Friday's end-of-month bitcoin options expiry could trigger significant market volatility: Deribit

Friday’s end-of-month bitcoin options expiry could significantly impact market volatility, according to Deribit CEO Luuk Strijers.Major cryptocurrencies, such as bitcoin and ether, have traded flat over the past 24 hours.

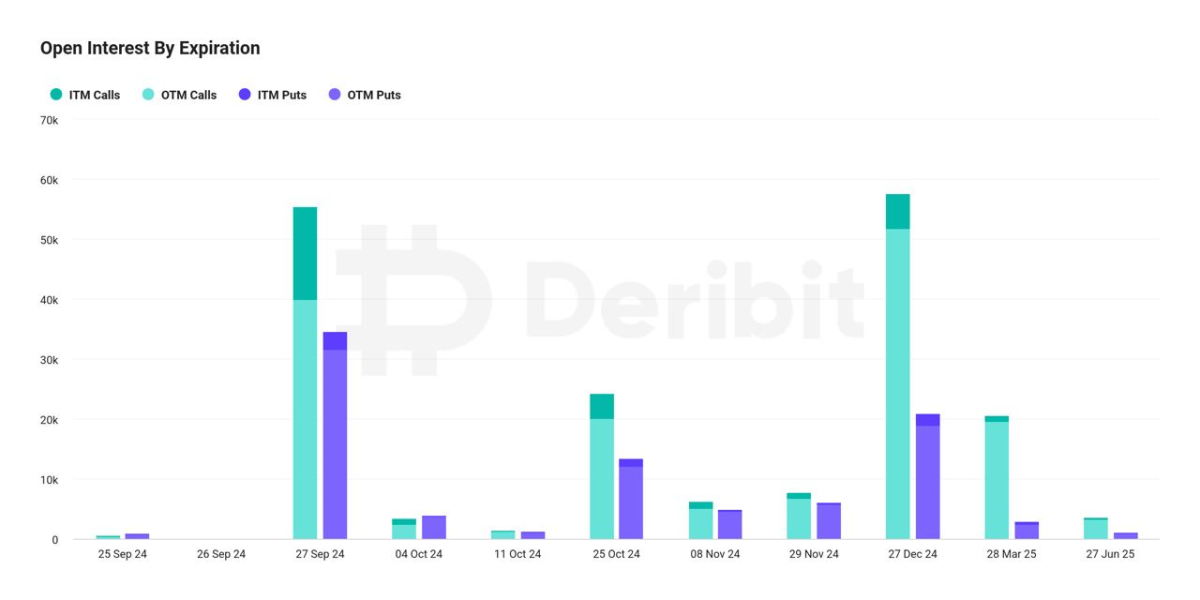

In total, the $5.8 billion in options set to expire represents 33% of all outstanding contracts currently on Deribit, making this one of the most significant expiries of the year and one that could shape the market's direction in the near term.

Bitcoin BTC +0.54% traded flat in the past 24 hours, changing hands at $63,568 at 12:03 a.m. ET, according to The Block’s Price Page . The price of ether decreased by a muted 0.6% to $2,601 in the same period.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

100% rebate for KYB users: Earn fee rebates on EUR bank deposits!

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services