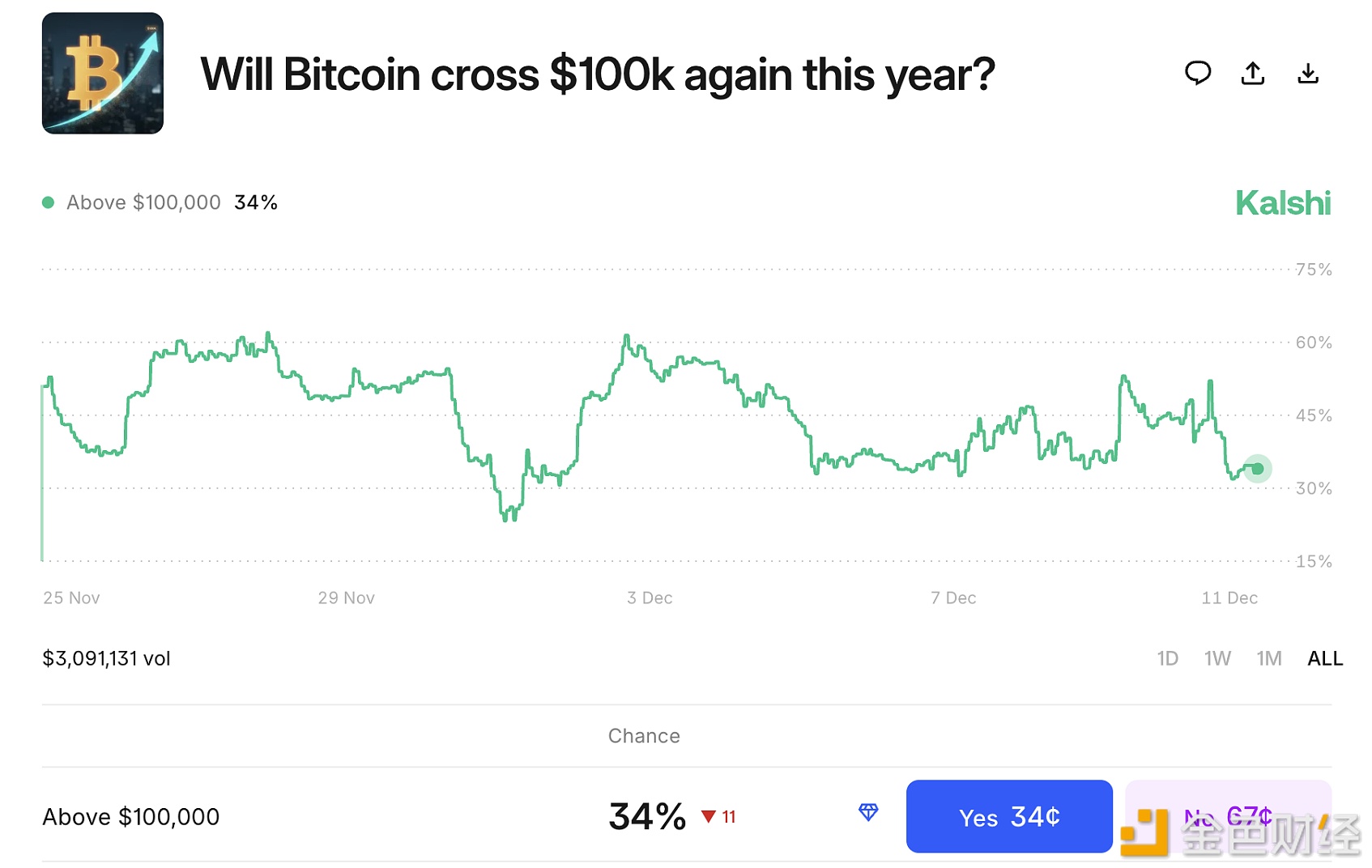

Prediction markets bet that bitcoin will not reach $100,000 by the end of the year