CryptoQuant says bitcoin’s 'supply in profit' level signals potential for further gains

Bitcoin’s price has increased nearly 8% following the U.S. Federal Reserve’s rate cut, with the “supply in profit” metric crossing its 365-day moving average, a key signal for potential further gains, according to CryptoQuant.However, Bitfinex analysts caution that while the recent uptick was initially driven by spot market buying, a slowdown in this activity may lead to consolidation or a partial correction in the near term.

Bitcoin BTC +0.39% 's price has risen nearly 8% following the U.S. Federal Reserve's 50 basis-point rate cut, influencing a key market indicator that suggests potential for further gains, according to an analyst at research firm CryptoQuant.

That indicator, the "supply in profit" metric, refers to the percentage of bitcoin's circulating supply that was purchased at a price lower than the current market value. When this percentage rises, it means a greater portion of bitcoin holders are in profit, which can lead to reduced selling pressure and increased market confidence.

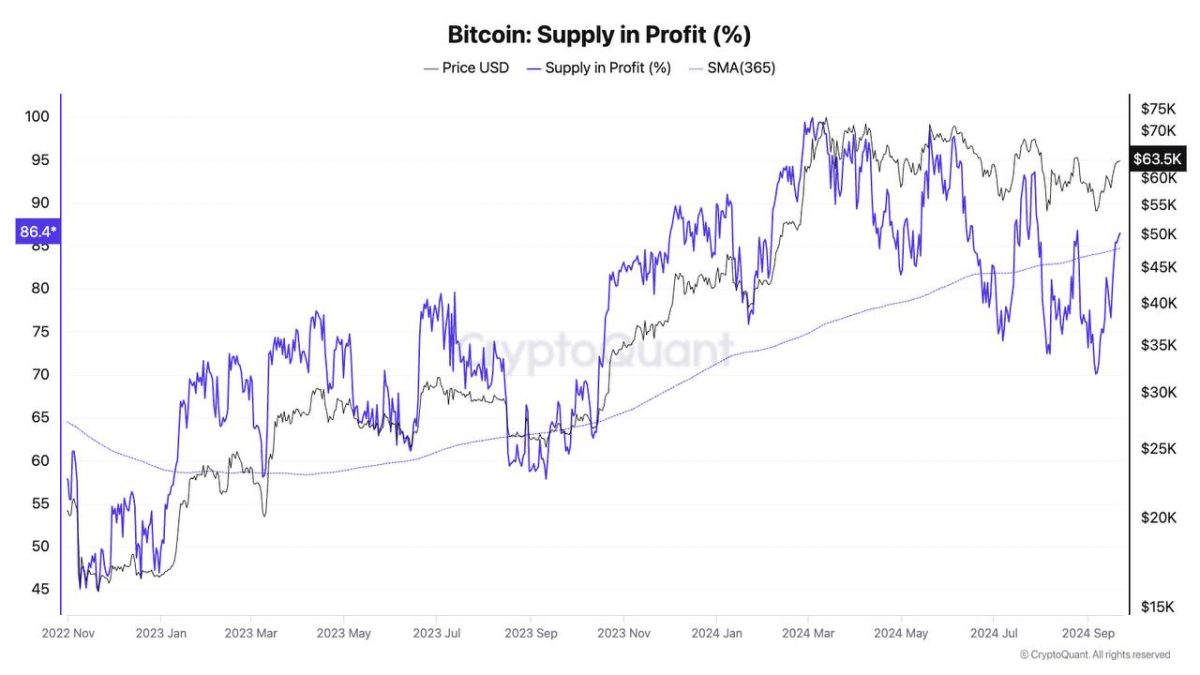

CryptoQuant’s Head of Research Julio Moreno told The Block that bitcoin's recent uptick has pushed the supply in profit metric above its 365-day moving average. "This inflection point is generally associated with further price gains," Moreno said, suggesting that bitcoin could see additional upward momentum.

The supply in profit metric has crossed over its 365-day moving average, which is generally associated with further price gains. Image: CryptoQuant.

Bitcoin price has surpassed a key psychological inflection point

According to a CryptoQuant blog post, the supply in profit level often acts as an emotional benchmark for investors, serving as a crucial support or resistance zone. "When the price exceeds this level, optimism tends to rise; if it falls below, selling pressure may increase," the post noted.

Bitfinex analysts, however, have urged caution. They observed that while bitcoin’s uptick was initially driven by spot market buying, this activity has since slowed, as indicated by the flattening of the spot cumulative volume delta (CVD). The CVD is a metric that measures the difference between the cumulative buying and selling volume in the spot market over a specific period. It essentially tracks whether buying or selling pressure is dominating in the market.

"We expect bitcoin to consolidate in a new range near current levels or experience a partial correction in the short term," they said in a recent report.

Bitcoin traded around $63,516 at publication time, according to The Block's bitcoin price data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!