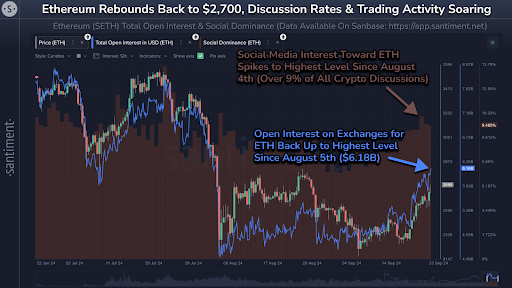

- Ethereum’s surge to $2,700 reflects a renewed interest from both retail and institutional investors.

- Social media discussions about Ethereum have hit 9%, marking significant market engagement.

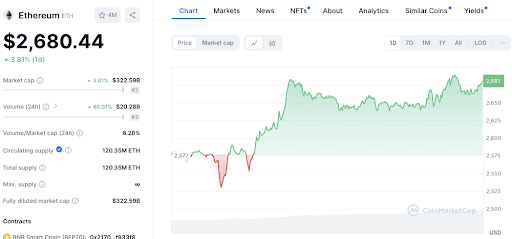

- Trading volume rose by 68.40%, indicating strong investor participation in the ETH market.

Ethereum ($ETH) has climbed back to $2,700, mirroring a broader crypto market rally. Data from top analytics firm Santiment, shows the rebound coincides with a noticeable uptick in social media chatter and trading activity, marking key achievements for the second-largest cryptocurrency.

Surge in Social Media and Trading Activity

Social media conversations centered on Ethereum have hit their highest point since early August. Currently, over 9% of all crypto-related discussions revolve around ETH. This increased interest goes hand-in-hand with a substantial jump in trading activity.

Read also: ETH Transactions Free from SEC’s Clutches? Coinbase CLO Raises Intrigue!

Source: Santiment

Source: Santiment

Open interest on Ethereum exchanges has reached $6.18 billion, its highest level since August 5. This shows that more investors are ready to trade Ethereum, helping to push its price higher.

Price Action and Support Levels

The 24-hour price trend shows Ethereum fluctuating around the $2,675 mark, a gain of 3.80%. This follows a notable upward movement from approximately $2,577. This rally indicates that Ethereum has pushed past previous resistance levels, demonstrating strong market momentum.

Source: Coinmarketcap

Source: Coinmarketcap

Ethereum seems to have formed several support levels. The price dipped briefly around $2,575 but quickly recovered, suggesting this area acts as a short-term support zone. Additionally, another potential support level lies slightly above $2,600, where the price stabilized before its recent surge.

Ethereum is currently trading near the $2,676 mark. This price point may act as a new resistance level, considering the recent price action. Also, a previously established resistance around $2,650 now seems to be acting as a support level, helping the ongoing rally.

Trading volume has surged by an impressive 68.40%, suggesting strong participation in the market. This uptick in volume reinforces the price increase, demonstrating that investors are actively engaging with Ethereum.

Read also: Ethereum’s Strong Fundamentals Might Push ETH’s Price To $12,000-$15,000 Range

ETH/USD 1-day price chart, Source: Trading view

ETH/USD 1-day price chart, Source: Trading view

Additionally, the 1-day Relative Strength Index (RSI) for Ethereum is currently at 61.79. This level indicates that the market may be slightly overbought in the short term. On the other hand, the 1-day MACD reading above the signal line at 9.12 suggests bullish momentum remains intact.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.