Crypto Analytics: Bitcoin, Litecoin, Dogcoin and Bitcoin Cash Miners Have Stopped Selling Their Currency

In Bitget news, cryptocurrency analytics firm Alphractal has revealed a significant change in miners' behavior, noting that Bitcoin, Litecoin, Dogcoin, and Bitcoin Cash miners have stopped selling their currencies. This is in stark contrast to their typical strategy of capitalizing on price fluctuations to stay in business.

According to Alphractal, miners have historically been speculative sellers, capitalizing on upward price trends to make the profits needed to keep mining operations afloat. Last year, Bitcoin miners in particular capitalized on price rises throughout 2023-2024 to sell their BTC holdings, during which time the Bitcoin hash rate skyrocketed due to increased competition among miners, which dramatically increased the amount of computing power needed for mining. As a result, many miners were forced to sell their tokens to remain profitable.

However, Alphractal notes that the selling pressure from miners is now almost gone. With Bitcoin's current value at a low level and mining profitability under pressure, miners are holding onto assets rather than selling, suggesting that less supply may be entering the market.

This shift in miner behavior could impact the broader cryptocurrency market, especially as it relates to supply and demand dynamics. If selling pressure from miners remains low, this could support higher prices for these digital assets in the short term, analysts said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

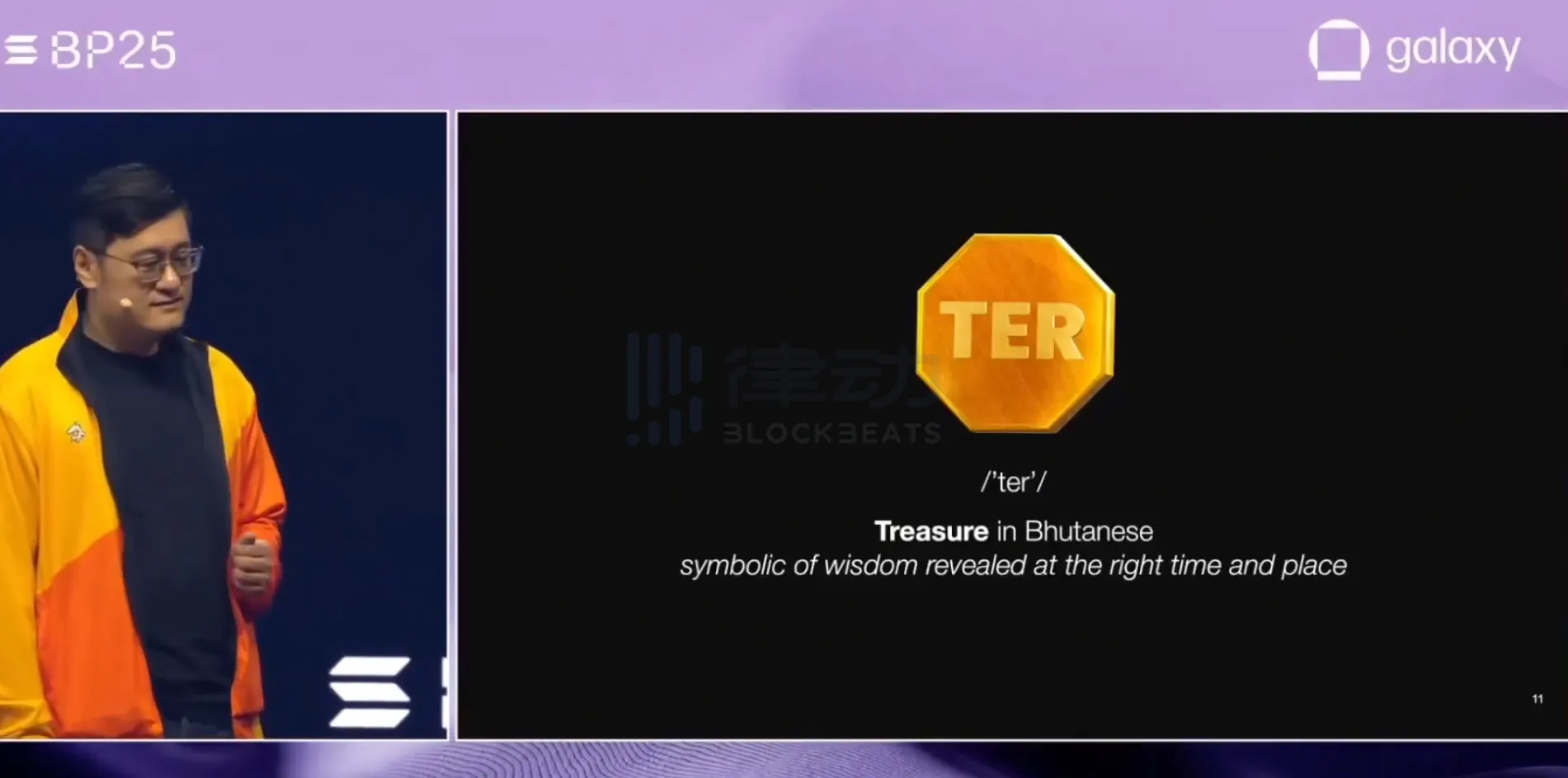

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network